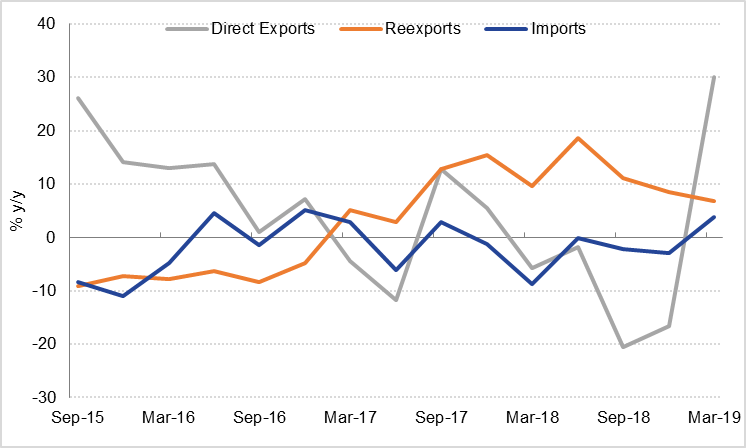

The total value of Dubai’s non-oil trade rose 7% y/y in Q1 2019, the strongest growth rate recorded since at least 2015. Exports grew 30% y/y after contracting through 2018, although re-exports growth slowed to 7%, the slowest rate of growth since Q3 2017. Imports grew 4% y/y after contracting on an annual basis for the last 5 quarters, suggesting that domestic in demand in the Dubai has picked up at the start of this year. This is consistent with the PMI data we have seen year to date, which also points to an acceleration in non-oil sector growth so far this year. Overall, Dubai recorded a trade deficit of -AED 148bn in Q1 2019, 2% smaller than the deficit recorded in Q1 2018.

Producer inflation in the US was in line with expectations in May, rising 0.1% m/m and suggesting very little inflationary pressure in the pipeline. However, the most recent increase in tariffs on Chinese imports is likely not reflected in last month’s data. The key US release today is consumer inflation for May, which is also forecast to rise 0.1% m/m, with core inflation (excluding food and energy) expected to accelerate to 0.2% m/m (2.1% y/y). Meanwile, Chinese CPI and PPI came in as expected in May, rising 2.7% y/y and 0.6% y/y respectively. CPI accelerated from April, while PPI eased somewhat.

The UK’s labour market remained relatively strong in April despite the slowdown in economic activity, with the unemployment rate remaining at a 45-year low of 3.8% while wage growth (excluding bonuses) rose by a faster than expected 3.4% y/y in the three months to April.

Japanese core machine orders surged 5.2% m/m and 2.5% y/y in April, much more than had been forecast and also faster than the growth recorded in March. The data released this morning suggests that capex in Japan remains resilient despite recent weakness in external demand and increased trade tensions.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Fixed Income

Treasuries traded within a narrow range amid fragile market sentiment ahead of the G-20 summit which may provide a breakthrough in stalled the US-China trade talks. Investors are wary as President Donald Trump defended the use of tariffs and China continues to vow a tough response. Yields on 2yr, 5yr, 10yr and 30yrs USTs closed at 1.93% (+3bps), 1.92% (unchg), 2.14% (-1bp) and 2.61% (-2bps) respectively. Sovereign bonds across the pond were a bit mixed with yield on 10 yr Gilts increasing 2bps to 0.86% while those on 10yr Bunds declined one bp to -0.23%. Credit protection costs were stable with CDS spread on US IG and Euro Main closing unchanged at 60bps and 61bps respectively.

Regionally, GCC Bonds closed largely unchanged with yield remaining stable at 3.74% and credit spreads also remaining unchanged at 169 bps.

In the primary market, Sharjah Islamic Bank hired banks for a benchmark sukuk. Looking ahead, Oman is preparing to tap the market and Bahrain plans to return to the international markets soon.

FX

The USD index remains near 2-month lows ahead of US consumer inflation data due later today. Concerns around an escalation in the trade war with China have also weighed on the dollar, with President Trump indicating he is not willing to move forward with a trade deal unless President Xi meets with him at the G20 at the end of this month, and “goes back” to the terms the US claims were agreed earlier.

Equities

Stocks slid in most markets yesterday as the rhetoric on trade talks remain negative. S&P 500 lost 0.03% and Dow Jones was down by -0.05%. Asian bourses are under pressure with Hang Seng and Shanghai composite down by 1.5% and 0.57% in early morning trades today as Hong Kong braces for strike and unprecedented protests against the controversial bill allowing extraditions to mainland China. That said, Nikkei seems to be holding up well, running 0.09% in the green this morning and Europe shrugged off trade fears with FTSE 100 and Euro Stoxx 50 closing up by 0.31% and 0.43% respectively yesterday.

Regional GCC markets were mixed amid weakened oil prices. Abu Dhabi Index was down 0.6% with volume of only $27 million and Dubai index closed marginally up (+0.02%). Tadawul closed up by 1.5%, reflecting continued benefit of cash inflow on the back of index inclusion.

Commodities

Oil markets are down again in early trading as a lower demand outlook from the US compounded a build in inventories reported by the API. Brent is off 1.4% this morning at USD 61.42/b while WTI is down more than 1.5%. The EIA lowered its demand growth forecast in 2019 to just 1.2m b/d, down 160k b/d from its previous view. The agency also lowered its forecast for US oil supply growth to 1.36m b/d (from 1.49m b/d previously. While the growth rate is lower, it still represents an increase in output of more than 12% y/y. For 2020 the EIA expects production at 13.26m b/d, up 0.9m b/d (unchanged from previously).

The API reported a build in inventories of 4.9m bbl compared with market expectations for a decrease of 481k bbl. The persistent rise in US inventories is weighing on front month futures and will help to encourage OPEC+ to extend their output cuts into the second half of 2019. The UAE’s energy minister said that rolling over cuts was the “right decision” although dates for the next OPEC meeting have yet to be agreed upon.

Industrial metals responded positively early in the day to news that China’s government would allow provinces to use proceeds from bond sales to invest in infrastructure to support a slowing economy. Iron ore ended the day more than 3.5% higher while aluminium, nickel, zinc, lead and copper all nudged higher.