Markets took a breath to start the week as anxiety eased over a looming trade war between the US and China spread. Steve Mnuchin and Robert Lighthizer, respectively the US treasury secretary and trade representative, have reportedly sent a letter to their Chinese counterparts outlining the steps the country needs to take to avoid the imposition of direct tariffs on up to USD 60bn of goods and services trade. Opening up China’s financial services, cutting tariffs on US cars and importing more semiconductors were among the list of demands. Markets responded positively to the news that negotiations would be underway rather than a unilateral imposition of the trade restrictions on China.

Profits at industrial companies in China were up 16% y/y in the first two months of 2018, slower than the pace of growth recorded in 2017. Industrial production has been levelling off in China in recent months but pollution related curtailments in the steel, aluminium and other heavy industries will be affecting the performance of Chinese companies at a time when commodity prices have been weakening.

Egypt began its presidential election yesterday as part of a three-day voting window from March 26 to 28 which will almost certainly see President Abdel Fattah el-Sisi returned for a second term. The incumbent is widely expected to win more than 51% of the vote, meaning that there would be no second-round run-off. A victory for Sisi will mean continued commitment to the IMF-sponsored reform economic reform programme Egypt began in November 2016.

Source: EIKON, Emirates NBD Research.

Source: EIKON, Emirates NBD Research.

US treasuries fell in response to easing fears about trade wars after Treasury Secretary Steven Mnuchin stated that he was cautiously hopeful that China will reach a deal to avoid tariffs on $50 billion of U.S. exports. Yields on 2yr, 5yr, 10yr and 30yrr UST closed up at 2.27% (+2bps), 2.64% (+4bps), 2.85% (+4bps) and 3.0% (+3bps) respectively. Credit spreads also eased in the US with CDS levels on US IG closing down by 4bps to 65bps. However, European markets still remained cautious. Yields on 10yr Gilts and Bunds were down marginally to 1.44% and 0.52% respectively and CDS levels on Euro Main rose a bp to 63bps.

GCC bond market had little catalyst to trade on, though sentiment remained weak on the back of increasing geopolitical risk. Yield on Barclays GCC bond index closed at its highest level for this year at 4.29% even though credit spreads tightened 2bps to 168bps as oil prices soared over $70/b mark. Fitch affirmed Etisalat’s rating at A+/stable, however, downgraded Ooredoo to A-/stable citing the company's standalone credit profile of BBB and the two notch support that it gains from its majority ownership by the Qatar Government. The rating change is largely reflective of Fitch’s revised rating methodology and therefore unlikely to impact bond prices materially.

Primary markets awaits initial price guidance on Bahrain’s potential new offerings.

The dollar remained on the back foot yesterday, losing ground against most of its major peers on fear that a trade dispute would disrupt global growth. However, as markets recovered some of their composure later in the day we saw a small risk on move and the JPY has now moved back above 105. Both EUR and GBP are extending yesterday’s gains into today while performance across commodity currencies is mixed with the loonie appreciating (mildly) so far against the dollar and the AUD and NZD slightly weaker.

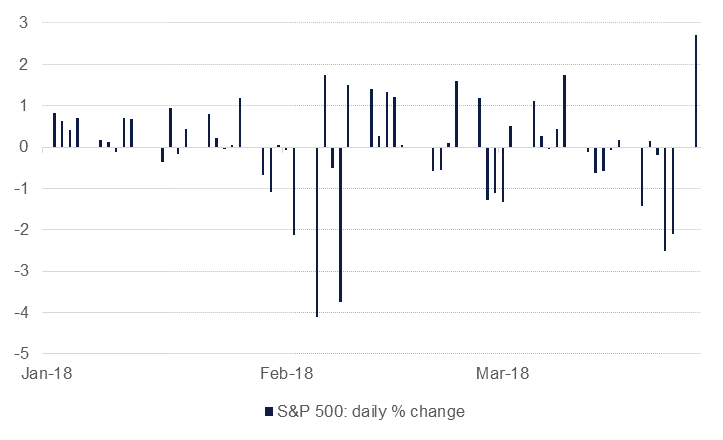

Equities markets halted the rout of previous few trading sessions closing the day mixed yesterday. European bourses generally had negative close ahead of easing trade war fears with Euro Stoxx losing 0.6% and DAX down by -0.57% yesterday. In contrast, US equities regained most of lost grounds of the previous week as S&P500 and Dow Jones both closed up by more than 2.7%.

Emerging market bourses also benefited from easing tariff talks. Nikkei and Hang Seng are trailing in green this morning at +1.87% and +0.93% respectively.

Despite the positive sentiment emanating from rising oil prices, GCC equities were mixed. Abu Dhabi exchange remained buoyed by 2.5% increase in FAB’s shares, closing the day up by 0.78% while DFMG was down -0.36% due to weakness in investment sector shares. Increasing capital inflow in KSA helped Tadawul to close up by +0.22% though Qatar and Bahrain closed lower by -).7% and -0.5% respectively.

Oil prices were subdued to start the week with both Brent and WTI futures giving up around 0.5%. Most of the market’s attentions was fixated on the launch of the new Shanghai oil futures contract which had a relatively successful start with large trades between trading houses and Chinese oil companies. Given restrictions on convertibility of the RMB we don’t expect to see a major diversion of funds away from WTI or Brent yet in favour of the INE contract.