VAT and higher oil prices to help budget deficit narrow in 2021

Oman introduced a 5% VAT on most goods and services from 16 April 2021, more than three years later than the UAE and Saudi Arabia and more than two years later than Bahrain, although they are ahead of Qatar and Kuwait which have yet to introduce the tax. The number of exempt items was raised from 93 to 488 including basic food items, financial services, medical care and equipment, education, and real estate transactions, rents, local and international transport services, and crude oil, its derivatives and natural gas.

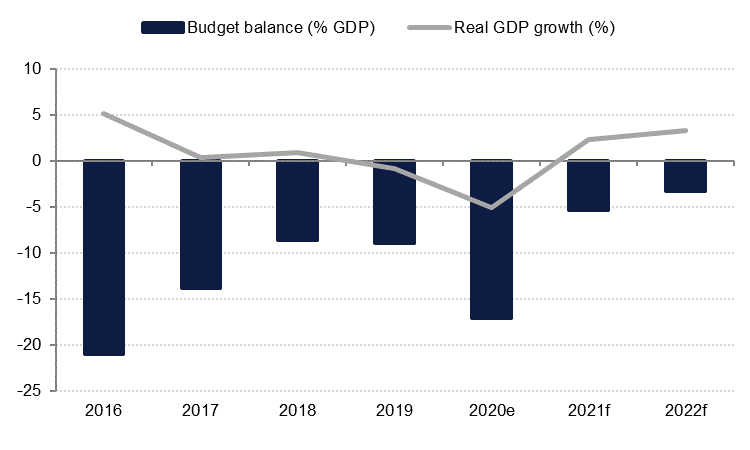

The authorities estimate that the VAT will raise OMR 400mn (USD 1bn) per year. This, together with higher oil prices than we expected at the start of the year should see revenue exceed OMR 10.4bn in 2021, higher than the budgeted OMR 8.6bn. However, we expect spending to exceed the budget as well, and we have pencilled in OMR 12bn in total expenditure. We thus estimate a budget deficit of OMR 1.6bn or -5.4% of GDP, a significant improvement on last year’s -17.1% deficit.

Bloomberg data shows a further OMR 1.6bn in debt falling due this year, bringing Oman’s total annual financing requirement to OMR 3.2bn (USD 8.3bn). Oman sold USD 3.25bn in international bonds in January, leaving around USD 5bn still to be financed. This will likely be through a mix of domestic borrowing and drawdown of reserves.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

Expect a modest economic recovery this year

Oman’s oil production increased by just under 1% in Q1 2021 compared with average output last year, compared with a sharp contraction in oil output from other GCC exporters. While Oman is not an OPEC member, it voluntarily complies with OPEC+ decisions. However Oman’s oil condensate production is not covered by the OPEC+ agreement and this has seen strong growth over the last year. With OPEC+ signalling a gradual unwinding of production cuts from May, we expect Oman’s oil production to continue to recover from last year’s cuts. We have pencilled in 2% growth in the hydrocarbons sector this year, making Oman the only GCC country where we expect oil production to boost headline GDP.

The IMF estimates Oman’s non-oil sectors contracted -10% in 2020, against our forecast of -7.0%. Rising coronavirus cases in Q1 21 and a slow rollout of vaccines relative to some other GCC countries has led to tighter restrictions on movement and activity being re-imposed through mid-May. We remain comfortable with our 2.5% non-oil sector growth forecast for 2021, bringing our headline GDP estimate for this year to 2.4%.