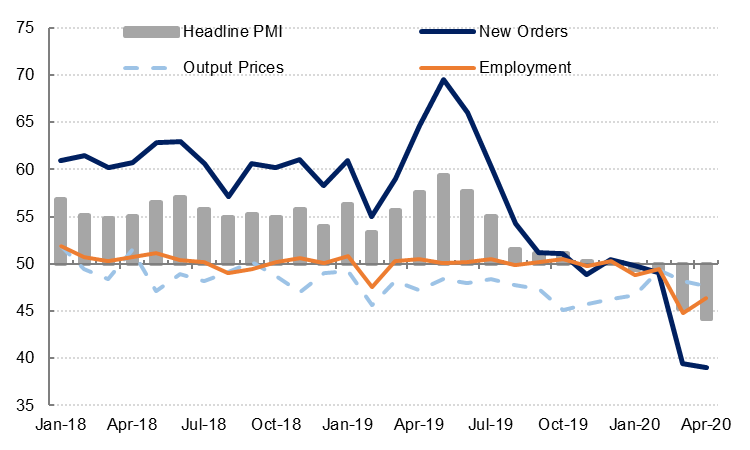

While the MENA PMIs remained firmly in contraction territory in April, the GCC PMIs look remarkably stable at first glance. The UAE PMI declined just over 1 point from March to 44.1 in April, while the Saudi PMI actually rose slightly to 44.4 from 42.4 in March. However, the disruption to global supply chains have resulted in PMI readings around the world being artificially boosted by lengthening supplier delivery times.

PMIs are calculated using five components of the survey: output, new work, employment, inventory and suppliers’ delivery times. Ordinarily, lengthening supplier delivery times are indicative of increasing demand for inputs and thus push the headline PMI higher. However, the longer delivery times in the last three months have not been due to increased demand but to factory and border closures that have disrupted supply chains around the world.

As a result, the output/ business activity and new work components of the PMI surveys are probably a more accurate reflection of the state of the private non-oil economies in the region than the headline PMI figures in the current unique circumstances.

Output/ business activity declined at a record rate in April with the index falling to 39.9 as restrictions to contain the spread of the coronavirus led to many businesses closing for most of last month. New orders also contracted at a record pace for the second month in a row. The new export orders index fell to 35.2 from 44.3 in March, as tourism ground to a halt and external demand contracted.

Employment in the private sector declined for the fourth month in a row, but the rate of decline was not as steep as in March. Staff costs also fell as many businesses put employees on unpaid leave or reduced salaries. As overall input costs declined in April, firms were able to offer further discounts on selling prices. Firms ran down inventories and reduced the overall quantity of purchases in April, on the back of much weaker demand and output.

Suppliers’ delivery times increased for the second month in a row, reflecting supply chain disruptions amid business closures. In April, the increase in supplier delivery times contributed 8.4 points to the headline PMI reading of 44.1.

Business optimism was at the lowest since August 2017, as firms reflected concerns about a protracted downturn, according to the survey.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

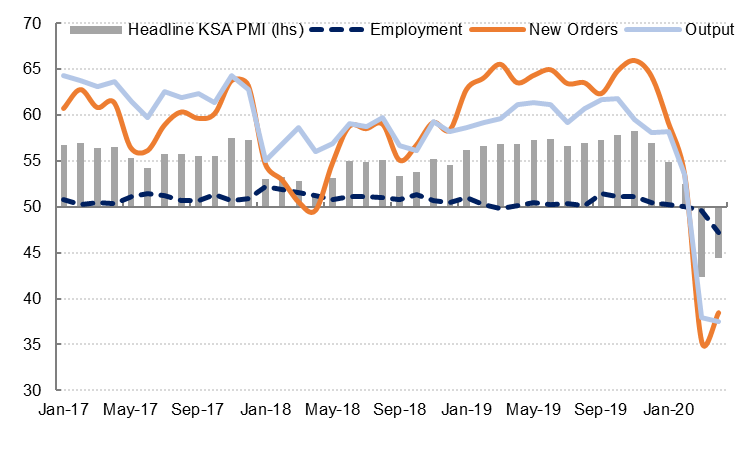

Output/ business activity in Saudi Arabia’s non-oil private sector declined at a record rate last month, with the index falling to 37.5. New work also contracted sharply, but the rate of contraction was slightly lower than in March, as some firms noted a shift to online orders in April.

Private sector employment also fell in April, after remaining surprisingly steady in March. Firms reported increased redundancies and hiring freezes as a result of the disruptions to business activity as a result of restrictions related to COVID-19. Staff costs also declined at a record rate in April as firms agreed shorter working hours and reduced pay with employees. Purchasing activity declined sharply both as a result of weaker demand and in some cases, difficulty in sourcing inputs.

Suppliers’ delivery times increased at a record rate as border closures and shipping delays disrupted supply chains, and some suppliers closed for business. This component contributed 9.3 points to the headline PMI reading of 44.4 in April.

Business optimism remained near the neutral level seen in March, as businesses remained uncertain about how long the restrictions on activity would remain in place, and the speed with which the global economy would recover.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research

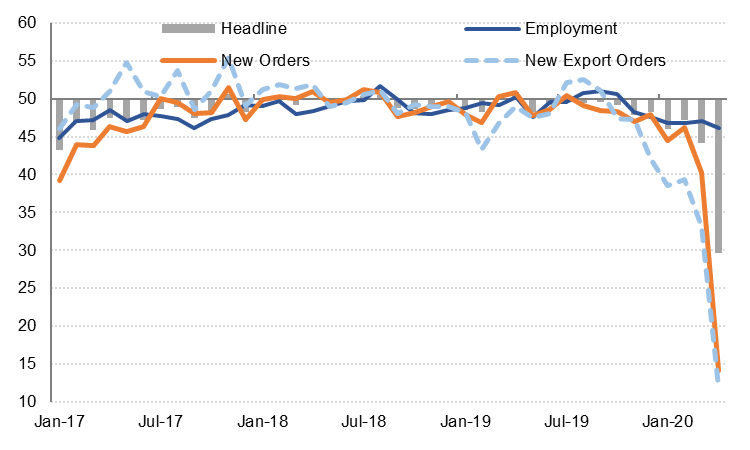

As the coronavirus pandemic took its toll on Egypt in April, the purchasing managers’ index made a dramatic fall back to 29.7, down from 44.2 the previous month and far below the neutral 50.0 level. This signifies the most rapid contraction in non-oil private sector activity since the series began in 2011, and is significantly worse than the previous index low of 37.1, recorded in 2012. The sub-indices represent a range of ‘worst on record’ results, with output particularly low as the government enacted a number of lockdown measures to try and contain the disease’s spread.

Of concern for the eventual recovery once the lockdown is lifted, new orders and new export orders were also especially low, suggesting that the bounce-back will be a fairly sedate one. In addition, employment was in negative sub-50 territory for the sixth consecutive month. This will likely exert a further weight on demand recovery, as will staff costs turning negative for the first time since February 2019, suggesting wages might be curtailed in addition to the job-shedding. There are efforts underway in Egypt to allow a gradual restart in economic activity, as hotels will be allowed to provide services for local guests at 25% of capacity to the end of May, and 50% from the start of June. However, even allowing for some local demand partially mitigating the loss of foreign visitors, the onerous requirements on hotels to be allowed to reopen will likely see only partial take-up.

We had been broadly in line with the government’s downwardly revised GDP growth forecast of 3.5% in the coming fiscal year starting in July. However, given these factors highlighted by the PMI results, and the fact that the recovery in tourism is looking increasingly likely to be pushed back later in the year, we now expect that growth next year will come in closer to the 2% Egyptian planning minister Hala al-Saeed on Sunday mooted as a possibility if the crisis continued to December.

Source: IHS Markit, Emirates NBD Research

Source: IHS Markit, Emirates NBD Research