Industrial metals have benefitted from market expectations that a US-China trade deal is imminent. Across the LME complex, all base metals have seen a positive performance year to date, with the LMEX index up 8.6%. Iron ore has stood out even more, up 26% ytd for 62% ore China basis, as Brazilian authorities ordered the closure of several mines in the country after a tailings dam burst, killing several hundred people.

The scale and scope of a US-China trade deal has yet to be released but in our view does more to remove a downside risk to markets rather than spark a dramatic improvement in demand this year. Global growth indicators across developed and emerging markets are pointing to slower performance, tempering demand for capital inputs such as industrial metals. However, no further escalation in the trade war should help set a floor under prices and lead to more discrete performance for individual metals based on idiosyncratic market characteristics.

Commodities generally may receive a boost from central banks, which are near uniformly adopting more dovish policy approaches in 2019. With the trajectory for Fed rates more uncertain and the market discounting the Fed’s projections, commodities should get a boost from a softer USD. However, the monetary easing now in place appears more like central banks fanning the embers of a dwindling fire rather than propping up sustainable growth. Any boost to commodities from central banks will likely be short-lived in our view.

The outlook for aluminium is skewed sharply by China’s trajectory, both on the demand and supply side of the market. Over the last few years, authorities have targeted the industry for capacity closures based on excessive (and in some cases illegal) capacity as well as environmental concerns. Winter-month production cuts will be coming to end over the next few weeks but the disruption to supplies this year appear to have been far smaller than initially expected.

China’s production recorded a monthly average of 3.04m tonnes in 2018, up 1.6% y/y after a 10% jump in 2017 (IAI data). Slower construction and industrial activity has seen domestic demand for aluminium weaken, causing a build-up in inventories in the last two and a half years to burdensome levels. SHFE stocks have fallen from their previous peak of around 1m tonnes but are still well above historic levels. Excessive production and inventories, along with a softer demand profile, have all contributed to weaker Chinese pricing: current prices on the SHFE are nearly 19% below their high in the last two years. These lower Chinese prices have fed back into international markets in the form of higher Chinese exports and kept LME forwards below USD 2,000/tonne.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

Beyond China, the aluminium market will also need to contend with the return of Rusal metal to the LME system. Metal from the Russian producer was barred from delivery in LME-based trades as the company came under US sanctions in Q2 2018. However, the US senate voted to remove those sanctions in January and the LME will now accept Rusal metal. Aluminium inventories in the LME system have been reasonably steady in the last year, compared with declines in the other base metals on the exchange, and the return of Rusal metal may exacerbate the surplus position. Of the LME markets in contango at present, aluminum relatively has the widest discount for spot prices compared with 3mth forwards.

We are lowering our forecast for aluminium prices in 2019 to an average of around USD 1,900/tonne compared with USD 2,150/tonne previously. Even as trade war fears dissipate, the outlook for aluminium remains challenging for sustained upward moves.

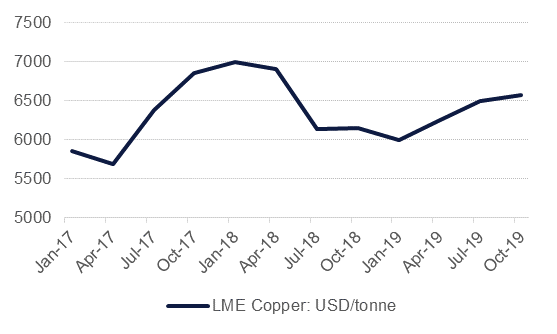

Copper prices have managed to push back above USD 6,000/tonne on hopes that a trade deal between China and the US could be reached and have so far recorded an average of around USD 6,100/tonne this year. Compared with aluminium, copper is in a much tighter fundamental position as inventories have been depleted and the market has had to endure several years of labour disputes affecting production in major producers in South America. Mine supply growth will stagnate this year and will remain low over the next few years as few new projects are set to come online. Beyond primary production China has introduced more rigid regulations on imports of scrap metal, helping draw in more primary metal and concentrates

The supply picture for copper supports a relatively more positive outlook for copper than aluminium. However, investor positioning is hardly optimistic. Speculators have generally held a net short position in COMEX copper futures since July 2018 as signs of a slowdown in global growth take hold. Indicators from heavy industry in China all point to weak performance in the domestic economy nor are developed markets providing much in the way of support.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

We are moderating our view on copper in H2 as risks to global growth remain prominent even beyond trade issues. We expect copper will record an average of around USD 6,330/tonne, down slightly on 2018 although the path over the course of the year will be higher.

Iron ore prices surged at the start of February to over USD 90/tonne for the first time since March 2017. The immediate catalyst for the gain was the bursting of a tailings dam at a mine in Brazil and the state of Minas Gerais canceling the mining license of a major iron ore miner in the country. Despite the interruption to supply, Brazilian exports in the month up to Feb 22nd were nearly 8% than the same level a year earlier.

However, the near-term spike in prices is likely to be unwound over the course of the rest of the year. Industrial indicators from China—whether one looks at fixed asset investment, manufacturing PMIs or producer price inflation—are all pointing softer. Indeed, SHFE rebar prices have been roughly flat for the last four months and far below 2018 highs. Chinese steel production slowed in December as margins compressed and producers are targeting lower grades of iron ore to maximize income.

We are initiating our coverage of iron ore (62% China delivery basis) and expect prices to be supported by the anxiety over Brazilian supplies and prospect of a China- US trade deal in the near term. Looking toward the second half of 2019, however, we expect prices will soften in line with other industrial metals and record an average of USD 70/tonne in 2019.