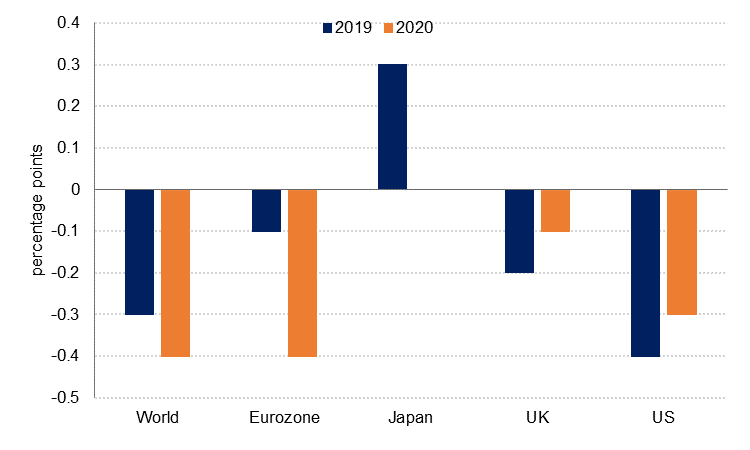

The OECD downgraded its forecast for global growth this year to 2.9% from 3.2% previously, citing escalating trade policy tensions and their impact on confidence and investment. The 2019 estimate, if realised, would mark the slowest global growth rate since 2009. The OECD also revised down its forecast for next year to 3.0% from 3.4% previously. Separately, the UAE central bank has revised up its growth forecast for 2019 to 2.4% from 2.0% previously, mainly due to a higher (5%) forecast for oil sector growth this year.

The Bank of England’s MPC kept rates on hold as expected last Thursday, but signalled a more dovish stance in the face of ongoing Brexit uncertainty, saying this would weigh on domestic demand and inflation. The bank’s forecast for Q3 GDP was revised slightly lower to 0.2%. The MPC’s decision to keep rates unchanged was unanimous. However, the committee stuck to the view that a no-deal Brexit would not necessarily lead to lower interest rates, and that a managed exit (with a deal) would most likely still lead to gradual rate hikes in the coming years. In the US, equity indices closed lower on Friday as trade tensions escalated again. A Chinese delegation cancelled planned visits to US farms and left the country early after comments by President Trump’s that he didn’t want an interim or partial trade deal with China. Talks are scheduled to continue in October.

In a surprise move, the Indian government announced a USD 20bn fiscal stimulus to the economy. The stimulus was in the form of a sharp reduction in the corporate tax of as high as 10% in most cases. The move brings India’s tax structure broadly in line with its Asian peers and possibly makes India an attractive destination for companies looking to set up a new manufacturing base outside of China. However, the move also jeopardises the government’s efforts in maintaining fiscal prudence, with the fiscal deficit target of 3.3% of GDP likely to be exceeded by 50-75bp in FY2020.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Notwithstanding a more measured tone from the Federal Reserve over further easing, Treasuries rallied last week. The move was closely aligned to the sharp rise in volatility in risk assets and continued elevated geopolitical tension. Yields on the 2y UST, 5y UST and 10y UST closed the week at 1.68% (-11 bps w-o-w), 1.60% (-15 bps w-o-w) and 1.72% (-17 bps w-o-w) respectively.

Regional bonds traded in a tight range despite large sized moves in benchmark yields. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +2 bps w-o-w to 3.22% and credit spreads rose +14 bps w-o-w to 150 bps. It is also worth highlighting that the CDS widened in the region for the first time in six weeks. The 5y Saudi Arabia CDS widened 13 bps w-o-w to 71 bps. Similar move was seen in 5y Dubai CDS (+13 bps w-o-w) and 5y Abu Dhabi CDS (+8 bps w-o-w).

DP World tendered an offer to buy back its 2024 convertible bonds and 2020 3.25% notes in cash through a reverse book building process. The combined face value of both bonds is USD 1.5bn. The company also said that it is considering options to issue new securities under its USD 10bn GMTN program.

Following last week’s gain, the first in three weeks, the Dollar Index (DXY) is trading slightly softer this morning and is down 0.06% to 98.45. Last week, the index had benefited from increased appetite for the USD after the market lowered expectations for more aggressive easing of monetary policy from the Federal Reserve. While the FOMC did cut interest rates by 25bps on Wednesday’s meeting, there were mixed signals on the timing and extent of any future cuts.

Regional equities closed mixed with major moves in Egyptian and Kuwaiti stocks. The EGX 30 index dropped in excess of 4% following concerns after protests. The KWSE PM index added +2.9% on the back of strength in banking sector stocks after the central bank did not follow the US central bank in cutting interest rates.

Oil markets remained on edge following the attacks on Saudi Aramco facilities last weekend and closed the week higher. Brent futures gained 6.7% over the week to settle at USD 64.28/b while WTI rose 5.9% to close at USD 58.09/b. The leadership of Saudi Arabia’s energy industry—the energy minister and Aramco officials—have been trying to reassure markets that supplies will remain stable and the enormous surge at the start of last week’s trading faded over the rest of the week.

Forward curves for both Brent and WTI adjusted upward to reflect greater uncertainty over supplies going forward. Brent time spreads settled in a backwardation of USD 1.08/b in the 1-2 month spread while 1-12 month spreads closed in a backwardation of more than USD 5.40/b at the end of the week. Longer dated WTI spreads widened but Dec 20 futures are still holding relatively close to USD 50/b, a level which does not offer much headroom for capex spending in the shale patch. The re-emergence of a wider backwardation in Brent should help to attract roll-yield investors into the market even if other fundamentals still point to soft conditions for oil in the near term. Net length in WTI had expanded in the week prior to the attacks, up by 12k contracts, but Brent net length fell thanks to speculators closing out long positions.