We have downgraded our growth forecast for Morocco this year in light of the drought that looks set to exert a sizeable drag on the economy. We now project real GDP growth of 3.1% this year, compared with our previous forecast of 3.8%. Central bank governor Abdellatif Jouahri recently outlined his concerns to parliament, giving the bank’s best-case growth scenario at 3.5%. Next year we expect growth to rebound to 4.2%. As ever, though, this 2023 forecast is dependent on a return to a more normal level of output from the agricultural sector, alongside the ongoing easing of the pandemic.

Morocco has seen the lowest levels of rainfall in three decades over the crucial December-February months, posing serious risks to harvests later in the year. We have already seen the effects of wild weather swings on production in recent years, with GDP output from the sector oscillating by double digit margins from negative to positive through 2015-2017 as rains disappointed, and then there were wide movements again once the pandemic hit in 2020. We had previously anticipated a normalisation in the sector following the rebound seen last year, similar to the average 3.7% growth seen over Q1-Q4 2018. However, a sharp contraction now looks like a much more likely scenario, barring any sudden recovery in water levels in the very near term.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Accounting for around 12% of the real economy, lower output in the agriculture sector will weigh directly on output overall, and this has been apparent in recent years with poor harvests as headline growth slowed in those years. Nor is the direct channel the only means by which headline growth will be hit – there are also implications for employment, inflation, and trade. The World Bank estimates that a third of all employment in Morocco was generated by agriculture in 2019. As such, the poor outlook for the sector has implications for private consumption levels, already impacted by the slow recovery in the tourism sector. Indeed, the closure of borders at the start of the year as the Omicron variant spread had already prompted us to downgrade our growth outlook for 2022 last month (see Morocco: Border closure will weigh on Q1 ). Some of the negative effect on households will be mitigated by a USD 1bn government plan to offer aid to farmers, amongst other measures, but even this is unlikely to entirely offset the impact.

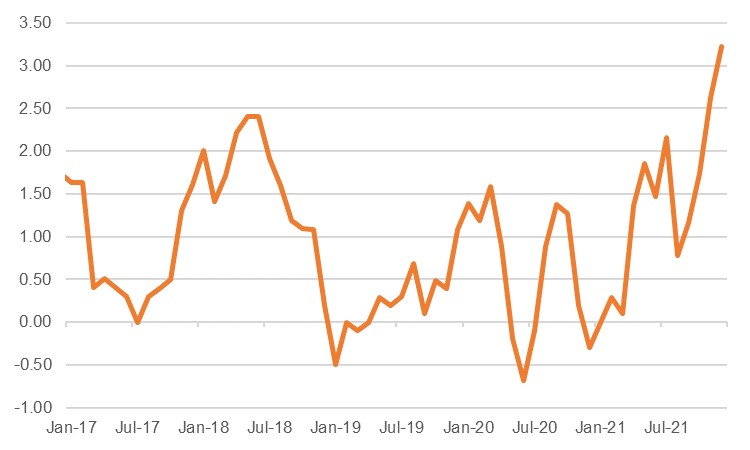

Aside from the employment issue, private consumption will also be hit by higher costs squeezing household finances. North Africa as a region is a major wheat importer, and the failure of the domestic crop will necessitate importing more essential foodstuffs from abroad, thereby presenting inflationary pressures, especially in the context of higher global grain prices. At 3.2% y/y in January, price growth was already at its highest levels since early 2009, and much like the rest of the world, the era of low and stable price growth appears to be over for the time being. Government subsidies on wheat and corn remain in place until the end of April presently, but it seems likely that the government will have to implement at least a modest hike to bread prices given the pressures being brought to bear on the budget; budget minister Fouzi Lekjaa has said that the government bill for grain subsidies looks set to be around three times that seen in a normal year. We forecast an average inflation rate of 3.0% this year, greater than the Bank al-Maghrib’s projection of 2.0% at its December meeting, as higher energy costs will also exert upwards pressure. Higher-than-expected levels of inflation could see the bank abandon the accommodative stance it maintained in December at its upcoming March meeting, in a further potential drag on growth.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

From a real growth perspective, the poor harvest also has implications for the trade balance, with imports now expected to expand at a more rapid pace than we previously anticipated, while exports will likely be slower. The upside risk is that tourism rebounds at a far faster pace as international and domestic restrictions on movement related to the pandemic ease, provided that expected dirham appreciation does not diminish Morocco’s attractiveness as a destination. We have also adjusted our current account balance forecast to a wider deficit of -3.8% compared with our previous forecast of -3.1% and last year’s -3.3%, with anticipated stronger growth in services exports later in the year helping to offset the greater food imports.