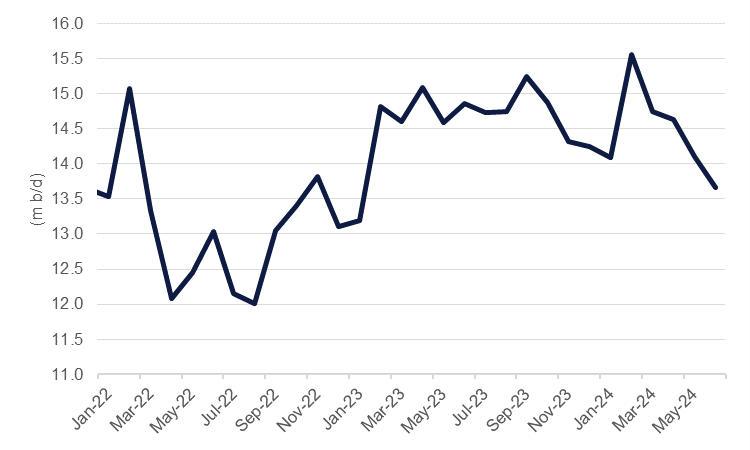

Oil demand in China has cooled substantially in data up to the end of Q2. Apparent oil demand, a proxy for consumption when full data on disappearances and oil stocks aren’t available, dropped by 8.1% y/y in June, accelerating a slump of 3.3% recorded in May. In volume terms, China’s apparent oil demand fell to 13.7m b/d in June, down from 14.1m b/d a month earlier and 14.9m b/d a year earlier.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

In its most recent oil market report the IEA estimated that China’s oil demand contracted in Q2 and projects annual growth of just 410k b/d this year before it slows to 370k b/d in 2025. In contrast, OPEC expects China’s oil demand will grow by 900k b/d in 2024 before easing to about 400k b/d in 2025.

The soft oil demand data pairs with broader signals of a sluggish economy in China. PMI numbers have been close to the neutral 50 level or below for most of 2024 while industrial production appears to be on a multi-year slowdown. Second quarter GDP growth slowed to 4.7% y/y, down from 5.3% in Q1, and short of targeted growth of 5% for this year. The Communist Party of China concluded its third plenum on July 18 with “high quality development” as a priority for the future of China’s economy as well as a focus on expanding domestic demand, reforming foreign trade and resolving issues in China’s property sector. None of the announcements directly link to greater industrial production or construction, sectors that would draw heavily on commodity inputs, including oil products.

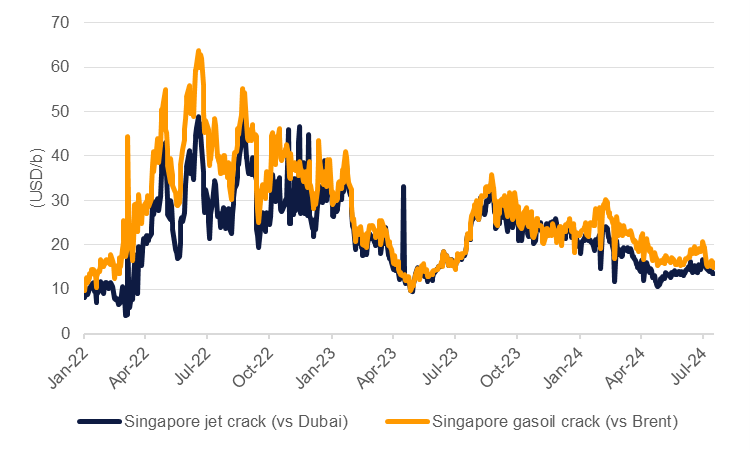

Slower Chinese oil demand growth is one challenge for global oil markets but a parallel risk are its exports of oil products. Net oil product exports rose to 2.4m tonnes in June, their highest level since February 2023. Indicative refining cracks in Asia have compressed substantially in the last year as demand has cooled. The Singapore gasoil/Brent futures crack has eased to USD 15/b as of mid-July, down from a year-to-date high of about USD 30/b in February this year and well below levels of USD 30-50/b encountered in 2022-23.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.