A monetary policy report (MPR) by the Federal Reserve released on Friday will serve as the basis for new Fed Chair Jerome Powell's congressional testimony on Tuesday. The MPR showed little difference with the last thoughts of the Yellen Fed, saying that that activity increased at a solid pace over H2 2017 and that the labour market continued to strengthen. It also mentioned that inflation has remained below target, and added that despite the tight labor market wage growth has been moderate, in part held down by low productivity growth. One thing that stood out was a warning of ‘elevated valuation pressures across a range of assets’ This may imply that financial stability will take greater precedence over backstopping the U.S. equity market in the new Powell Fed.

The appearance of coordinated UK government position with regard to a post-Brexit trading relationship with the EU, was taken positively at the end of last week. The proposal aims to establish a free trade deal similar to the one Canada achieved with the EU, but with better access to the EU's single market through close regulatory alignment. However, the approach described as ‘managed divergence’, may still not be enough to keep the May government afloat. PM May will detail the plan publicly in a speech later this week, but it still stands the chance of being voted down by members of her own party who along with the opposition Labour party object to the UK withdrawing from the EU’s customs union. The Brexit negotiation process will enter a crucial phase in March, with both the UK and the EU seeking settled positions ahead of an EU leaders' summit.

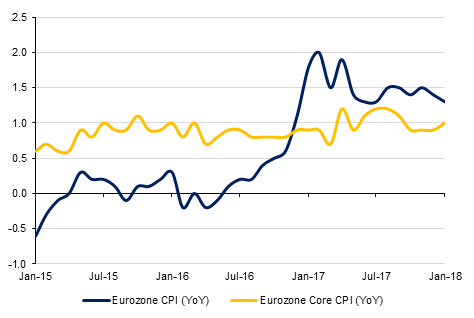

In its January meeting minutes the ECB referenced the ‘recent volatility in the exchange rate of the Euro was a source of uncertainty’ for price stability. While the ECB failed to signal when asset purchases are likely to come to an end, it implied that it would drop its easing bias from its policy statement at the upcoming Council meeting on the 8th March. This meeting is now coming into view, and the number of council members urging an end to QE seems to be growing. ECB President Draghi will testify to the European Parliament later today.

It was a week of two halves for US Treasuries as a perceived hawkish tilt in minutes of the last Federal Reserve meeting was offset by sharp gain in risk assets towards the end of the week. Eventually, the belly of the curve flattened with yields on the 5y USTs and 10y USTs closing lower by 1bps at 2.61% and unchanged at 2.87% respectively. Yields on the 2y USTs and 30y USTs rose 5 bps and 2 bps to 2.23% and 3.15% respectively.

The mixed move in benchmark yields and sharp rise in oil prices helped GCC bonds as they posted their slowest decline in five weeks. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose 1 bps w-o-w to 4.14% and credit spreads widened by 1 bp w-o-w to 155bps.

S&P expects GCC bank’s net interest margins to decline slightly from 2.8% in 2017 and cost of risk rising as a result of implementation of IFRS9 rules. The rating agency also expects stable ratings for GCC banks.

The dollar gained against a basket of other major currencies over the last week, the Dollar Index rising by 0.88% to close at 89.88. The index had climbed as high as 90.235 before finding resistance at the capping resistive trend line of the daily downtrend that has been in effect since 18 December 2017. Analysis of the weekly candle hourly candle chart shows that the index has been in a sideways range bound movement between 89 and 90 for the majority of February and we expect this pattern to continue in the absence of any catalyst to break the range.

EURUSD fell 0.89% last week to close at 1.2295. Analysis of the two hour candle chart shows that a triple top may have formed and the price may now be testing the supporting baseline that has been in effect since 17 December 2017. While the price remains below the 1.2350 level, we expect further declines towards our Q1 2018 forecast of 1.22.

Regional equities started the week on a mixed note with the DFM index adding +0.6% and the Qatar Exchange index losing -0.2%. In a trend consistent with last week, volumes remained well below par. In fact, the total value traded on the ADX was a mere AED 50mn.

DP World (-0.2%) closed marginally lower after Djibouti terminated its contract with the company on the Doraleh Container Terminal. DP World clarified that the company see no financial impact from the decision. Dubai Islamic Bank gained +1.2% after the company said that the rights issue will be priced at a 45% discount to the prevailing market price on the date decided by the board.

Oil prices ended the week higher, gaining more than 3% for WTI and up more than 3.8% for Brent futures. Markets appeared to respond comments from Saudi Arabia’s energy minister that the oil market was going through a ‘clear’ rebalancing and he also expressed hope that OPEC and its partners would be able to end their production cut agreement in 2019.

EIA data was released later than usual because of a US public holiday but showed a decline of 1.6m bbl in total crude stocks and mixed performance across the rest of the barrel. Refinery utilization ticked downward while production was nearly unchanged. The drilling rig count in the US added 1 oil-focused rig last week, up 197 from the same time last year.

Investor positioning in WTI futures and options was balanced last week as overall net length rose by just 478 contracts while in Brent the shedding of long positions continued and an increase in shorts took net length down by of 19k lots.