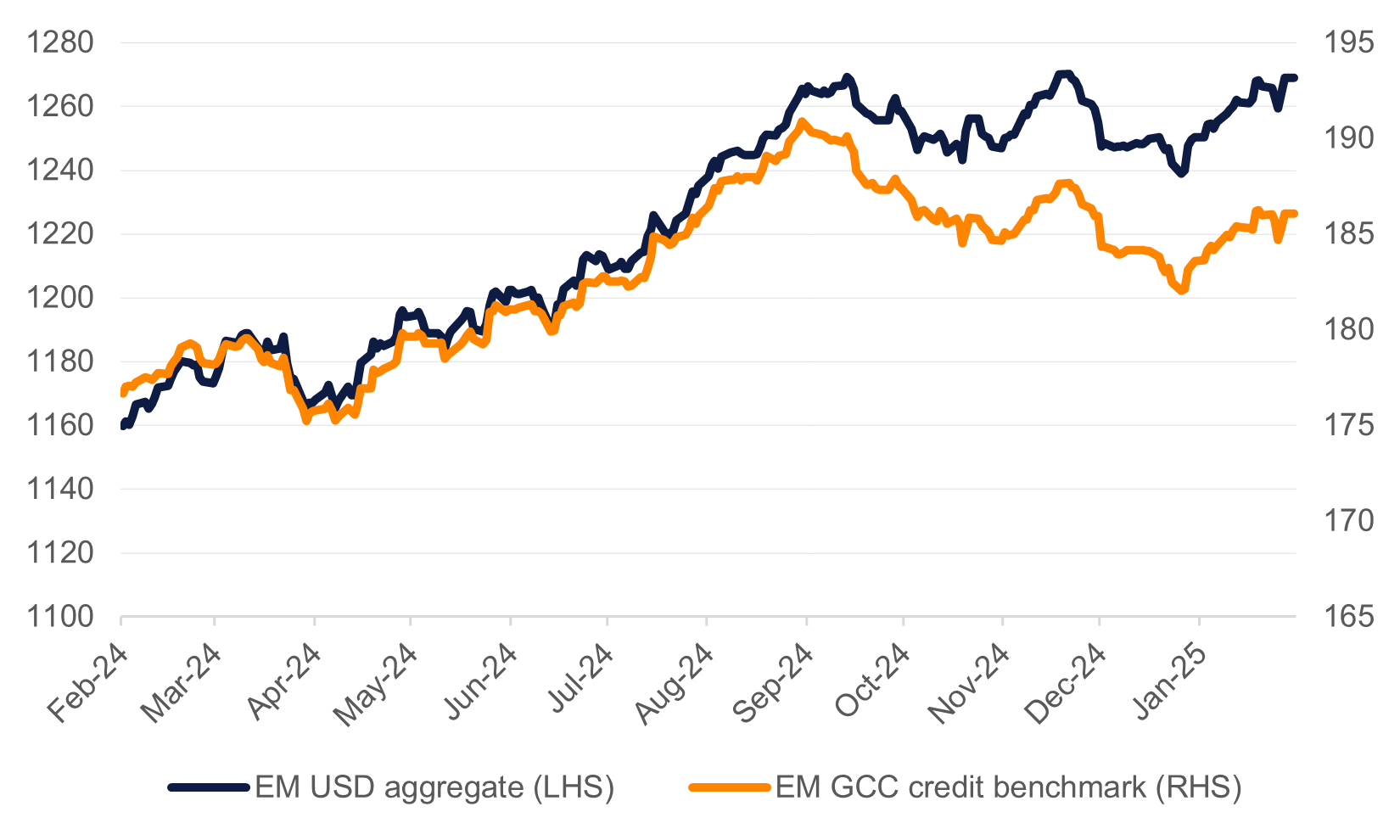

Emerging market bonds showed some wide day to day volatility last week as bond markets in general responded to the hotter than expected January inflation data from the US. Bloomberg’s index of USD-denominated EM bonds added 0.2% for the week as a whole ending February 14, though dropped 0.3% on Thursday in response to the inflation data followed up by a 0.4% gain a day later.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

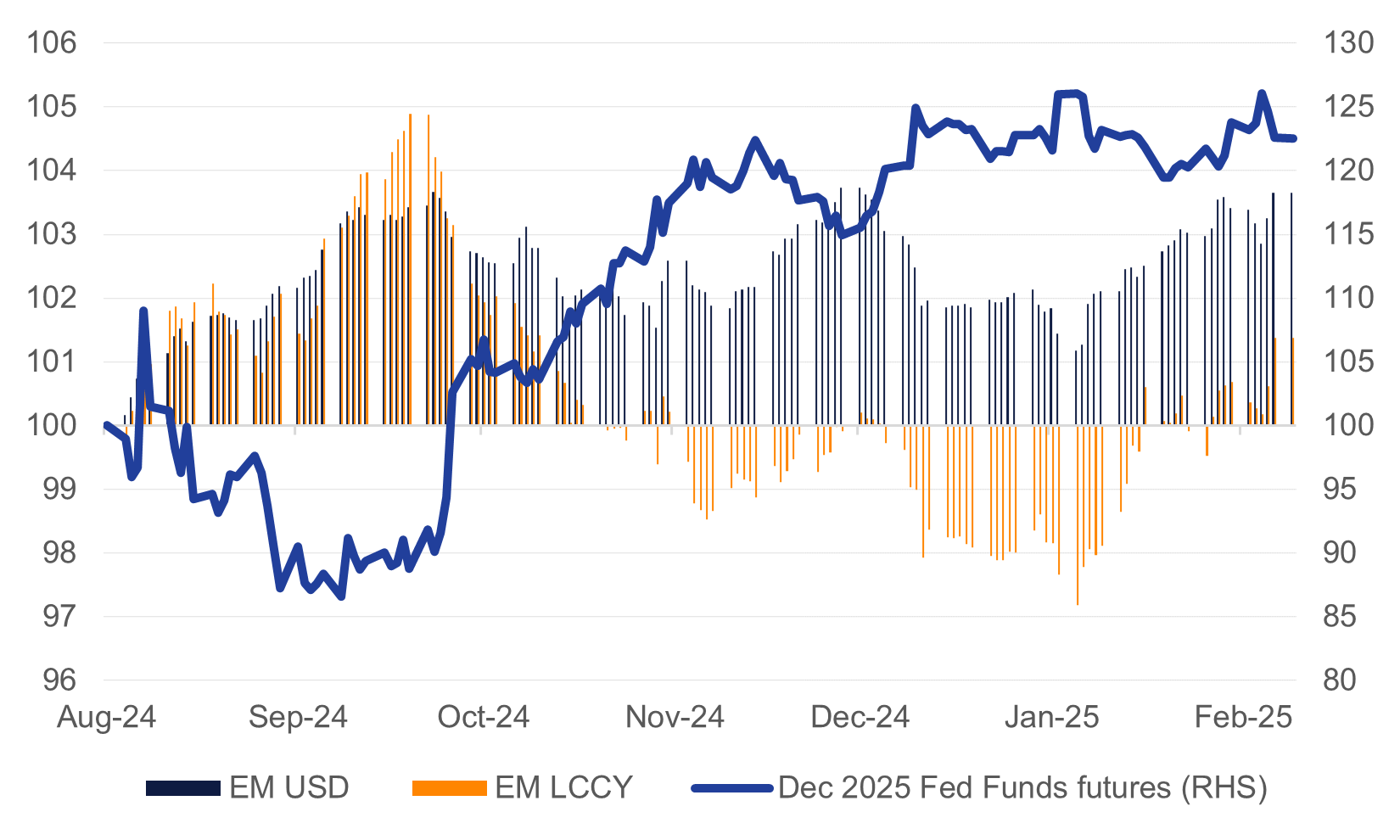

Fed funds futures markets are pricing in about 1.6 25bps cuts from the Federal Reserve over the rest of 2025, just shy of 40bps in total. Volatility in expectations for baseline rates has played out much more in local currency emerging market bonds. But the stablisation in views of fewer cuts or higher for longer has allowed individual economic dynamics to play out in local currency markets since the start of 2025.

Source: Bloomberg, Emirates NBD Research. Note: Aug 9 2024 = 100. A lower index for Dec 2025 Fed Funds futures implies more rate cuts / a higher index implies fewer.

Source: Bloomberg, Emirates NBD Research. Note: Aug 9 2024 = 100. A lower index for Dec 2025 Fed Funds futures implies more rate cuts / a higher index implies fewer.

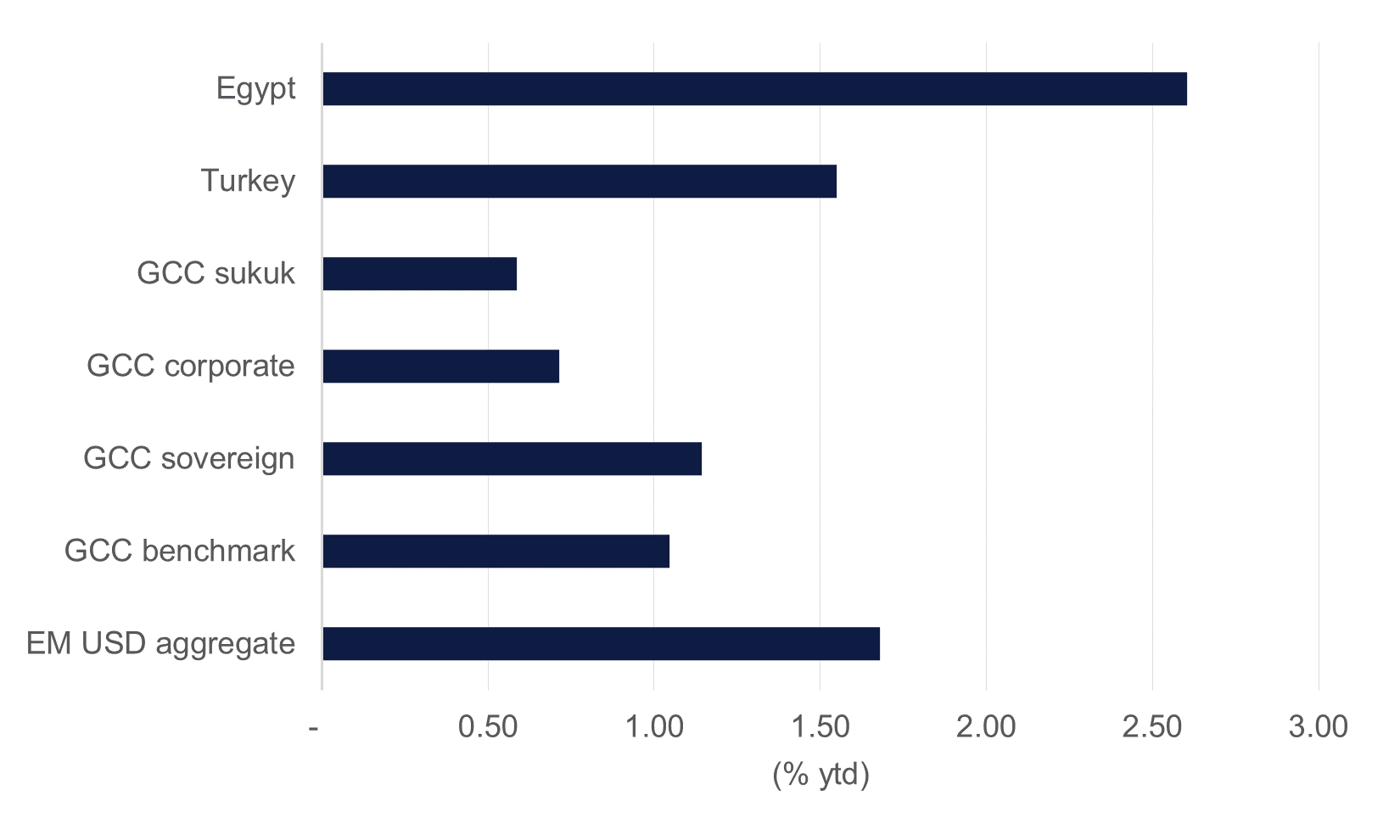

GCC credit was quiet on a weekly basis with Bloomberg’s region wide index recording less than a 0.1% gain on the week ending February 14. High-yield and sukuk were the standouts although the weekly gains were negligible. At a geographic breakdown Bahrain bonds were the winner last week with a gain of 0.3% in the index while indexes for both the UAE and Saudi Arabia were flat week/week. Beyond the GCC Turkish bonds rallied by 0.3% week/week and Egyptian bonds added 0.6%.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Turkey’s central bank governor, Fatih Karahan, said that the central bank would take a “very gradual” approach to cutting rates and that “prudence is key.” That follows on 500bps of cuts that the TCMB has taken since December last year.

Selected new issuances in the last week include: