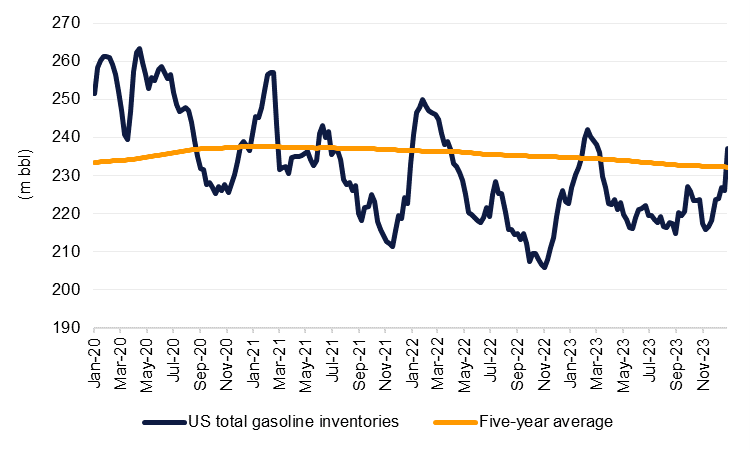

US oil market data pointed to a heavy end for 2023 according to the first weekly release from the EIA for 2024. Total commercial crude stocks dropped by 5.5m bbl in the week ending December 29 to a slightly more than 431m bbl, not far off their rolling five-year average level from 2018-22. However, product data indicated much weaker demand. Gasoline stockpiles rose by almost 11m bbl, the single largest weekly increase since Q2 1993, and increased to 237m bbl, their highest level since March last year. Distillate inventories also increased massively, rising by 10.9m bbl, their single largest weekly increase since January 2019, though aggregate levels remain near their five-year average.

Source: EIA, Emirates NBD Research.

Source: EIA, Emirates NBD Research.

Since the start of the year oil markets have traded somewhat sideways. Some fundamental data, like the weekly report from the EIA, has so far been soft and broad macro signals like PMI numbers from major economies have shown some weakness. China’s December manufacturing PMI for instance deteriorated to 49 from 49.4 a month earlier and India’s manufacturing PMI also dipped in December though to a still robust 54.9.

At the same time, however, other signals have been constructive. China has issued 2024 import quotas for its private sector refiners that are roughly on par with levels for 2023 and will probably need to top them up later in the year when a new mega refinery opens. Elsewhere, US labour market data has been better than expected with both initial jobless claims and the ADP report giving tentative signs of further resilience in employment conditions.

Admittedly, data has been sparse in the first five days of 2024 and it shouldn’t be taken as a strong signal for what lies ahead for the rest of the year. The additional cuts pledged by some OPEC+ members at the end of November last year have only been running for about a week. Indications as to how good compliance with those cuts has been will only be available toward the end of the month at earliest.

But oil markets for now seem to be looking through the elevated geopolitical tensions in the Middle East and Red Sea region. Militant attacks on shipping in the Red Sea isn’t affecting production but it is causing a rerouting of vessels to a much longer route around Africa. Attacks elsewhere in Iran and Iraq will also keep the geopolitical temperature high. As the OPEC+ cuts take effect we expect to see oil markets closer to balanced in Q1 which amid geopolitical concerns over security of supply should help put a floor under prices. We hold our forecast for Brent futures at an average of USD 85/b for Q1.