Oman will introduce VAT in April 2021, according to a royal decree issued on Monday. Essential food items, medical care, education and financial services will be exempt from the tax. Oman’s budget deficit has widened by 36% y/y in H1 2020 on the back of lower oil revenues, which are the main source of government revenue. The UAE and Saudi Arabia introduced VAT in January 2018, with Bahrain following in January 2019.

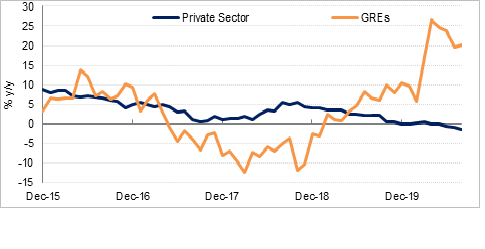

UAE broad money supply (M2) grew 11.1% y/y in August, the fastest annual growth since 2014. Bank deposit growth accelerated to 7.7% y/y in August, as corporate deposits rose 2.4% m/m after six months of decline. Gross loan growth was flat m/m and up 5.5% y/y in August. Public sector borrowing continued to be the main driver of bank loan growth, with private sector credit declining -0.4% m/m and -1.6% y/y in August. Separately, Bloomberg reported that the UAE may issue a federal bond by the end of this year or in early 2021, citing an undersecretary at the UAE ministry of finance. The federal government budget is relatively small at 10-12% of the consolidated UAE budget, and is usually balanced.

The value of Dubai’s non-oil trade reached AED 551bn in H1 2020, down -18.5% y/y. Exports grew 0.8% y/y in January to June, but both imports and re-exports declined on an annual basis, largely due to the Covid-19 pandemic resulting in border closures and weaker global demand. The official press release noted that the value of Dubai’s non-oil trade had increased m/m in May and June. However, on an annual basis, total non-oil trade was down by almost a third y/y in Q2.

In the UK, tighter restrictions unveiled on Monday pose additional downside risk to growth, which has already started to slow. Areas deemed “very high risk” – currently only Liverpool - will see pubs, and possibly gyms and betting shops closed and not allow mixing of households. “High risk” designation would restrict members of different households from meeting indoors. “Medium risk” restrictions are currently in place across England: 10pm closing times for pubs and restaurants and the “rule of six”. Three temporary Nightingale Hospitals that had been closed for summer are now on stand-by.

Indian CPI rose 7.3% y/y in September, up from 6.7% in July and August, faster than the 6.9% consensus estimate, confounding expectations that price growth would start to ease as pandemic-related bottlenecks and supply chain disruptions dissipated. In light of the acceleration in inflation, the likelihood of a further 2020 interest rate cut by the RBI is looking increasingly less likely. The bank will likely look to boost liquidity through other measures, as seen at its MPC meeting last week, with any further rate cuts now pushed out to 2021.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

US markets were closed thanks to a public holiday at the start of the week but treasuries are tentatively nudging higher in early trade this morning. The 2yr UST yield has dipped to 0.1469% while the 10yr is at 0.7571%.

European bond markets were higher across the board to start the week with yields on 10yr gilts down nearly 1bp to 0.269% and bund yields slipping by almost 2bps to -0.546%.

Local media reported that the UAE may issue a federal government bond by the end of 2020. Bonds are normally issued at the emirate level in the UAE given the federal government has a comparatively smaller budget.

Moody’s lowered its rating on GEMS Education, a UAE-based school operator, to ‘B3’ given the weak conditions in the domestic economy as a result of the Covid-19 pandemic.

It was a quiet session for major currencies on Monday following the American holiday. The USD fluctuated in a tight range between 93.050 - 93.250, ending the day virtually unchanged but experienced a slight rise this morning to reach 93.170. USDJPY remained on the back foot, dropping by -0.23% to trade at 105.37.

The EUR recorded losses of -0.25% and trades around the 1.18 handle amid fresh concerns related to the spread of Covid-19 in the region and fresh lockdown measures being imposed. The GBP finished the day in a positive fashion after British PM Boris Johnson announced a new three-tiered restriction system for the UK but has reversed most of these gains. Still the currency has managed to hold on to some minor gains to reach 1.3045, marking a break above the 50-day moving average of 1.3029.

The AUD dropped dramatically in the evening and further so this morning, falling by -0.99% to trade at 0.7170 whilst the NZD decreased by -0.40% to reach 0.6640..

Equity markets started the week on the front foot, driven by a renewed tech surge which helped the NASDAQ close 2.6% higher on the day while the Dow Jones and the S&P 500 gained a more modest 0.9% and 1.6% respectively. In Europe, the DAX and the CAC both closed 0.7% higher, but the imposition of new regional restrictions on meetings and movement by the British government saw the FTSE 100 lose 0.3%. Japan’s Nikkei was the only other loser on the day among major equity indices, also losing 0.3%. Elsewhere in Asia the Shanghai Composite gained 2.6% yesterday, but is trading 0.6% lower this morning. S&P 500 futures are also down modestly, reflecting uncertainty around a Covid-19 vaccine trial by Johnson & Johnson which has been paused due to a participant becoming ill.

Oil prices were weaker to begin the trading week as concerns over strikes in Norway and Hurricane Delta in the US eased. Brent futures fell 2.6% to close at USD 41.72/b while WTI slipped by 2.9% to close at USD 39.43/b.

Libya’s national oil company has lifted force majeure at its largest oil field which will allow production to rise to 600k b/d by the end of October. Libya is not bound by the OPEC+ production cuts and its increase in output will add further pressure on OPEC+ members to stick to their production cut targets as closely as possible.