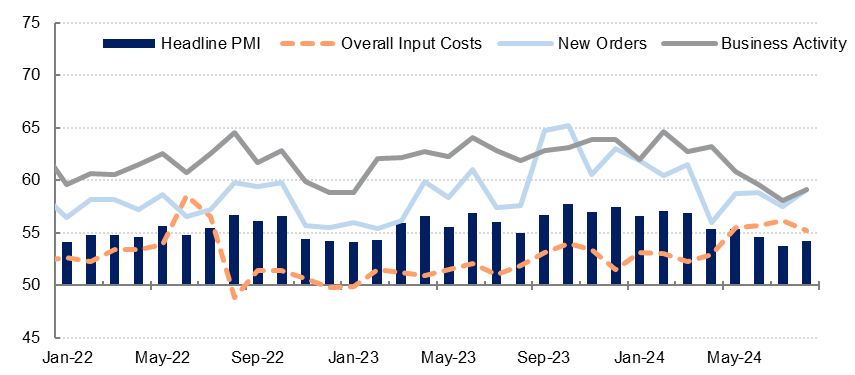

The UAE’s purchasing managers’ index (S&P Global PMI) rose to 54.2 in August after dipping to its lowest level in almost three years in July. Business activity and new orders both rose at a faster pace last month, with the latter supported by improving external demand as new export orders rose at the sharpest pace since October 2023. Employment growth remained lacklustre overall, as increased hiring in some firms was offset by staff cuts in others. Backlogs of work continued to rise in August but at the slowest rate since January.

Input costs have risen relatively sharply m/m since May, and 13% of firms reported higher input costs again in August. This was attributed to higher prices for raw materials, transport, IT equipment and maintenance, according to S&P Global. Consequently, output prices also rose for the fourth consecutive month, although the increase in selling prices in August was marginal.

Overall, firms remain very optimistic about the outlook over the coming year, with the future output index remaining above the 60.0.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

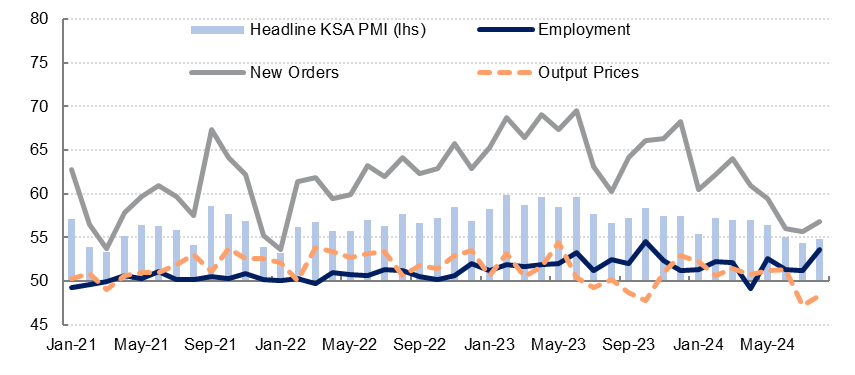

Saudi Arabia’s Riyad Bank PMI also improved to 54.8 in August from 54.4 in July, largely on the back of stronger new orders and employment growth. The employment subindex rose to its highest level since October 2023. Business activity increased in August but at a slightly slower pace than in July. Backlogs of work continued to decline as they have every month since May, with the August decline the sharpest in the last four months.

Price pressures in the kingdom appear to be more muted than in the UAE, with only a modest increase in input costs in August. Firms reduced selling prices on average for the second consecutive month in a competitive environment. Business optimism improved from July, and the future output index was the highest since April. Investment, population growth and rising tourism numbers were citied by firms as reasons for their upbeat outlook over the coming year.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research

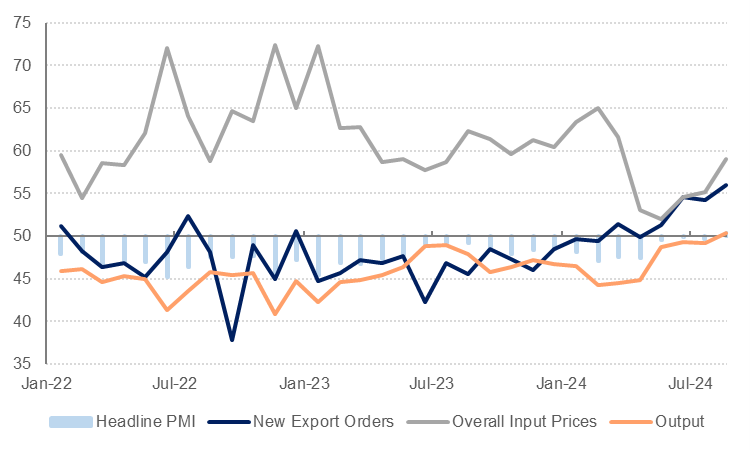

The Qatar Financial Centre PMI rose to 53.1 last month from 51.3 in July, driven by a sharp rise in non-oil sector employment. The employment component of the survey rose to 54.9 in August from 48.4 in July, the highest level since January 2019. Employment growth was broad-based across all sectors and particularly strong among service providers, according to S&P Global. New order growth rose at a faster pace as well last month, while the output index was largely unchanged from July.

Input costs rose sharply in August, with this sub-index jumping almost 5 points from July to the highest level since August 2020. Staff costs were likely a key contributor to higher input costs as this component also rose sharply in August, in tandem with the increase in hiring. Purchase prices rose at a faster rate last month as well, with the wholesale & retail sector seeing the fastest rise in purchase prices. Wholesalers and retailers passed on their higher costs through increased selling prices, but lower selling prices in the construction sector meant that average output prices declined in August.

Egypt’s PMI rose to 50.4 in August from 49.7 in July, the first reading above the neutral 50-level since November 2020. Business activity expanded modestly in August as demand stabilised, even as new work orders declined slightly overall. Export orders increased for the fourth consecutive month and at the second-fastest pace on record. Manufacturing appeared to be the main driver of export order growth last month.

However, price pressures increased in August with overall input prices rising at the fastest pace since March. Over a quarter of firms surveyed said their input costs had increased last month and the trend was evident across all sectors but particularly in wholesale & retail trade. The higher costs were attributed to rising purchase prices and effects of the weaker pound, although staff costs increased slightly as well.

Firms added headcount again in August, albeit only modestly, and purchasing activity picked up also. Backlogs of work were largely unchanged from July. Firms were, on average, the most optimistic about the coming year than they have been in more than two years.

Source: S&P Global, Emirates NBD Research

Source: S&P Global, Emirates NBD Research