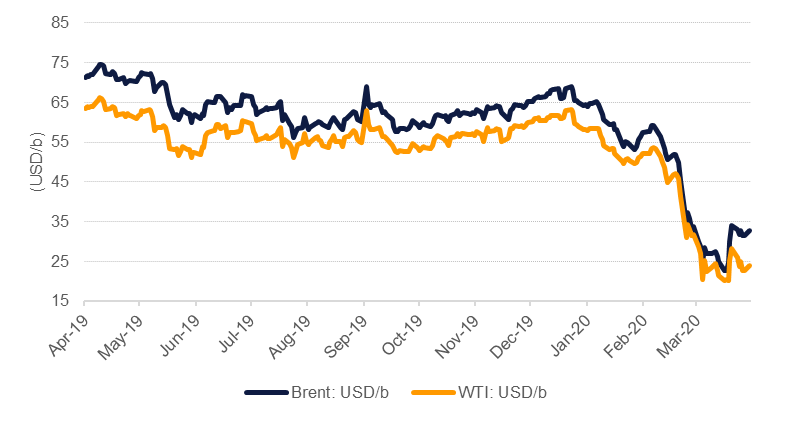

OPEC+ managed to get its production deal across the line last night, downgrading its cut agreement to 9.7m b/d for the first two months from 10m b/d previously. For the remainder of the terms of the deal—which last until April 2022!—the level of cuts has also been tempered. It appears that US president Donald Trump’s proposal to take some of the share of Mexico’s cut helped to get the deal agreed as it was highly uncertain whether a deal was going to be reached or not in fraught oil market diplomacy. Prices have risen in early trade this morning, up by 4% in the Brent market to just around USD 33/b. The cuts will come into effect in May, leaving a few more weeks of heavy supply volumes coming from Saudi Arabia, Russia and the UAE that will continue to pile up in inventories. The scale of the cuts, while impressive as OPEC+’s largest ever agreement, likely won’t be enough to offset the complete collapse in oil demand taking place in major economies. Thus the deal should help to prevent prices from excessive downside but probably won’t be enough to help boost prices much higher.

Eurozone finance ministers finally managed to get an economic rescue and support package across the line after failing to reach agreement during marathon talks earlier in the week. The agreement is worth EUR 540bn (roughly 4.5% of Eurozone GDP) and includes employment support, SME lending and a crisis support component that is meant strictly for healthcare related spending and would be drawn from the European Stability Mechanism. However, there was no agreement on debt mutualisation which several southern European economies—namely Spain and Italy which have been the most badly affected by coronavirus—have requested. Overall the deal is welcome but still looks relatively small considering the economic damage that coronavirus is wreaking across Europe. Italy has announced an extension of its national lockdown until the start of May while both Spain and France look to be following suit.

Inflation in the US sank in March as low petrol prices pushed the headline CPI index down to 1.5% y/y from 2.3% a month earlier. Even when stripping out volatile food and energy prices core consumer prices fell as airlines and hotels cut fees as a result of the impact of coronavirus. Inflation will likely be a backburner consideration for the Fed at the moment as the central bank takes step to ensure the US financial system has ample liquidity and purchases loans of SMEs.

Qatar will pay some private sector salaries for three months, at an estimated cost of USD 820mn. Salaries of both Qatari nationals and expatriates are covered under the programme. Bahrain and Saudi Arabia have announced measures to cover a portion of salaries of their citizens employed in the private sector but Qatar is the first government in the region to include expatriate workers in such a scheme. In the UAE, the ministry of economy announced it would cut fees on 94 of its services including licensing, registration and trademarks, in a bid to reduce costs for businesses. A senior judge also reiterated that employees that had been made redundant should continue to receive their housing allowances from their previous employers until they are able to leave the UAE or find other employment.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed lower as risk assets rallied hard. The new steps announced by the Federal Reserve did help USTs pare some of those losses. Yields on the 2y UST and 10y UST ended the week at 0.22% (flat w-o-w) and 0.71% (+12 bps w-o-w).

The Federal Reserve announced a loan program worth USD 2.3tn to aid small and mid-sized businesses and state and local governments as well as fund the purchases of some types of high yield bonds, collateralized loan obligations and commercial mortgage-backed securities. Unsurprisingly, the Bloomberg Barclays US Corporate index and the Bloomberg Barclays US Corporate High Yield index returned +3.0% 1w and +5.3% 1w respectively.

Regional bonds did see some buying interest even as primary issuances dominated flows. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped -10 bps w-o-w to 4.58% and credit spreads tightened 18 bps w-o-w to 391 bps.

Following bond issuances by Qatar and Abu Dhabi, Dubai raised AED 1bn from private placement of an eight-year sukuk which was priced to yield 4.71%.

Fitch affirmed Etihad Airways rating at A with stable outlook. The rating agency also affirmed the rating of Kingdom of Saudi Arabia at A with stable outlook citing strong fiscal and external balance sheets including high international reserves and low government debt.

The dollar reversed all of its weekly gains to trade below the 100.00 mark, finding support at the 99.400 level and ending the week at 99.484. The currency declined heavily as jobless claims in the US reached historic highs and with the announcement that the Fed will provide extra emergency stimulus totalling USD 2.3trn in loans to aid business and governments. The JPY was largely unchanged despite experiencing some choppy movement. The weakening dollar has caused the currency to stabilize very close to last week's closing price at 108.45.

The Euro started the week with a bullish tone and remained that way throughout amid the dollar's weakness. It saw an increase of 1.25% on last week's closing price to finish at 1.0936. This was helped by the news that EU finance ministers agreed upon a EUR 540bn strimulus package to support their economies. Sterling saw similar positive movement for the week, despite experiencing a dip on Tuesday. It finished the week at 1.2454, just over a 1.50% increase from last week, buoyed by the improving health condition of UK PM Boris Johnson.

The AUD soared last week increasing over 5.50%, now trading at 0.6348, its highest point in a month whilst the NZD saw similar movement, increasing over 3.50%, ending the week at 0.6077.

Regional equities started the new week on a mixed note. The DFM index added +4.1% while the Tadawul lost -2.0%. The rally on the DFM was broad based amid bargain hunting by investors. The Tadawul was led lower by weakness in petrochemical stocks as doubts remained over the OPEC+ deal to cut outputs. Saudi Aramco and Sabic lost -1.3% and -3.4% respectively.

Oil markets have opened higher in response to the OPEC+ production cut deal. Brent is up 4.3% at USD 32.84/b while WTI is 5% higher at USD 23.89./b. The gains this morning likely reflect some relief that OPEC+ diplomacy is still functioning rather than a strong endorsement that the deal will make a significant dent in the oversupply in crude markets. The market will now wait the official selling prices from Saudi Arabia as an indicator of conditions in the physical market.