Oil prices have largely shrugged at the OPEC+ decision in early June to maintain production cuts for a prolonged period and paid little heed to Saudi Arabia’s planned additional cuts of 1m b/d for July. Front month Brent prices declined in the week following the OPEC+ meeting, trading currently around USD 75/b, extending year-to-date losses to nearly 13%. The drop in prices so far this year seems to be driven by a market squarely focused on demand, particularly stemming from data out of China.

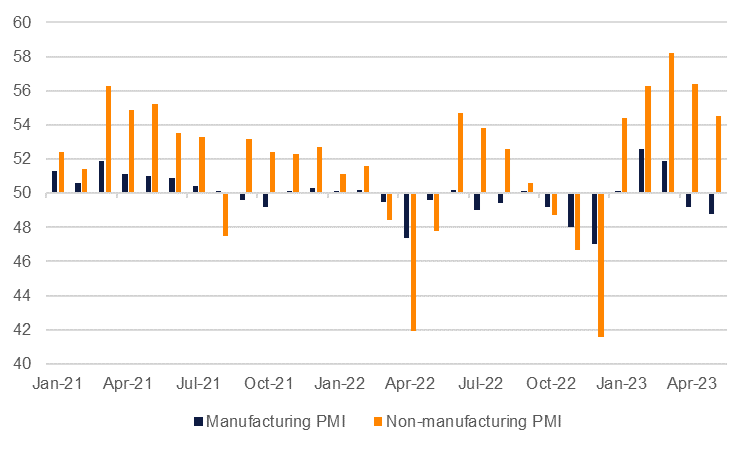

Since China ended its stringent Covid-zero policies at the end of last year its economic performance has failed to put a strong bid under commodity prices. Manufacturing PMIs—both from official and private sectors surveys—have either shown signs of contracting activity or been near flat. Trade data has also pushed weaker: exports dropped almost 8% y/y in May while imports fell on an annual basis for both April and May. Beyond the relative underperformance to expectations of the hard data, market sentiment on China appears to skew heavily negative with concern that strain in the country’s property market will be a persistent—and potentially heavy—drag on economic activity.

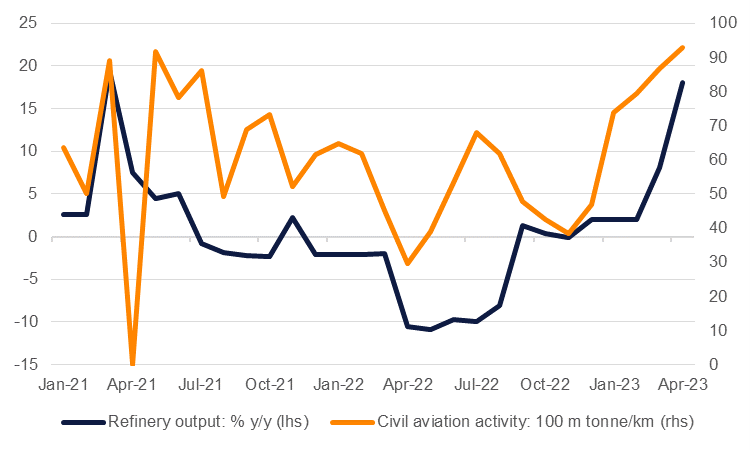

However, the general softness in China’s headline economic data as well as doubts over how robust it will perform in the rest of the year stands at odds with the relative strength of apparent oil consumption data for the country. Apparent oil demand jumped almost 25% y/y in April to 15.1m b/d, even faster than the near 10% increase recorded for March. Apparent oil consumption data is by necessity a proxy for demand when there is not full data availability but the strong data is backed up by what the IEA has noted as demand at “the highest mark ever recorded” in Q1. In its June oil market report the IEA actually revised its China oil demand growth forecast up by 230k b/d, assuming growth of more than 2m b/d y/y from Q2 onward. A major part of that recovery is air travel: total airline transport was up 65% year-to-date as of April, led primarily by domestic air travel where the number of routes is far larger than the international component.

China’s government is also not ignoring the drop in activity and the central bank there has already cut its reverse repo rate and may follow through with cuts to the prime policy rate, the MLF, later this week. Targeted measures for the property sector in particular may also be forthcoming and while the direct pass-through to oil consumption is likely to be marginal, it will ultimately be positive.

The recovery of China’s oil demand is the primary variable in determining how strong global oil consumption will be in 2023. The IEA projects demand growth of 2.45m b/d y/y for 2023 for global oil demand with China alone accounting for more than 60% of the increase. Should demand fail to come into close to those levels for China, overall demand growth this year may look much more like pre-pandemic levels of closer to 1.1-1.5m b/d. Demand in developed economies is set to flat-line this year even if expectations of a dire recession have so far failed to materialize. Among emerging economies beyond China, demand growth will still be positive—apart from in Russia according to IEA projections—but it will be slower than 2022.

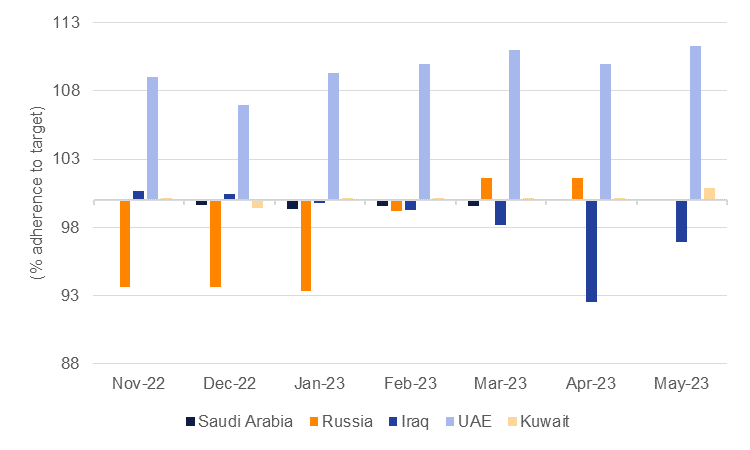

Even in a scenario with much slower demand growth than the IEA’s baseline projections, supply still won’t be enough. We expect that Saudi Arabia will extend its voluntary 1m b/d production cuts beyond July, helping to kick-start an inventory draw in Q3 while the rest of OPEC+ has committed to production cuts until the end of 2024. OPEC’s own projections are for a market deficit of 2.7m b/d in July, comparable to levels in Q4 2021 when oil prices surged year/year as economies recovered from 2020.

Getting to a deficit of that size will require stringent compliance with OPEC+ production quotas which among OPEC countries has been relatively strong, abetted by countries underperforming their target levels. Russia has committed to cuts of 500k b/d from its February 2023 levels but so far has only delivered around 300k b/d of those cuts and weekly export volumes had actually been trending higher, though have dipped in the last few weeks as production has declined. Russian adherence to OPEC+ targets will be a point of contention within the producers’ alliance, with Saudi Arabia’s energy minister wanting more transparency on Russian production levels.

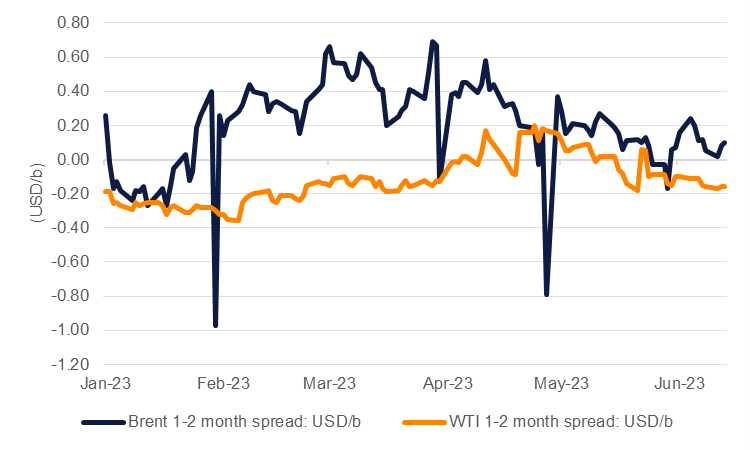

But while markets are set to endure a tight oil market now and over the horizon, prices are still trading on anticipated weakness in activity and consequently an expected crash in demand. The forward structure of both the Brent and WTI curves has weakened considerably. WTI is already in contango at the front end of the curve while Brent futures have moved close to neutral. But options markets would suggest there isn’t much downside from here: risk reversals in the Brent market have seen the put skew shrink in the past month. Speculative traders also seem to have heeded the warnings of the Saudi energy minister with net length expanding in Brent futures and options positions in the last several weeks.

Our oil price assumptions for 2023 have been predicated on a deficit helping to push prices higher over 2023 once an inventory build was overcome in Q1. Fundamentals exert a powerful force on oil markets though evidence in 2023 suggests that sentiment is outweighing them. We are marking our oil price assumptions to market and now expect a shallower path forward for both Brent and WTI futures. We now assume Brent at an average of USD 82/b in 2023 (from USD 88/b previously) and USD 77/b for WTI (from USD 83/b previously). The outlook for prices is subject to a myriad of risks, not the least of which will be China’s demand picture actually collapsing or Saudi Arabia choosing to quickly unwind its voluntary 1m b/d of cuts meant for July.