Oman looks set to become the first GCC country to introduce personal income tax, as the Shura Council forwarded the draft personal income tax (PIT) law bill to the Council of State at the end of June. This suggests that there is renewed momentum behind the bill which has been on the cards since outlined in a ministry of finance 2020-2024 economic plan published in late 2020. The bill was then approved by the Shura Council in November 2022 with seemingly little progress since, but it now appears that the bill is nearing the end of its legislative cycle.

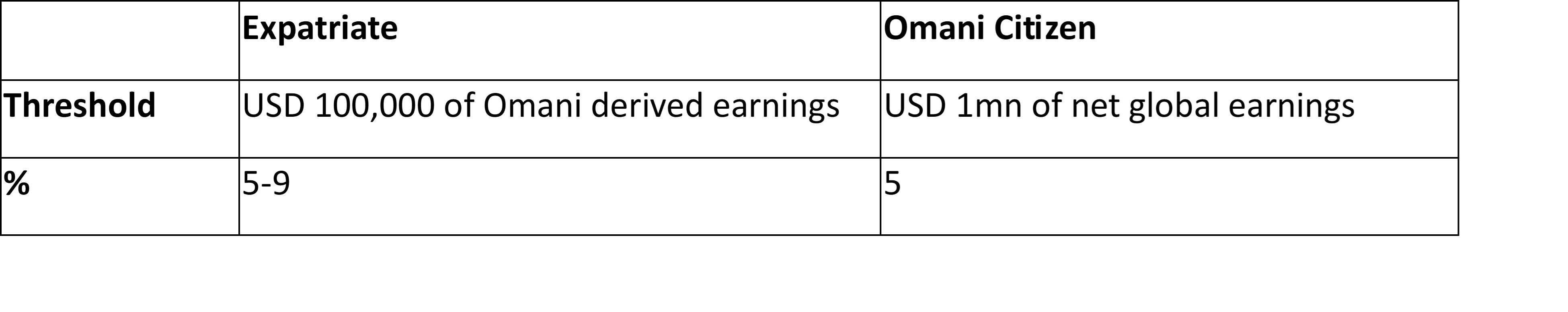

The final details of the tax brackets are yet to be announced, but it has been reported that foreign nationals will be liable to PIT of 5%-9% on income from Oman over USD 100,000, while for Omani citizens the threshold will be orders of magnitude higher at net global income over USD 1mn, which would be taxed at 5%. The new PIT could be introduced as early as 2025 which would put the country back in the vanguard of widening the tax base in the GCC. Oman has long had corporate income tax, even if in a limited capacity. It was introduced in 2009 and raised from 12% to 15% in 2017, with the tax only now introduced in the UAE. However, Oman subsequently lagged the UAE and Saudi Arabia in introducing VAT.

Source: Media reports, Emirates NBD

Source: Media reports, Emirates NBD

Until the final details and likely introduction date of the PIT are announced, we will leave our fiscal forecasts for Oman unchanged. Initially at least the new PIT will not impact the majority of people in Oman, whether expatriate workers or citizens; there are 2.2mn expats in Oman, making up 42.3% of the total population of 5.2mn. Within this 2.2mn, the majority (1.4mn) have an educational attainment level of less than general diploma. While it is not a perfect indicator of income, only 214,503 expat workers have a bachelor’s degree or higher diploma so the number of foreign workers on the kind of USD 100,000-plus salary that would be liable to PIT is likely lower still than this – so fewer than 4.2% of the population at large. The number of Omani citizens meeting the USD 1mn annual income threshold is likely to be similarly small.

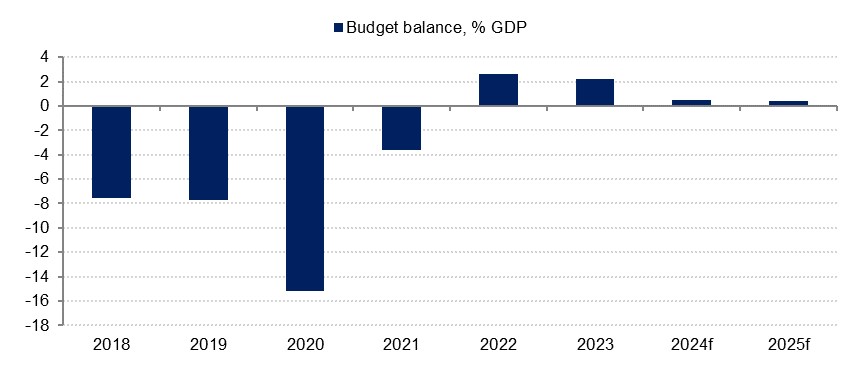

Nevertheless, the move towards PIT by Oman is another signal of a fiscally sound government looking to widen its tax base and bring down its recently onerous debt levels. Oman’s fiscal position continues to improve, and we forecast a budget surplus this year and next. If realised, this would mark four consecutive years of budget surpluses after the balance turned positive again in 2022, averaging 1.5% of GDP over the period. This stands in stark contrast to the preceding decade to 2021, which saw a straight run of budget deficits, averaging 8.3% of GDP.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

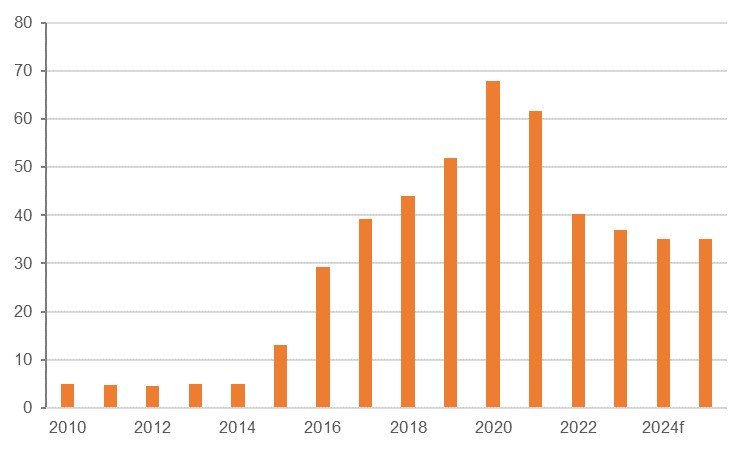

The sharp fall in global oil prices in H2 2014 precipitated the initial deterioration in Oman’s fiscal environment, and while there was a modest narrowing of the deficit over 2018 and 2019, the Covid-19 pandemic which emerged in Q1 2020 exerted further pressure on finances. At the same time, Oman lagged some of its GCC peers in widening its fiscal base through the introduction of VAT, leaving it over reliant on hydrocarbons income that was not as assured to cover spending as it had once been, and a moribund private sector. The persistent budget deficits saw Oman’s debt burden expand rapidly, from just 4.9% of GDP in 2014 to a peak of 67.9% in 2020.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

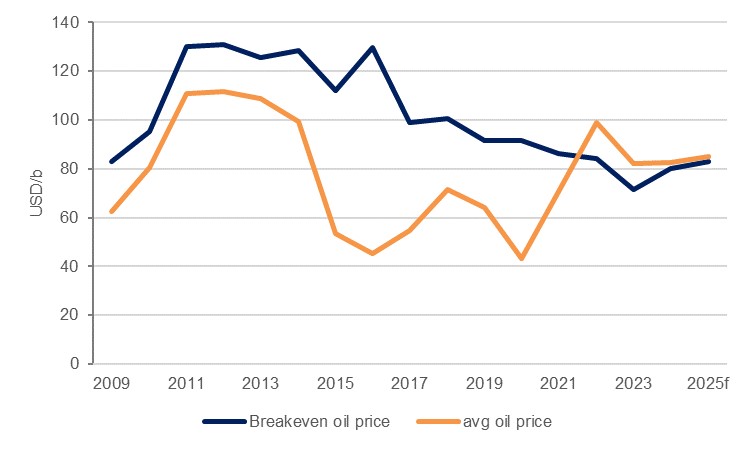

Over the past several years, however, Oman has made considerable strides in balancing its books. And while this has been substantially aided by a higher oil price coming out of the pandemic, that has not been the whole story. Rather there has also been a greater focus on fiscal consolidation and on widening the tax base and the government’s sources of income away from simply relying on hydrocarbon sales.

In April 2021, Oman introduced VAT for the first time, more than three years later than the UAE, and there have also been a series of divestments of SOEs by the Oman Investment Authority (OIA), with around USD 3bn netted in 2023 according to the IMF. Looking ahead, the OIA’s divestment plans include potentially dozens more listings over the next five years, while the PIT would add a little more to this income from 2026 onwards perhaps. Revenue from hydrocarbons will remain the most important factor in Oman’s finances, accounting for 71.9% of total revenue last year, but this was lower than the long-run average. With the divestment plan set to bolster the private sector and non-oil GDP, CIT income should rise as a share of total revenue in the coming years, further diminishing the importance of hydrocarbon revenues.

Oman has also made progress on curbing spending, with expenditure falling from an average of 40.2% of GDP over the 10 years to 2022 to just 27.7% last year. Part of this fall is related to accounting, with investment into petroleum development and gas exploration, and current spending on petroleum development, moved off the state budget and on to the financials of the energy companies. However, spending has continued to decline even after this had passed through over 2019 to 2021; spending fell some 10 percentage points of GDP over the two years to 2023.

Source: Haver Analytics, Bloomberg, Emirates NBD Research

Source: Haver Analytics, Bloomberg, Emirates NBD Research

We estimate that the breakeven oil price for Oman’s budget will come in just under USD 80/b this year, which would be lower than our USD 82.5/b forecast average, which will enable a further draw down of debt levels. From the 2020 peak, Oman’s debt to GDP fell to just 36.5% of GDP last year, and the ministry of finance forecasts it will drop further to 35.0% this year. In Q1, the ministry repaid OMR 188mn of outstanding obligations, taking the total down to OMR 15.1bn.

Source: Bloomberg, Emirates NBD Research

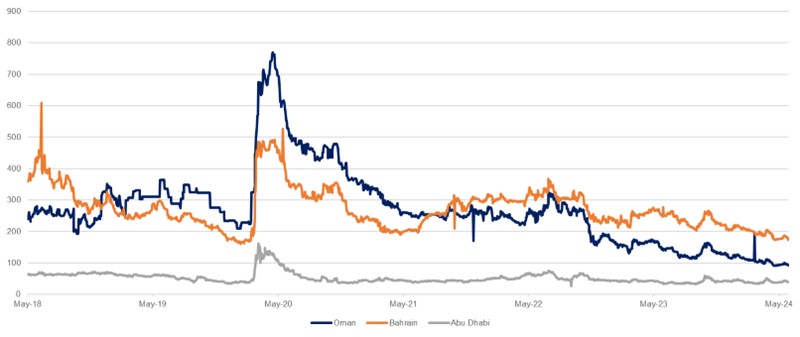

Source: Bloomberg, Emirates NBD ResearchThe turnaround in Oman’s fiscal position has been reflected in its external appraisals, with a series of upgrades from the major ratings agencies over the past 12 months putting it on the verge of regaining investment grade status. Meanwhile, Oman’s 5yr CDS spreads have fallen to a series low of just 90 points last month, from highs of 763 during the Covid-19 pandemic. From having been persistently wider than Bahrain’s through 2019 to 2021, Oman’s spreads are now some 80 points narrower as the sultanate has made greater progress on fiscal consolidation.