Oman and Bahrain were the first GCC sovereigns to tap capital markets this year, as they sought to take advantage of the low-rate environment to finance expected budget deficits in 2021.

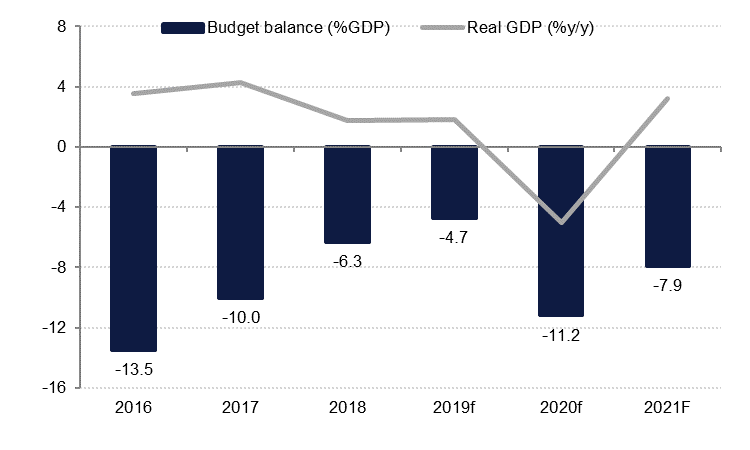

Bahrain raised USD 2bn last week in a three-part bond sale with 7y, 12y and 30y tranches. We expect Bahrain’s budget deficit to narrow to –BHD 1.1bn (USD 3bn) or -7.9% GDP this year from an estimated -11.2% in 2020 on the back of higher oil prices as well as increased non-oil revenues as economic activity recovers. The budget for 2021 does not envisage significant additional spending cuts this year.

The January bond issue will only cover around two-thirds of Bahrain’s estimated deficit and in addition there is a USD 975mn dollar bond maturing this year. Bahrain will continue to draw on the USD 10bn GCC support package, although ratings agency Fitch noted that Bahrain will likely need further support once the current package runs out in 2023.

GDP data show the economy growing 1.4% q/q in Q3 2020, following four quarters of q/q contraction. On an annual basis, GDP contracted -6.9% y/y in Q3 2020, after a -9.0% y/y contraction in Q2. Transport & communication and hotels & restaurants recovered q/q as borders re-opened but output in these sectors remained significantly lower than in Q3 2019. Overall, we estimate Bahrain’s economy contracted -5.0% in real terms in 2020, and we expect 3.2% growth in 2021.

Sheikh Salman bin Hamad, Bahrain’s crown prince, was appointed as Prime Minister in November, following the death of Sheikh Khalifa. Sheikh Salman is viewed by many commentators as more reform-oriented, but it remains to be whether he will accelerate the pace of fiscal and other reform in the kingdom.

Source: Haver Analytics, Emirates NBD Research

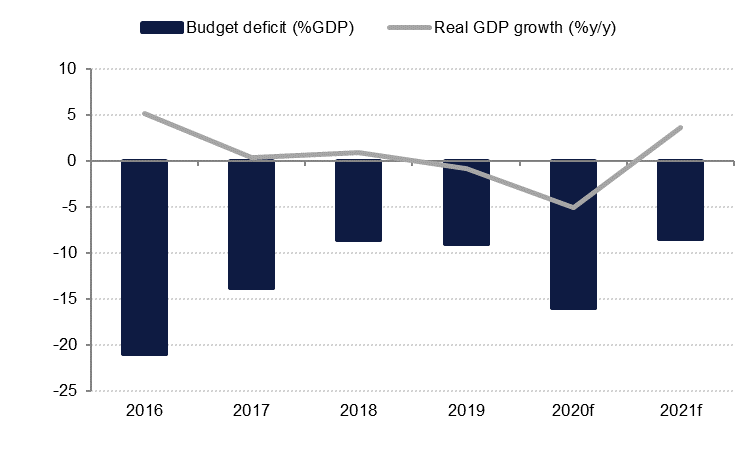

Source: Haver Analytics, Emirates NBD Research

Oman raised USD 3.5bn by issuing 10y and 30y bonds and tapping its existing 2025 bond in January. This was the third time since October 2020 that Oman tapped capital markets, raising a combined USD 2.5bn in October and November last year.

The 2021 budget makes provision for a deficit of OMR 2.2bn (USD 5.7bn), only slightly lower than our forecast of OMR 2.3bn (-8.6% of GDP) so the January eurobond issuance would cover more than 60% of the projected deficit, with the balance of financing likely to come from reserves.

Unlike Bahrain, Oman does not have a financial support package from other GCC countries (although talks are reportedly ongoing) and the new Sultan has announced significant reforms over the last year in a bid to tackle the large deficit and also to boost growth in the country. These included streamlining the government, reducing spending in H1 2020 as a result of sharply lower oil revenues, and cutting energy subsidies for large consumers. After several postponements, 5% VAT will come into effect in April 2021 and Oman has also mooted the possibility of introducing an income tax on high earners.

The government also announced a new – ambitious - five-year financial plan (2021-2025) which aims to bring the budget into balance by 2025 by capping expenditure at 2020 levels, improving the efficiency of public spending and boosting non-oil revenues.

Other reforms have been recently announced as well, including the appointment of a crown prince to reduce uncertainty around succession planning. Labour market reforms include allowing expatriates to change jobs without getting permission (NOC) from employers, while also making it more difficult to hire expatriates in certain sectors. Earlier this week, Oman announced that some jobs would be open to Omani nationals only, including administrative and financial roles in insurance companies, accounting, car sales as well as lower skilled jobs such as driving.

We expect growth to reach 3.7% in 2021 after an estimated -5.1% contraction in 2020. Higher oil prices and the introduction of VAT should allow the budget deficit to narrow to -8.6% of GDP this year from an estimated -16.1% in 2020, even with some slippage on the expenditure side.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research