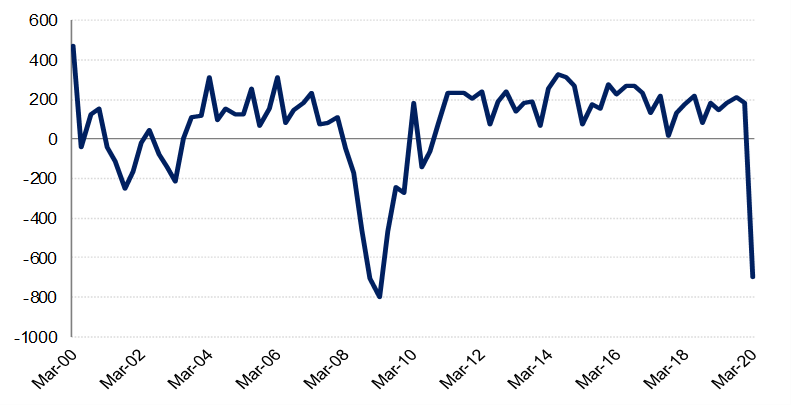

Friday’s -701k decline in US non-farm payrolls was much worse than the market had expected and pushed the unemployment rate up to 4.4% from 3.5% in February. The biggest decline in jobs was unsurprisingly in the leisure and hospitality sector, which lost 459k jobs. The survey reflected the situation as at 12 March, and jobless claims have risen by nearly 10mn in the last two weeks, suggesting that the April data is likely to be even worse. The response rate was also lower than usual in March, indicating businesses that had already closed didn’t reply to the survey, so the March numbers may be under-reporting the extent of job shedding last month. Aditionally, the underemployment rate (people current in part time work who would prefer full time) rose to a three-year high of 8.7%, and labour force participation declined.

The UAE appointed veteran banker Abdul Hamid Saeed as central bank governor over the weekend. On Sunday, the central bank announced additional measures to boost liquidity in the banking sector and provide extended support to borrowers. Banks’ cash reserves requirements were reduced to 7% from 14% to free up AED 61bn and banks are allowed to defer interest and principal repayments on loans until the end of the year. Relief measures that had been announced in March for 6 months have now been extended for the rest of the year. The announcement came after the authorities in Dubai tightened restrictions on the movement of people for the next two weeks.

Oil prices declined this morning as an OPEC+ meeting which had been planned for today was rescheduled for Thursday April 9. Russia and Saudi Arabia remain critical to reaching a deal to balance markets. However, the US which is the world’s largest oil producer has so far not indicated it would join OPEC+ in curbing oil production.

Turkish CPI inflation data was released on Friday, showing that price growth slowed to 11.9%, from 12.4% in February. This was the first disinflation in five months, as the oil price crash fed through to lower prices at the pump, helping to offset a renewed lira sell-off and mounting coronavirus disruption. However, real interest rates remain in negative territory after the benchmark one week repo rate was cut by 100bps to 9.75% in an unscheduled meeting on March 17. The TCMB is becoming increasingly active in bond buying as it seeks to stem lira losses, having run down FX reserves by USD 1.1bn in the week to March 27, but with global risk-off sentiment and mounting cases in Turkey, continued lira weakness is likely. As such, the disinflation seen last month may prove to be the exception.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed higher as investor sentiment remained cautious following weak economic data and the unabated spread of coronavirus. Gains at the short-end of the curve faded following the Fed’s announcement that it will slow down the pace of bond buying program to around USD 50bn a day from the revised target of USD 60bn a day. The Federal Reserve bought USD 334bn of USTs to take its total purchases to USD 965bn since lowering the lower bound of the rate to 0%. Overall, yields on the 2y UST and 10y UST ended the week at 0.22% (-2bps w/w) and 0.59% (-8bps w/w) respectively.

Regional bonds came under renewed pressure following gains in the previous week. The YTW on Bloomberg Barclays GCC Credit and High Yield index rose +5bps -/w to 4.68% and credit spreads widened 13bps to 409bps.

Last week saw the dollar's uptrend resume. After starting the week at 98.365 its DXY index rallied more than 2% to close at 100.677, even as economic data began to show the impact of coronavirus containment strategies on US economic activity. Rising demand for the world's reserve currency reflects renewed risk aversion as there remains no end in sight to lockdowns and travel restrictions in countries around the world. The next key level to look out for will be the 101.00 resistance. The JPY struggled to make decisive movement in either direction, hitting lows below the 107.00 mark on Wednesday, but has since recovered to the 108.50 area.

Despite the EUR showing signs of recovery towards the end of the previous week, it has since slumped over 3% to reach lows of 1.0800 after starting the week at 1.1141. IHS Markit said that its monthly composite PMI data points to an annualized contraction of about 10% in the Eurozone. The UK also experienced a similar negative assessment as Markit's PMI index for the services sector fell to 34.5 last month, the steepest decline since the survey began in 1996. GBP saw choppy movements throughout the week, dropping over 1.50% to close at 1.2270 after starting the week at 1.2460. The AUD and NZD also reflected this bearish trend declining by 2.80% and 2.70% respectively.

Regional equities closed mixed at the start of the new week despite sharp rally in oil prices over the weekend. UAE bourses closed lower with the DFM index and the ADX index losing -2.4% and -2.2% respectively. Banking sector stocks came under pressure after they revealed the extend of exposure to NMC and Finablr. Dubai Islamic Bank lost -4.8% after it revealed a USD 541mn exposure to NMC together with Noor Bank. Abu Dhabi Islamic Bank (-4.9%) said it has an exposure of USD 291.4mn to NMC.

Oil markets endured another week of extreme volatility as US President Donald Trump claimed to have brokered a deal that would bring an end to the current price war and see producers like Saudi Arabia, Russia and others cut production to restore balance to markets. Following the President’s tweet prices on Thursday shot up almost 50% to USD 36.29/b in Brent futures before settling and closing on the day up “only” 21%. WTI saw similar extreme moves, with prices closing that session up almost a quarter. That oil prices could gain so much and it not be the dominant driver for financial markets suggests that attention remains fixated on the economic damage being wrought by the coronavirus pandemic. Trump’s plan, where he ‘hoped’ that Saudi Arabia and Russia would cut production by as much as 10m b/d, may not even be large enough to offset the enormous build in inventories this quarter that will be a result of an absolute collapse of demand.

When all of last week’s hysteria ended, Brent futures closed up 37% over the week at USD 34.11/b while WTI settled at USD 28.34/b, up nearly 32%. Forward curves also adjusted sharply with the contango in Brent markets narrowing by more than 50% at the front of the curve while WTI saw a roughly 30% improvement in 1-2 month spreads. However, contango across the curve still remain wide at well over USD 1/b at the front end and more than USD 5/b in 1-12 month for both Brent and WTI futures. In the US, the drilling rig count continues to plummet, down by 62 rigs last week alone and more than 120 since mid-March.