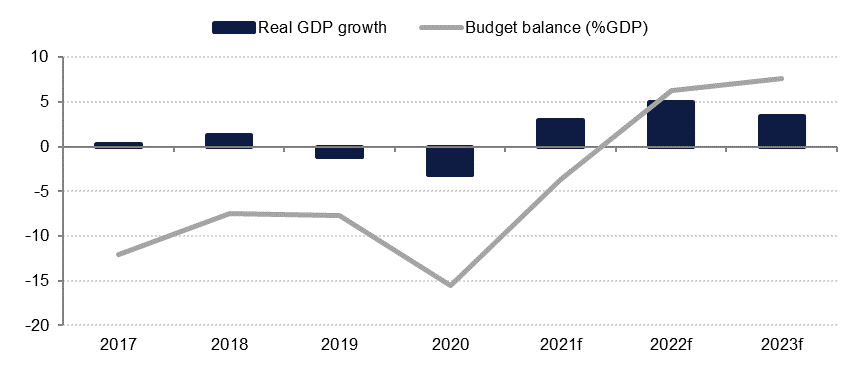

We have upgraded our forecast for 2022 GDP growth largely on the back of higher than expected oil production year-to-date: Oman’s crude oil output exceeded 1.1mn b/d in July and August, and is up over 9% so far this year, compared with average 2021 production. Oman has also increased LNG exports this year and is investing in boosting capacity in this space as well.

The surge in oil and gas prices has helped to turn around Oman’s budget and the sultanate is on track to record a budget surplus of 6.3% of GDP according to our estimates. Revenues in the year to July were up 47% y/y while expenses grew just 8.8% y/y over the period. Within revenues, gas revenues surged 120% y/y while oil income was up 45%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

The government has used some of the fiscal surplus to reduce the stock of public debt, which fell almost 11% y/y in H1 2022 following a voluntary debt buyback of USD 700mn at the end of June. Further debt reduction in H2 should see the debt to GDP ratio decline to 43% of GDP by the end of this year, down from over 67.3% at the end of 2021. Our forecasts for 2023 show another sizeable budget surplus of 7.6% of GDP which will further allow the government to strengthen the sovereign balance sheet.

CPI inflation has slowed to 2.4% y/y in August from 4.4% y/y in January, with food prices up 4.9% in the latest reading. Housing and transport costs have been relatively contained in Oman, and aside from food prices, the component showing the fastest price growth this year has been education followed by healthcare. Like many other GCC countries, petrol prices have not increased in Oman this year, helping to curb overall inflation.