Metals prices have been hammered following the June 16 FOMC meeting where the Federal Reserve outlined the possibility of two rate hikes as early as 2023. Gold prices fell more than 6% over the course of the week and are holding now well below USD 1,800/troy oz on the spot price while LME copper fell almost 9% to close to USD 9,000/tonne. As markets adjust their inflation expectations post-Fed we would expect to see some divergence in the performance of metals over the coming months.

The Fed did revise its inflation projections higher for 2021 at the June meeting, expecting PCE inflation at 3.4% y/y in the fourth quarter compared with 2.4% in their March projections. However, they barely nudged their 2022-23 expectations higher and left their longer-run assumptions unchanged, all of which are around the 2% that the Fed is targeting under its new average inflation mandate. The market has adjusted quickly to move in line with the Fed’s view that inflation will largely be related to the reopening of the economy and that it will be transitory, the bugbear word for inflation hawks.

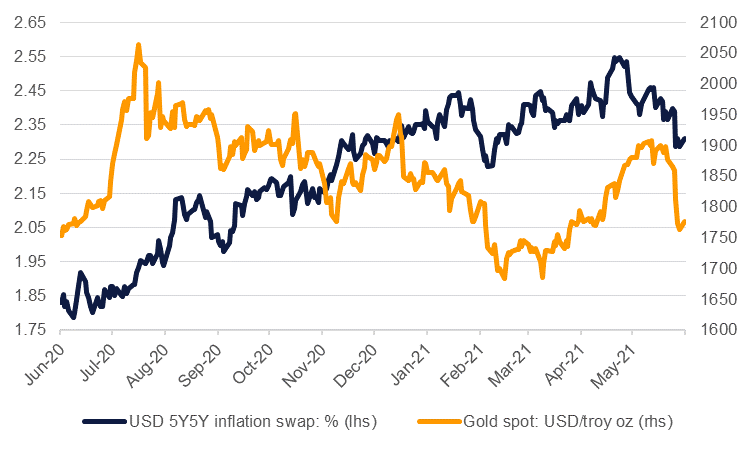

Repricing of inflation risk a worry for gold

The UST curve has flattened considerably with near-term rates rising on the anticipation that hikes are coming while the longer-end has rallied as long-run inflation fears dissipate, or at least the market is pricing in that the Fed will be able to manage inflation in an orderly manner. Inflation swaps in the USD market were already in decline ahead of the Fed but took a steep dive after the FOMC with 5Y5Y swaps now down at around 2.3% compared with 2.55% in mid-May.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

The apparent market acceptance of the Fed’s inflation narrative is damaging the near-term prospects for gold. With inflation only a 2021 phenomenon, at least for the US, then the benefits of holding gold as an inflation hedge weaken. Moreover, if the economy does perform in line with the Fed’s expectations—growth of 3.3% in 2022 and 2.4% in 2023—then long-term yields should move higher too and help to draw funds away from gold and back to US Treasuries. We also haven’t heard an assessment from the Fed yet about when they will begin their tapering of asset purchases. An announcement around the Jackson Hole central banking summit in August would seem likely and could set the market up for more dollar strength and gold weakness.

Our projection for gold prices in 2021 had been for them to weaken in line with a general rise in UST yields and a recovering economy. We are maintaining our expectations for gold to record an average of USD 1,700/troy oz in Q3 and USD 1,650/tory oz in Q4 with an annual average target of USD 1,717/troy oz. We expect the move lower in gold to bring silver lower as well and maintain our targets for an average of USD 23/troy oz and USD 20/troy oz in Q3 and Q4 respectively.

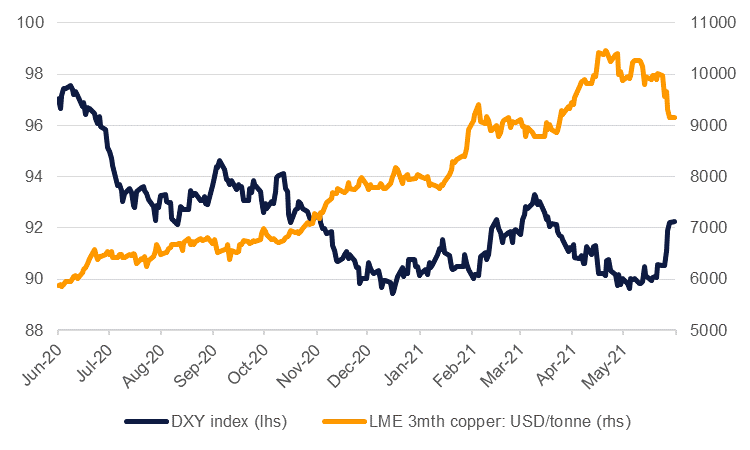

Dollar hunts for over-extended industrial metals

For the industrial metals the main downside risk from the Fed’s new projections and potential for hikes in 2023 comes via a higher dollar. Base metals in the LME complex were weaker across the board in the day following the Fed but had already begun to wobble on signs that China was taking steps to ease commodity price inflation feeding through into its economy. Aluminium prices have been oscillating in recent weeks around USD 2,400/tonne while copper has fallen almost 13% since its mid-May peak of USD 10,460/tonne to trade around USD 9,145/tonne at present.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

As we outlined in a recent note (Metals markets keep eye on inflation, June 9 2021) we still believe that the underlying fundamental picture in metals markets is positive. The tightness in the copper market in particular supports prices remaining at their multi-year highs even if a stronger dollar helps to dampen down some of the exuberance markets have endured this year. We maintain our view for copper prices to rise steadily in 2021, even if we remain conservative by the current levels of the market. For aluminium the risk has always been that supply is not as constrained as other metals and a positive supply response to prices above USD 2,000/tonne is a high possibility. We hold our view for prices to remain above USD 2,000/tonne for the rest of 2021 before sliding—albeit slightly—into next year.