Metals markets have received a boost since mid-way through Q4 2022 as it became clear that China was preparing to end its stringent Covid-19 restrictions. Now that the country has lifted most of its rules on controlling the virus, the potential for a less encumbered Chinese economy has helped to provide some support for metals prices. Copper forwards on the LME, for instance, have moved solidly back above USD 8,000/tonne since November and iron ore futures are now trading above USD 100/tonne again, having dipped to less than USD 80/tonne at the end of October.

China’s decision to move away from stringent Covid rules has removed a major obstacle for metals markets, and commodities in general. But the outlook for 2023 does appear challenging. Since the removal of restrictions, China has seen a sharp rise in the level of Covid-19 infections that is causing a near-term drag on activity: the manufacturing PMI for December dropped to 47, its lowest level since February 2020 when China dealt with the initial surge of the virus. Until this wave runs itself out, and with Chinese New Year holidays approaching in just a few weeks there is potential for further rises in case numbers, the prospect of a big bump in industrial activity looks limited.

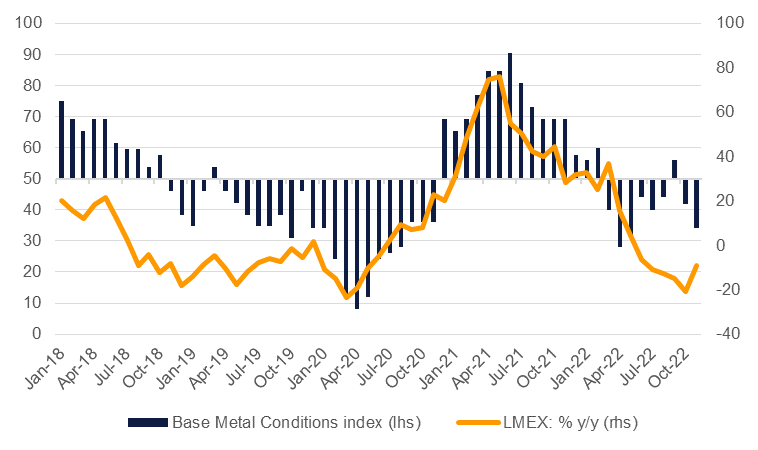

Beyond China, there is widespread negativity on the health of the global economy for 2023. Whether prompted by central banks aggressively tightening policy or businesses slowing investment thanks to high costs—for wages or materials—a global slowdown is well underway. We track conditions for industrial metals across a wide range of indicators—industrial activity, borrowing costs, inventory levels among others—and the macro environment for metals looks poor in the near term.

Source: Bloomberg, Emirates NBD Research. Note: levels below 50 indicate poor conditions for metals prices, levels above 50 suggest better conditions.

Source: Bloomberg, Emirates NBD Research. Note: levels below 50 indicate poor conditions for metals prices, levels above 50 suggest better conditions.

Some economies may yet prove resilient to a substantial recession—the US looks set for potentially a mild recession if one does even occur—but a slowdown in activity still bodes poorly for industrial demand and investment, and metals more generally. Indeed, housing is one of the few areas in the US economy that is unequivocally negative: new housing starts plummeted in H2 2022 in the US, dropping by 16% y/y in November.

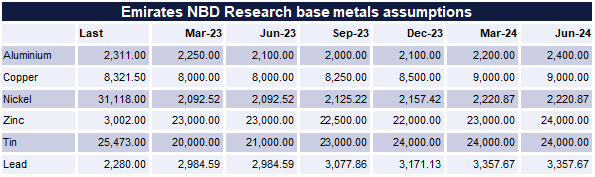

While copper prices have been able to bounce off lows close to USD 7,000/tonne hit mid-way through 2022, we wouldn’t rule out some softening from present levels of around USD 8,300/tonne. We expect copper prices to average around USD 8,000/tonne in H1 as it becomes clear a widespread recession or slowdown is in place. But on the assumption that the recession won’t be particularly harsh, in terms of employment or impact on businesses, we see prospects for prices to improve in the second half of the year and into 2024 as the macro case for copper—and industrial metals more broadly—remains strong. Expanding infrastructure investment and greater electrification of transport will mean heavy appetite for metals going forward. Should a recession be heavier that would pose more downside risks for prices for a prolonged period.

Source: Bloomberg, Emirates NBD Research