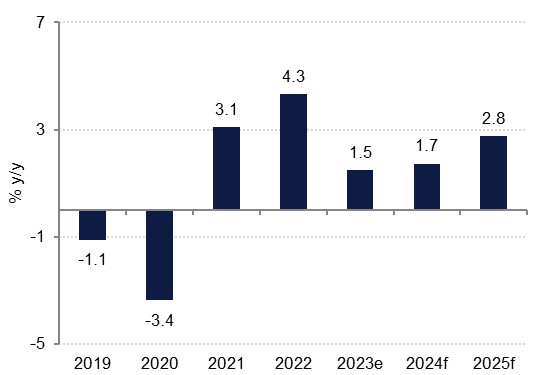

We forecast real GDP growth of 1.7% in Oman this year, which would reflect a modest acceleration on the 1.5% we estimate for 2023. Once again it will be the non-oil sector that will drive the expansion, as we expect flat growth in the oil sector this year after an estimated contraction in 2023. Even with another year of constrained oil output, we anticipate an ongoing improvement in the fiscal position, with the debt load continuing to ease from the elevated levels seen several years ago.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Oil sector will see flat growth this year

Oil production in Oman averaged 1.05mn b/d over January to November last year, down 1.9% on the 1.07mn b/d produced over the corresponding period in 2022, and for the full year we have estimated a production decline of 2.0%. This informs our hydrocarbons GDP estimate of a 0.6% contraction in 2023, with natural gas and condensates production helping to offset the more sluggish crude oil production; production of condensates, which are exempt from the OPEC+ agreement, were up 8.5% y/y over the same January to November period. Nevertheless, this growth estimate stands in contrast to the 10.2% hydrocarbons GDP growth recorded in 2022 as oil production was ramped up post the Covid-19 pandemic.

Looking ahead, previously agreed OPEC+ production curbs were reaffirmed by member states in late 2023 (Oman committed to cutting by 40,000 b/d in May) and are set to remain in place through the first quarter at least before potentially coming off modestly thereafter. While near-term oil production is likely to be weaker y/y, the Omani hydrocarbons sector also stands to benefit from ongoing investment in exploration and development. According to the Oman News Agency, total investment in the sector totaled USD 5.8bn in the first half of 2023, with capital expenditure accounting for 62% of that. As such, we project flat hydrocarbons GDP this year.

Non-oil sector will underpin growth

With oil sector growth set to be dampened once again by constraints on production growth, it will be the non-oil sector that drives the expansion in Oman this year. We forecast non-oil growth of 2.5%, which would be in line with both our estimate for last year and moderately stronger than the average over the decade to 2022 (2.2% pa). Over the first three quarters of last year, non-oil sector growth averaged 2.7% y/y.

The tourism sector has continued to recover from the pandemic shock, and according to the UN’s World Tourism Organisation (UNWTO), international visitor numbers were at 2.1mn, up 343% on 2022 but still 17.6% off pre-pandemic 2019. Growth continued in 2023 at 43.2% y/y over the first three quarters and we anticipate ongoing growth, if at a slower pace, over the coming years. While a global slowdown does pose a risk to the pace of the expansion, Oman is becoming increasingly attractive to new growth markets in Europe. The proposed launch of a GCC unified tourist visa, which was agreed to by ministers from all six states in October, would also support ongoing growth in visitors, not least from regional non-national residents.

As with the rest of the GCC, anticipated lower interest rates in the second half of next year should encourage greater consumption and investment from both households and businesses, especially with prices pressures likely to remain benign. We forecast an average annual CPI inflation rate of 2.0% next year, higher than our estimate of 1.0% in 2023.

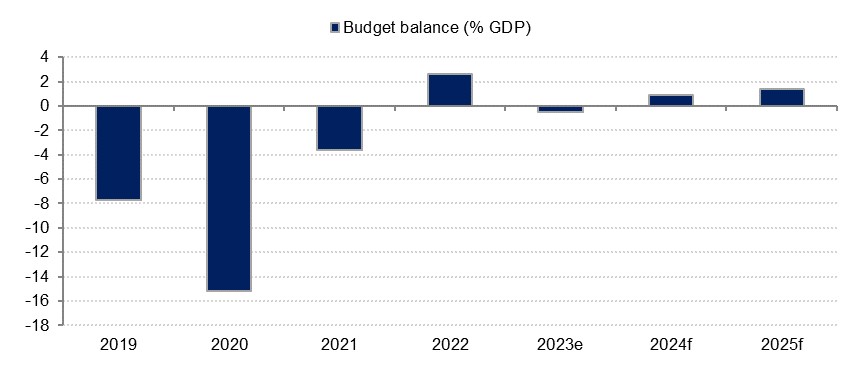

Budget

With oil production constrained, and prices likely to average similar to those last year, Oman’s government revenues from oil will see only modest growth, but higher natural gas revenues and an increasingly diversified tax base (VAT was introduced in 2021) will cushion the impact. Meanwhile, we anticipate that expenditure will remain flat, meaning a fiscal surplus equivalent to 0.9% of GDP this year, compared with our estimate of a modest -0.5% deficit in 2023 and a surplus of 7.3% in 2022. A reversal from the period of consecutive fiscal deficits has enabled Oman to reduce its government debt to 38% of GDP in 2023 according to ratings agency S&P, down from around 70.0% in 2020. This improved fiscal position has been recognized by the major ratings agencies, with Fitch, S&P, and Moody’s all upgrading Oman’s score in the second half of last year.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research