OPEC+ has agreed to delay increasing output by an additional month. Those countries that have been providing additional voluntary cuts—including Saudi Arabia, Russia, Iraq, the UAE, Kuwait and Kazakhstan among a few others—had originally planned to increase output in October but delayed it until December when they met in September. The planned increase in output, which will be phased in gradually over 2025, will now begin in January.

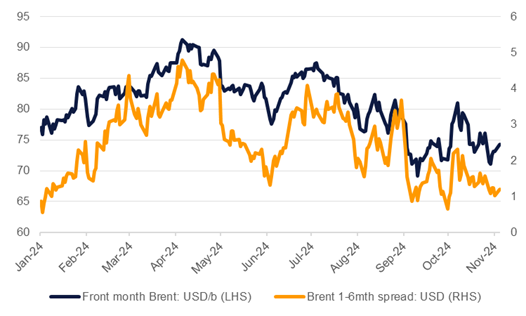

Conditions in oil markets clearly are not favourable for a substantial increase in production from OPEC+. Front month Brent futures have dropped from more than USD 87/b in early July to less than USD 75/b by early November and have traded as low as USD 69/b as anxieties over demand come to the fore. There have been brief pushes higher in prices in the intervening weeks as markets respond to concerns that critical global energy infrastructure could be caught up in regional geopolitics. But as it has become clear that shipments and production have been unaffected, the geopolitical premium in oil prices has deflated quickly, leaving the market to focus on fundamentals. Time spreads, which remain in backwardation, have also narrowed considerably as markets price in looser conditions.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Our expectation for oil in 2025 is that prices will struggle amid a negative macro backdrop. Moderate demand growth will be overwhelmed by production increases, including modest levels from OPEC+ countries as well as unrestricted output from producers outside of OPEC+. Delaying the planned increase by an additional month will do little to redress the pending surplus for 2025 as even full compliance with target levels still implies a build in inventories. Our price expectations for 2025—Brent at an average of USD 73/b—are based on oil market balances moving into surplus and we are keeping our targets unchanged at this time.

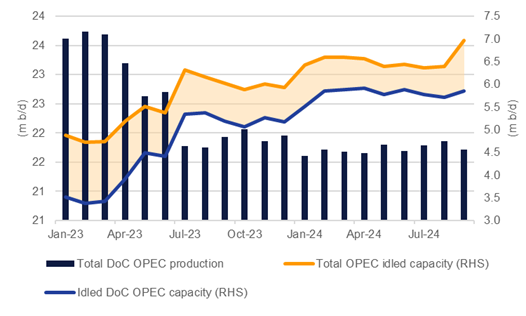

The impact on GDP growth for the GCC economies that are participating in OPEC+ may be more pronounced although a single month of oil production should have a relatively limited impact. As oil prices struggle to find a positive signal OPEC+ countries will wane in their enthusiasm for perpetual production restraint. Among the OPEC countries participating in production management, roughly 5.9m b/d of capacity are being held off markets. Demand growth is unlikely to increase quickly enough over the next several years to absorb all of that excess capacity which will act as a top-side barrier to prices.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.