Oman’s finance ministry proposed a raft of measures to reduce the budget deficit over the medium, including the introduction of income tax on “high income” individuals from 2022. If implemented, Oman would be the first GCC country to impose an individual income tax. No qualifying income level was mentioned, nor was it clear whether the proposed tax would apply to all residents and citizens or expatriates. The finance ministry also plans to gradually reduce subsidies on electricity and water to zero by 2025, and exempt visa fees for visitors from more than 100 countries in a bid to boost tourism. Some real estate transaction fees could also be reduced. We estimate Oman’s budget deficit will exceed -15% of GDP this year, and without the sizable cushion of sovereign wealth enjoyed by several other GCC countries, has had to rely on expensive debt financing in recent years and has been slow to tackle budget reform. The Sultan recently announced that VAT would come into effect in April 2021, more than three years later than in the UAE and Saudi Arabia.

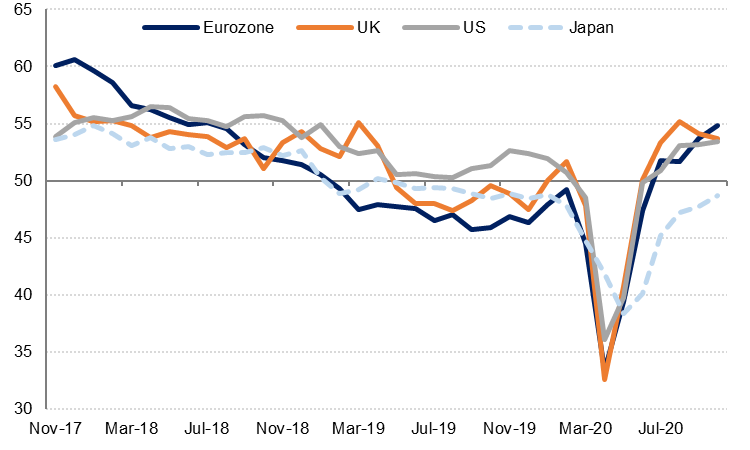

Manufacturing sectors in several major economies continued to rebound in October, according to the latest PMI survey data. Eurozone (54.8), UK (53.7) and US (53.4) manufacturing PMIs beat forecasts and in the Eurozone and US were higher than the previous month. While Japan’s manufacturing PMI remained in contraction territory at 48.7, the October reading was better than the 48.0 recorded in September. However, renewed lockdowns across Europe and the UK will likely weigh on output in November.

In the US, the ISM manufacturing survey was also much stronger than forecast in October, rising to a two-year high of 59.3 from 55.4 in September, with new orders and prices paid rising strongly last month. Encouragingly, the employment component moved back into expansion territory (53.2) for the first time since July 2019.

The RBA cut policy rates—as expected—by 15bps to 0.10% as well as taking its target for the 3yr yield to the same level. The RBA has also introduced a QE programme targeting the longer end of the curve and will buy up to AUD 100bn of 5-10yr bonds over the next six months.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US Treasury markets were mixed a day ahead of the presidential election. The front end of the curve lost some ground—yields on the 2yr UST edged up slightly to 0.1545%—while the longer end of the curve gained with the 10yr UST yield down by 3bps to close at 0.8434%. Markets will be nervy until the outcome of the election is known, which may not be for some days if the counting of postal ballots takes some time in key states.

Emerging market bonds held steady with future direction only likely to be clearer until after a new president emerges. Spreads over USTs edged slightly higher to 341bps.

It was a quiet session for major currencies on Monday. The GBP was amongst the biggest movers, reacting to the news that the UK will enter a nationwide lockdown, staying in the red all day and at one point falling to a low of 1.2855. Reports of progress in Brexit talks, particularly surrounding fisheries, has provided a reversal for Sterling, but the currency still recorded a loss of -0.23% overnight but is trading higher at 1.2930 this morning. The EUR continues to struggle amid rising Covid-19 cases in the region and is virtually unchanged at 1.1650.

The USD could not find major headwind in any direction, likely a result of the uncertainty of the upcoming presidential election, but experienced a slight decline this morning to trade at 93.975. USDJPY was similarly tentative but has rallied modestly and trades at 104.70.

The AUD reacted in a relatively restrained way to a dovish tone from the RBA this morning where policy rates were cut to 0.10% along with the yield curve target and a new AUD 100bn QE programme. The RBA seems to be explicitily pushing for a weaker currency, saying the policy actions should “contribute to a lower exchange rate.”

US equities rebounded on Monday ahead of today’s election, with the S&P500 and DJIA up 1.6% and 1.2% respectively. Energy, materials and industrials gained strongly, while tech stocks lagged, and the Nasdaq Composite up just 0.4%. S&P 500 futures are up slightly as of this writing.

European equities rallied the most in five weeks after last week’s rout. The Stoxx 600 gained 1.6% while the FTSE rose 1.4%. The CAC40 and DAX indices were both up more than 2%.

The Saudi Tadawul ALSI closed up almost 2% on Monday, as bank stocks led the index higher. The DFM and AD general indices saw more modest gains of 0.6% and 0.1% respectively.

Oil prices managed a sharp intraday recovery overnight. After a gap lower opening which saw Brent futures fall to below USD 36/b they managed to gain more than 4% on the day to settle at nearly USD 39/b. WTI futures saw similar range of movement, closing up 2.9% at USD 36.81/b.

Russia’s energy minister has reportedly discussed with oil companies in the country about delay the OPEC+ production increase that is scheduled for the start of January. Production from OPEC members rose by 470k b/d last month thanks to greater than 100k b/d gains from both Nigeria and Iraq along with a 300k b/d increase in Libya’s production. Collective compliance with output targets has fallen to 77% with no country hitting their target last month.