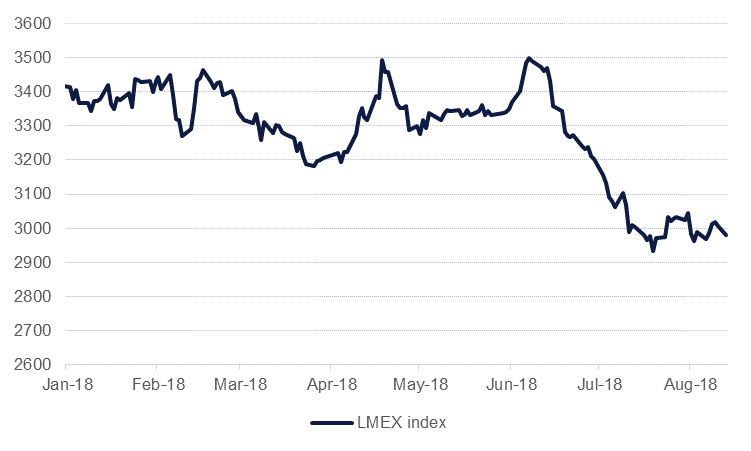

The escalating trade war between the United States and China is weighing heavily on global commodity markets and hitting metals most directly. The LME index of six base metals has declined 12.8% year-to-date with most of the decline occurring in the last two months as China and the US have imposed retaliatory tariffs on each other. The sharp depreciation of the Turkish lira since the start of August has created another headwind for metal futures on fear that a deterioration in Turkey’s economy could herald the start of a wider slump in emerging markets. However, we see the risk of contagion to the fundamentals of other EMs from the Turkey sell-off as reasonably low and expect a slowdown in global trade to be the more severe risk for base metals until the end of the year and into 2019.

Source: Eikon, Emirates NBD Research.

Source: Eikon, Emirates NBD Research.

A slowdown in China’s economy initiated by regulatory efforts to curb excessive credit growth is starting to show up in data and will also raise questions about commodity demand more generally. Fixed asset investment growth slowed to just 5.5% y/y in July compared with 6% a month earlier while industrial production growth held flat at 6%. We don’t anticipate that China’s authorities will allow for a sharp drop in economic performance and the government is already taking steps to ensure that any downturn bottoms out in the near term. Relaxed lending conditions and increased government spending will help keep a floor under growth; both real estate investment and construction starts spiked in July.

Source: Eikon, Emirates NBD Research

Source: Eikon, Emirates NBD Research

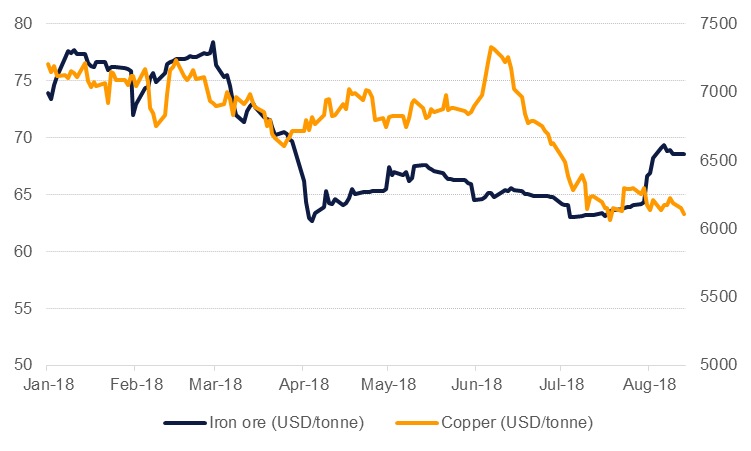

Anticipation of China’s government putting a floor under growth may help to explain some of the divergence between iron ore and copper prices in recent weeks. Copper has plummeted from more than USD 7,000/tonne in June to a little above USD 6,100/tonne currently on the LME. Meanwhile, iron ore futures have jumped to almost USD 70/tonne from a level around USD 63/tonne where they spend most of Q2 the start of Q3. Prices for steel products in China have been trending solidly upward since Q2 while coking coal prices and freight rates from Australia have been stable or declining, helping to keep margins healthy at Chinese steel mills.