U.S. assets had a strong day yesterday as Treasuries rose, alongside solid gains on Wall Street, with the dollar firming as well. A run of positive earnings results helped lift the S&P 500 over 0.9% and above its record peak from 2018. Treasuries were supported even as USD40bn in 2-year notes were sold. New home sales also beat expectations rising 4.5% to 692k in March, even after February's stronger than expected 5.9% increase and after a drop in existing home sales on Monday. On a slightly softer note the April Richmond Fed manufacturing index fell 7 points to 3 after falling 6 points to 10 in March. In Asia the Chinese PBOC stepped back from providing further broad monetary easing and instead offered CNY267bn in targeted medium-term loans to banks. This more calibrated approach has caused Asian stocks to ease slightly as it suggests that further liquidity provision will be more piecemeal.

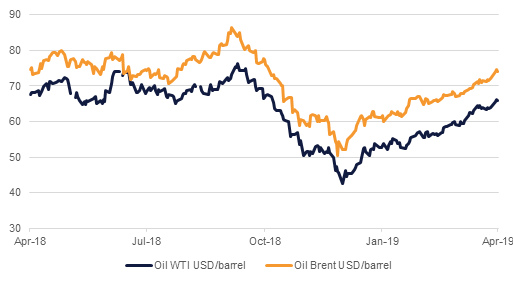

Oil prices are still in the spotlight today, and a bit more volatility came back into them yesterday, with some downward pressure returning as concerns about inventories momentarily outweighed the issue of U.S. waivers on Iran. However, this was shortlived, with prices recovering back as the market rethinks how Saudi Arabia will respond to the U.S. decision to reduce Iran exports to zero. The U.S. has said that Saudi would make up for the reduction in Iranian barrels but that remains to be seen. Last year, when President Trump surprised markets by issuing waivers on Iranian oil exports to a number of countries, the oil market quickly became oversupplied, resulting in prices crashing from USD 75/b to USD 45/b at year end. This time around, it is thought that Saudi Arabia will likely stay in wait and see mode with regards to its production levels, and only respond when it sees that Iranian exports have actually been reduced. OPEC next meets formally in June so it has time to weigh its response.

Egyptian President Abdel-Fattah el-Sisi could remain in power until 2030 following a constitutional referendum which has extended his current term by two years to six, and enables him to stand again when it is over in 2024. 88.8% of voters were in favour of the amendments, which also included 25% female representation in parliament, allowing vice presidents, and re-establishing the upper house.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US treasuries were largely steady while reversing some of the previous day’s losses. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed marginally lower at 2.36% (-3bps), 2.36% (-3bps), 2.57% (-2bps) and 2.98% (-1bp) respectively. Strong corporate earnings inspired optimism saw the 2yr-10yr curve steepen to 21bps, its highest for this year. In contrast, sovereign bonds in Europe fell with yields on 10yr Gilts and Bunds rising to 1.22% (+3bps) and 0.04% (+2bps) respectively. Credit spreads in the developed world were mixed with 1bp decline in CDS levels on US IG to 57 bps but unchanged on Euro Mian at 58bps.

Regional GCC markets were steady with average yield on Barclays GCC index reducing by a bp to 4.04% on the back of benchmark yield tightening. Credit spreads were unchanged at 158bps.

In the credit space, Moody’s upgraded several Egyptian banks (NBE, BM, BdC, CIB) following a similar rating action on the sovereign.

The USD was firmer overall yesterday, as markets digested strong earnings data in the US and good new home sales data. In particular the AUD extended its recent drop overnight after weaker-than-estimated Australian inflation data boosted the chances of RBA rate cuts. Q1 headline inflation was flat q/q and fell to 1.3% y/y while the trimmed mean measure rose 0.3% q/q with the y/y rate falling to 1.6% from 1.8% previously.

As we go to print, AUDUSD is trading 1.02% lower at 0.70297. After breaking and closing below the 100-day (0.7127) and 50-day (0.7112) moving averages yesterday, the cross is on course for a fifth day of declines. Should the 23.6% one-year Fibonacci retracement (0.6962) fail to provide support, the price will be vulnerable to a more significant decline.

Stock indices in the US reached their record highs in response to stronger than expected corporate earnings announcements. S&P 500 gained 0.88% and Dow Jones closed up by 0.5%. Europe was also mostly in the green. That said, Asian bourses are failing to track the US stock rally as most of economic news out of the region this week has been bearish. The Topix fell 0.3% and Shanghai composite closed lower by 0.4%.

GCC markets also failed to track the rally in the developed world. DFM closed down by 0.33%. Muscat was down 0.5%, Qatar closed lower by 0.18% and Kuwait indices fell 0.46%. Tadawul was the one that gained from high oil prices, closing up by 0.36%.

Oil futures added to their gains overnight as the market continued to grapple with the US fully enforcing sanctions on Iranian crude exports. Brent closed at USD 74.51/b, up 0.6%, while WTI gained more than 0.9% to finish the day above USD 66/b. The IEA released a statement overnight saying that crude markets remain adequately supplied thanks to an increase in global spare capacity and cautioned against prices rising too much in the context of softening global growth. Meanwhile press reports indicate that OPEC would be prepared to increase production so long as demand was there to soak up any excess.

The pending imposition of sanctions is helping to further tighten forward markets. Dec spreads in Brent and WTI are near one-year highs while spreads closer to the front of the curve are now in backwardation in both contracts. In the Dubai market, the 1-3 month spread hit USD 1.6/b in backwardation, its widest level in the past year.