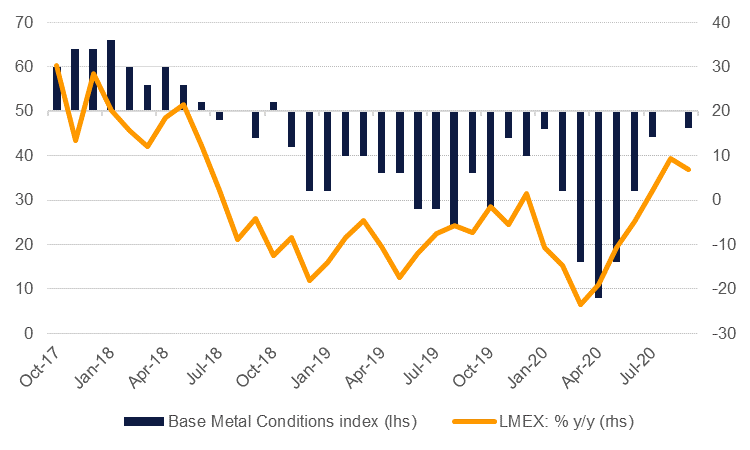

Macro conditions for industrial metals had been improving in recent months as economies recovered from sharp drops in activity in Q1-Q2 as a result of the Covid-19 pandemic. Signs of rebounding in industry, a resumption of global trade and accommodative monetary policies have helped commodity prices surge from multi-year (or in some cases record) lows. Our measure of macroeconomic conditions for base metals hit its highest level in August and is holding close to those levels on the preliminary read for September. While the index still correlates with negative year/year performance in the LMEX index of base metal prices, it is nevertheless significantly better than the weak levels hit earlier this year.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

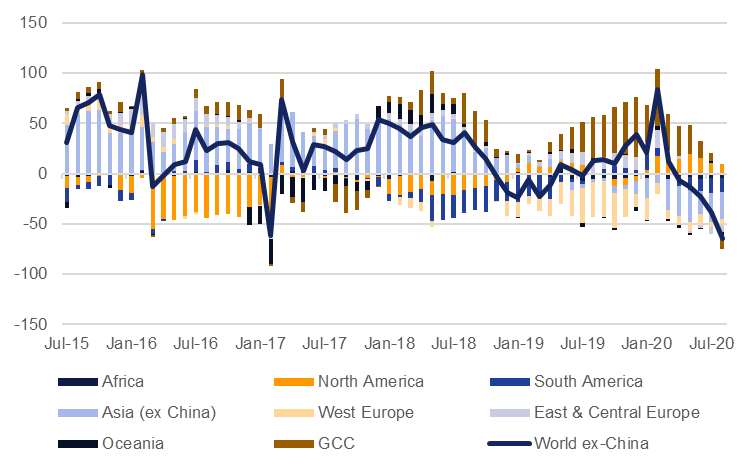

Global manufacturing PMI figures hit 52.3 for September, their highest level since August 2018, with gains coming from both emerging and developed markets. China’s manufacturing PMI numbers, both the official read and the Caixin survey, have held in expansionary territory since at least May as the economy there shows strong signs of rebounding from a weak Q1. Beyond China conditions have been more mixed among major Asian economies but all are still reporting manufacturing figures well above the slump at the start of Q2.

Manufacturing has also been one of the signs of strength among developed markets in recent months even as a rising number of Covid-19 cases has weighed on sentiment and the near-term growth outlook: Germany’s manufacturing PMI spiked to 56.4 in September, well above a year-to-date trough of 34.5 hit back in April while in the US, the ISM manufacturing PMI slipped marginally but at 55.4 in September still represents a strong print. The manufacturing PMI figures globally are positive but as we have noted in the past they represent assessments of month on month changes rather than an indicator that economies are back to or exceeding pre-pandemic levels of output.

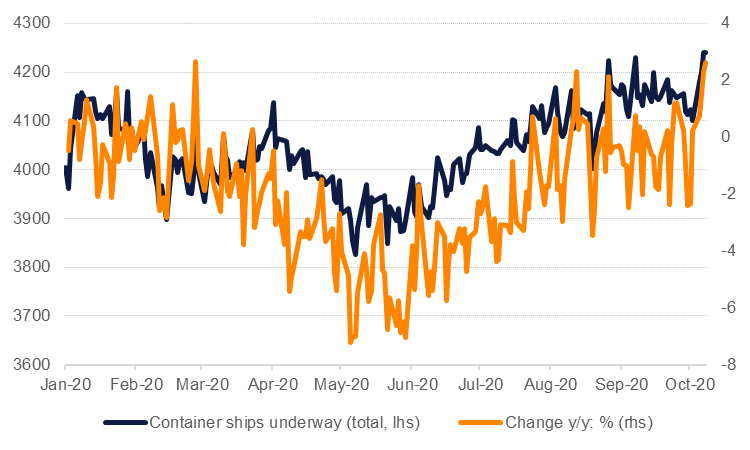

Global trade volumes have also begun to show some signs of stabilization. The CPB index of world trade volume has jumped up from its May low and had been managing to grow m/m in June and July (latest data available). The number of container vessels currently underway has also recovered strongly, back to just below pre-pandemic levels as of early Q4 2020. Conditions for global trade should continue to be accommodative going forward as central banks keep policy rates low: lower USD financing costs tend to have a stimulatory effect on global trade, bringing down the cost of trade finance.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Central banks among the major economies have all pledged to keep policy rates on hold well until inflation, growth or employment show signs of returning to sustained higher levels. While policymakers have generally kept policy unchanged over the past few months, preferring to let the extraordinary amounts of stimulus already in markets to do its job, there remains scope for the Federal Reserve in the US, the ECB, the Bank of England as well as for some emerging market central banks to keep adding support, even if it is just a pledge that interest rates are anchored at low levels for a prolonged period.

While this combination of improving manufacturing activity, recovering global trade and low rates can be a potentially powerful cocktail to propel commodity prices higher, they are being counterweighed by the Covid-19 pandemic and governments’ efforts to get control of the virus. Stop/start lockdowns and halts to economic activity, financial market volatility as investors try to price in the trajectory of the virus and changes in consumer/industrial behavior (more remote working, socially distanced workplaces) are all proving to be significant hurdles for higher commodity demand and prices.

We are still broadly optimistic that economies will improve in 2021, at least on base effects alone, and that some economies will be able to converge quite closely to pre-pandemic levels of activity as societies adjust to living with Covid-19. However, an out of control outbreak that pressures health services or policy errors are major risks to this outlook and thus our conviction in a sustained commodity rally for 2021 is less confident than it may otherwise be given the supportive macro factors outlined above.

Aluminium prices (LME forwards) have rallied more than 20% since hitting a low of USD 1,462/tonne in mid-May. Production ex-China has sunk as prices have fallen below most of the global cost curve and demand tapered off early during the pandemic’s economic fallout. However, widespread closures have been minimal and with prices currently at around USD 1,800/tonne more output shut-ins may be limited. Production in China has continued to push higher this year with the daily run rates back up over 100k tonnes according to IAI data.

Source: IAI, Emirates NBD Research

Source: IAI, Emirates NBD Research

Aluminium inventories have been increasing this year as demand was interrupted by the Covid-19 pandemic. While stockpiles are nowhere near the mountain of metal that markets had to absorb in 2015-16, total LME inventories are still roughly 50% higher as of early October than they were a year ago. Metal inventories in China have normalized after spiking in Q1 as industry went on hold.

The uncertain outlook for the progress of Covid-19, particularly in the US and other developed markets where it had seemed to be under control, poses a major risk to the outlook for industrial demand, and for aluminium in particular. Housing activity has received a boost thanks to low interest rates in nearly all economies but maintaining consumer confidence will be key for rallies to be sustained.

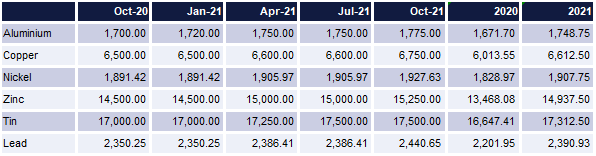

We had an optimistic outlook on aluminium earlier in the year and LME forwards have beaten our price targets. Provided our base case for a return to growth next year and measures help to contain the virus we still expect to see aluminium prices holding up. However, substantial upside from where prices are at the moment may be challenging thanks to further capacity increases from China (a 6.9% increase estimated from Shanghai Metals Market/Bloomberg). We now expect to see aluminum prices at an average of USD 1,750/tonne in 2021 (USD 1,730/tonne previously).

The aluminium market also remains at the centre of the current US administration’s aggressive trade policies. Should Donald Trump win November’s presidential election we would expect tariffs on metal to remain a tool in the administration’s playbook when negotiating trade deals. But a Biden victory may not mean an end or reversal of tariffs either. Biden has not outlined in specific detail a view on metals tariffs but we do not expect a complete reversal of the current level of tariffs. An eventual rollback of some of the aluminium market tariffs, particularly on key trade partners of the US such as Canada is likely but we would likely wait until further along during a Biden presidency.

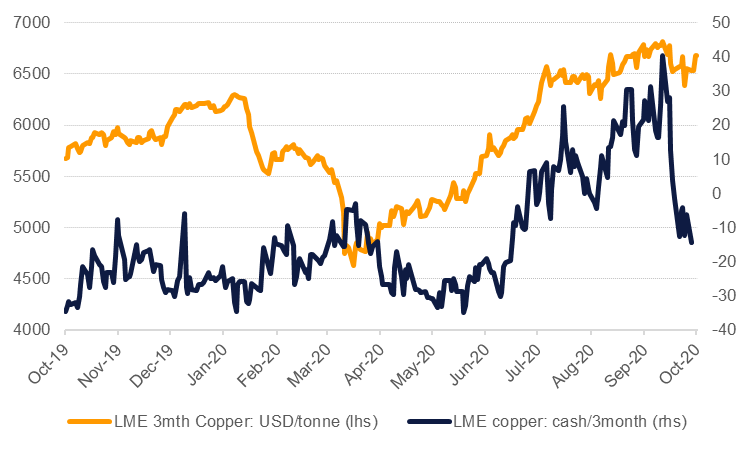

Copper prices have recorded the strongest rally among the base metal complex, up over 44% as of early October at USD 6,679/tonne compared with USD 4,630/tonne hit in early March. We had positive expectations for copper in our Q3 metals outlook and they have largely played out. Anxiety over supply in major producers thanks to Covid-19 affecting Peru and Chile considerably has helped to push prices higher, even as miners have learned to live with the virus and run operations on reduced staff. But that dynamic itself has prompted one of the perennial issues with copper supply; labour disputes. Several major mines in Chile are in the process of mediation with strikes a potential near term threat to supply.

Copper inventories have also narrowed compared with a burdensome position in H1. Both LME and SHFE inventories have narrowed in recent months, helping to contribute to a tightening of forward structures in copper: LME cash-3mth spreads moved into backwardation of as much as US 40/tonne in mid-September. They have since moved back into contango in line with several large single-day deliveries into LME warehouses. We maintain our view for a gradual rise in copper prices for 2021 to an average of USD 6,612/tonne.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research. Note: USD/tonne, average of period.