Financial markets endured a complete risk-off/risk-on cycle overnight as expectations of sustained tensions in the Middle East waned. The gyration was perhaps most evident in oil markets where benchmark futures moved nearly 10% intraday from their highs to lows; Brent at one point was up to USD 71.75/b before pushing below USD 65/b. Equity markets nearly all managed to close positively while yields on 10-year USTs moved from 1.7% in early trade to more than 1.87% at their peak. Volatility is likely to persist in the short-term given that no party will be transparent as to whether there will be any further escalation of geopolitics in the Middle East but for now markets can resume looking to fundamentals for direction.

The World Bank expects global growth at 2.5% in 2020, a very modest improvement from 2.4% estimated for 2019. Like many other multilateral institutions, the World Bank pointed to trade disruptions acting as a drag on growth. Most countries received downgraded growth projections with growth in China expected at 5.9%, the Eurozone at just 1% and Japan at 0.7%. The bank was more optimistic for emerging economies, however, expecting growth to accelerate from 3.5% to 4.1%. For the Middle East, the World Bank expects the UAE to expand by 2.6% this year and Saudi Arabia at 1.9%.

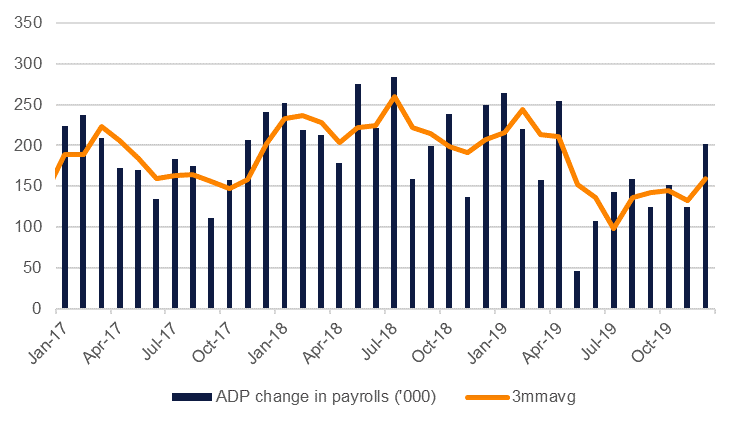

The ADP private sector gauge of employment in the US showed that 202k jobs were added in December, the best result in eight months. The ADP also revised up its November figure to nearly twice as high as its previous estimate. Data showed that hiring was spread across all companies with midsized firms doing particularly well. NFP figures are due out on Friday with market expectations of a gain of 153k for December.

There was more manufacturing gloom coming out of Germany with data showing that factory orders for November declined by 1.3% m/m, falling well short of market expectations for a modest gain. Similar to a trend in the US, stripping out volatile orders for aircraft shows up a better picture with core orders actually gaining m/m. The soft performance from Europe’s biggest economy will keep the Eurozone in a relatively vulnerable position should it find itself in the sights of the US administration for revision to their trading relationship.

Source: Bloomberg, Emirates NBD Research.

Source: Bloomberg, Emirates NBD Research.

Treasuries closed lower following revival in risk sentiment after comments from the US President where he suggested that the US will not be escalating the ongoing hostility further. Yields on the 2y UST and 5y UST closed at 1.58% (+4 bps) and 1.66% (+5 bps) respectively.

Regional markets closed largely unchanged as investors remained cautious relative moves in benchmark indices. The YTW on Bloomberg Barclays GCC Credit and High Yield index was flat at 3.19% while credit spreads tightened 5 bps to 141 bps.

Risk haven currencies pitched and yawed in line with changing percpetions of whether the US and Iran would escalate hostilities further. JPY moved to 107.60 in early trading yesterday only to close at more than 109 as a risk-on tone materialized. CHF saw similar moves while gold has edged further back from USD 1,600/troy oz.

The change in risk attitudes along with a strong ADP report helped lift the Dollar Index. This gain of 0.3% helped the DXY index closed closed at a 2020 high of 97.278. Analysis of the candle charts shows that this level is not far from the 50% one-year Fibonacci retracement of 97.348, a level that provided resistance to further gains yesterday. A close above this level is needed in order for the index to hold onto these gains.

In EM currencies, INR has strengthened in early trading today, gapping lower at the open to 71.46 against the dollar while TRY gained considerably, closing near to 5.9 from an intraday high of more than 5.98 against the USD.

Developed market equities closed higher as both US and Iran indicated de-escalation in the ongoing conflict. The S&P 500 index and the Euro Stoxx 600 index added +0.5% and +0.2% respectively.

Regional markets closed sharply lower as investors’ pared position ahead of comments from key personnel involved. The DFM index dropped -1.2% with all market heavyweights closing lower.

After an enormously volatile day of trading, oil prices settled lower overnight. Brent futures closed down 4.2% at USD 65.44/b while WTI fell nearly 5% to close back below USD 60/b. Both contracts endured intraday moves of nearly 10% as signs of easing tensions between Iran and the US collapsed markets. Forward curves also tanked with time spreads in 1-2 month contracts for both Brent and WTI hitting lows for the year so far.

Adding more downward pressure to oil, the EIA reported a build in US crude inventories, against market expectations, of 1.2m bbl last week. Gasoline and diesel stocks also rose substantially with total crude and product stocks up by almost 15m bbl last week. Crude production in the US was unchanged at 12.9m b/d while crude exports slipped from the prior week’s record high to 3.1m b.d

OPEC’s secretary general, Mohammad Barkindo, told an energy conference that the producers’ bloc would ensure security of supply should any output be affected by ongoing tensions in the Middle East. He also cautioned that oil markets appear over-supplied in H1 and that only by the second half of the year would demand show signs of growing.

Click here to Download Full article