Oil prices have struggled to find a direction in 2024 as markets have been buffeted and buttressed by countervailing forces. Since the start of the year, front month Brent futures have traded in roughly a USD 10/b range, from a low of USD 74.79/b at the start of the year to a year-to-date peak of USD 84.80/b at the end of January. Volatility, as measured from options markets, has also declined steadily in 2024 with the 25D risk reversal hovering close to neutral as the impact from the escalation of geopolitical risks in the Middle East has faded.

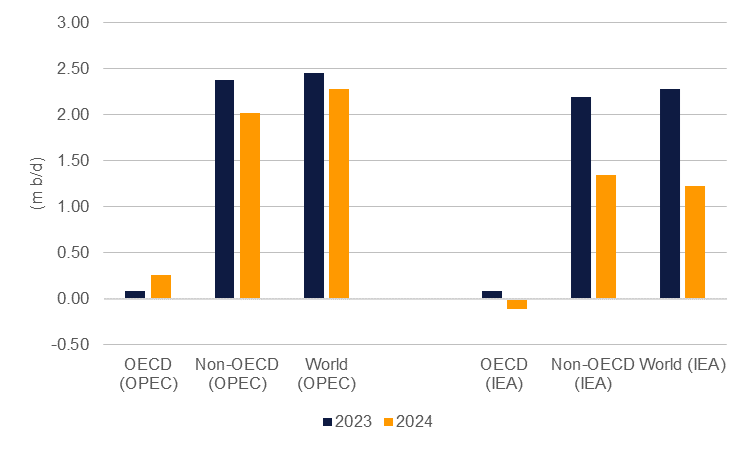

Markets have been balancing expectations that demand growth will soften substantially from last year’s strong performance against a supply picture that looks susceptible to constraint, whether voluntary or otherwise. The IEA and OPEC continue to disagree widely on how well oil demand will perform this year. In their latest monthly market report, the IEA projects global demand growth of slightly more than 1.2m b/d in 2024 while OPEC is still projecting greater than 2m b/d. In all likelihood, demand will probably come somewhere in between these bullish and bearish expectations as economic activity in some regions like the Eurozone slows but is offset by better growth in some emerging economies like India.

Source: IEA, OPEC monthly oil market reports, Emirates NBD Research.

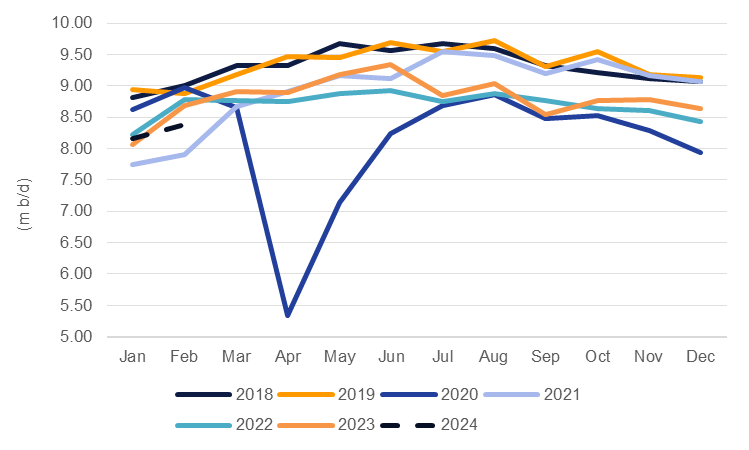

Source: IEA, OPEC monthly oil market reports, Emirates NBD Research. As a proxy for demand the EIA in the US measures product supplied (disappearance of products from primary sources). Since mid-way through Q4 2023 there has been a notable drop in oil product demand in the US with gasoline and jet fuel both off sharply from their mid-summer peaks. There is a high degree of seasonality in product demand with gasoline consumption in the US peaking in the summer driving holiday season. Nevertheless, gasoline supplied has noticeably started 2024 on a relatively soft footing compared with years prior.

Source: EIA, Emirates NBD Research.

Source: EIA, Emirates NBD Research.

Balanced against the softer demand profile for 2024, at least when compared with last year, is continued production restraint from OPEC+. Several producers within the alliance have made deeper cuts for Q1 and a decision on whether they will be extended will likely be announced in early March. Market surveys of OPEC production show there was a drop in January output but most of that was related to supply disruptions in Libya caused by protests. There have been pledges by some producers—Iraq and Kazakhstan—to improve their compliance with the lower production targets for Q1.

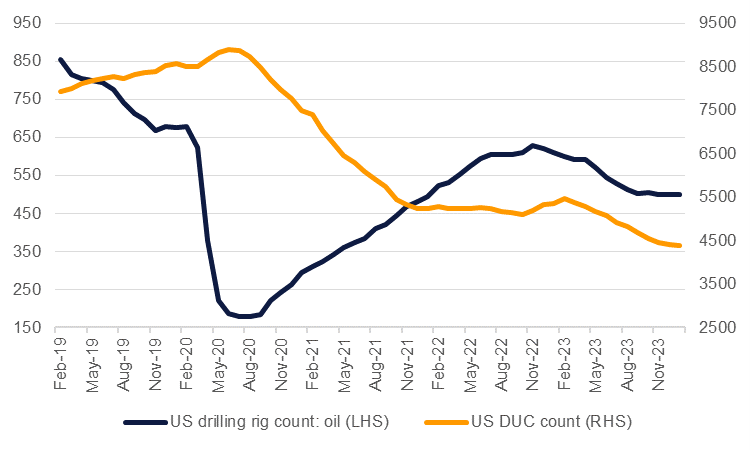

Production growth from the US will also cool this year after a surge in the second half of 2023. Taking the drilling rig count as a headline proxy for capex and the drilled but uncompleted well backlog as a proxy for production capacity, the outlook for US production is much more muted.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The net result is for oil prices to remain in search of a catalyst for a bigger move either higher or lower. Prices have been trending higher since the start of the year: front month Brent futures are up 8% since the start of 2024 and have averaged slightly below USD 80/b for Q1 so far. That is below our target of an average of USD 85/b but there are still several weeks to run in the quarter. More indicative of the market’s view than spot prices may be time spreads: front month spreads in the Brent market have risen to just under USD 1/b in backwardation, a relatively high level implying some near-term tightness in the market.