We have revised down our outlook for Moroccan growth this year, largely on the back of external factors rather than any particular domestic drivers. We now forecast real GDP growth of 4.9% this year, down from our previous projection of 5.2%, and slower than the Bank al-Maghrib’s 5.3% forecast. The slow pace of vaccinations in Europe, the major source of visitors to Morocco, runs the risk of an underperformance in the Moroccan tourism sector. With renewed domestic restrictions on movement and activity in countries such as France and Germany, the horizon for a full resumption in international leisure travel for these countries has been pushed back, and this will weigh on the Moroccan economy.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Nevertheless, the expectation is that all Moroccan sectors will start to see a recovery at some point in 2021, returning to growth after the -7.1% contraction last year. Over 10% of the population has been vaccinated, and while there remain challenges in the rollout, a gradual normalisation is expected. Combined with sizeable fiscal stimulus and ultra-loose monetary policy – the Bank al-Maghrib held rates at 1.5% on March 23 – the conditions are generally supportive for robust growth.

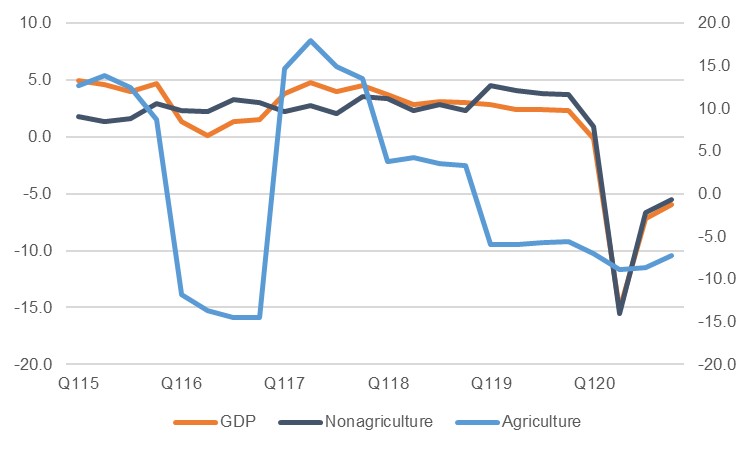

The pandemic was not the only major drag on Moroccan GDP last year – the agricultural sector, around 12% of the economy, endured eight consecutive quarters of y/y contractions over 2019 and 2020 as regions of the country struggled with very little rain and resultant poor harvests. While a recovery is by no means guaranteed, even a return to baseline output levels in the sector would generate a considerable boost to growth, providing upside risk to our projections.

Morocco’s current account deficit narrowed to just -1.5% of GDP last year, from -3.7% in 2019, despite the pressures on the economy at large. This was the smallest shortfall since 2007, driven by a sharp drop in imports which outweighed both the impact of lower goods exports and the severe hit to services exports via the tourism sector. Remittances also held up well last year.As the economy recovers in 2021 the current account deficit will widen once more, driven in part by the rally in oil prices seen since the start of the year – we forecast an average Brent price of USD 67/b in 2021, compared to USD 50/b last year – and by a general recovery in goods imports as activity slowly returns to normal. We forecast a current account balance equivalent to -4.2% of GDP this year. However, should any recovery in the tourism sector be pushed further back by a slower-than-expected normalisation in travel, then the current account shortfall would be wider than we currently anticipate.

.jpg) Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Despite a widening current account deficit we expect no undue pressures on the dinar, and forecast only a modest depreciation over the year, in line with the generally better outlook for the dollar and a weaker euro as the European recovery is delayed. We forecast a year-end level of MAD 9.20/USD, compared to current levels of MAD 9.04/USD. Morocco’s foreign reserves increased substantially last year (from USD 23.7bn in January to USD 33.6bn in December), in part on the back of Eurobond issuance and assistance from the IMF and the AfDB. With some six-seven months’ worth of import cover, we see little scope for a rapid sell-off in the dinar. Indeed, the fact that Morocco elected to repay early around one third of the USD 3bn it drew on from the IMF should provide some measure of reassurance to any investors concerned by recent ratings downgrades Morocco has had from the major agencies, most recently S&P in April.

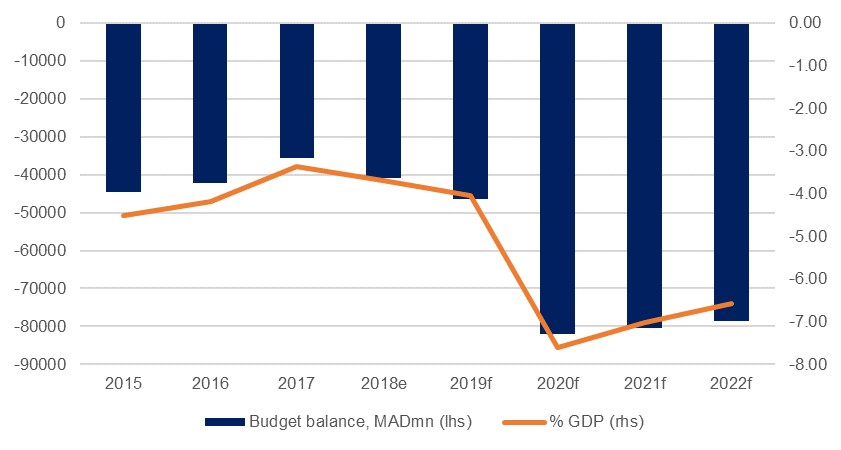

In its downgrade of Morocco’s long-term foreign and local currency ratings to junk status – albeit with a stable outlook – S&P cited the country’s widening budget deficit, and what it anticipated would be a slow pace of budget consolidation. The fiscal shortfall widened to -7.6% of GDP last year as revenues fell (tax revenues declined -5.7%) and expenditure (minus investment) grew 27.4%. The Bank al-Maghrib is especially bearish with regards to the prospect of narrowing this deficit, projecting a shortfall of -7.2% this year and -6.7% in 2022, compared to the -6.5% 2021 projection in the government budget back in October. Given the ongoing challenges to the economy in Morocco, we have adjusted our own projections to better reflect the outlook for slower fiscal consolidation, albeit moderately more bullish than the central bank with a 2021 forecast of -7.0%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research