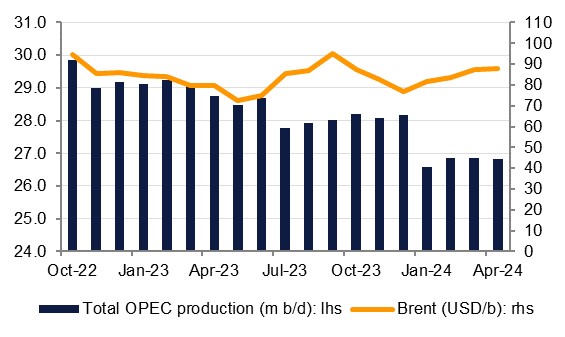

OPEC+ ministers held a ministerial meeting at the start of June and agreed to extend production cuts from baseline levels—not current output—until the end of 2025. According to the press release that accompanied the ministerial decision, the cuts are meant to provide “long-term guidance and transparency for the market” and stressed the “critical importance of full conformity and compensation” for over-production.

At a collective level, the production target for 2025 has been set at 39.725m b/d. That represents a cut from a baseline level (reference production) of 42.2m b/d that was established in July 2021 and has been adjusted given that Angola has left the OPEC+ framework and Mexico has not participated in the cuts at all. Among major producers in the Middle East, Saudi Arabia’s 2025 target production was set at 10.48m b/d (production April estimated at 9.04m b/d), Kuwait at 2.68m b/d (2.43m b/d estimated for April) and Iraq’s at 4.43m b/d (compared with April estimated production of 4.2m b/d). Russia’s target for 2025 was set at 9.95m b/d. These targets are essentially the same as the 2024 targets that OPEC+ agreed to in June 2023. The UAE, however, has received a higher production target of 3.519m b/d, up from 3.219m b/d (current output is estimated at 3.12m b/d as of April).

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Alongside the ministerial agreement, however, those countries that are making additional voluntary cuts agreed to extend them until the end of September 2024 and then phase production back in over the rest of 2024 and into 2025. Saudi Arabia’s target for 2025 then becomes 9.73m b/d in practice rather than 10. 48m b/d. For the UAE, the target with the voluntary cuts in 2025 becomes 3.234m b/d.

OPEC+ also extended the assessment period for reference production levels until the end of November 2025 rather than the end of June 2024 and these reference levels will apply for 2026. The extension implies that OPEC+ intends to continue managing production levels while also pushing any debate on allocating baseline production among members well into 2025. That may alleviate some potential for near-term discord but will not address the risk of a disorderly end to the OPEC+ framework.

OPEC+ agreed what they had to do at the June meeting: an extension of production cuts until the end of 2025, albeit heavily caveated and amended almost immediately with the additional voluntary cuts. But cuts remain from a near theoretical reference level, not current production which is what markets will actually respond to. Looking at the targets for 2025 compared with production among just the core OPEC MENA members (Saudi Arabia, Iraq, UAE, Kuwait and Algeria), targeted production at the end of 2024 is less than 30k b/d lower than current production and for 2025 will represent an increase of almost 1.5m b/d. Moreover, several countries within the OPEC+ framework are still over-producing their targets and the clearance to higher target levels for next year may prompt more leakage.