It was a quiet start to the week with US, UK and some Asian markets closed on Monday, and regional markets closed for Eid holidays. Data released in the US yesterday was better than expected, with new home sales rising slightly in April as low mortgage rates appeared to offset concerns about the impact of the coronavirus and consumer confidence also a little higher in May than in April. The data helped boost equities, with markets seemingly shrugging off increasing geopolitical tension between the US and China for now.

In Europe and the UK, stocks rallied as countries take further steps towards easing lockdowns and infection rates appeared to be slowing. The UK is expected to allow some non-essential businesses to open on 1 June, with more to follow by the middle of June. Japan ended its nationwide state of emergency on Monday.

More stimulus measures have also contributed to the risk-on sentiment. The ECB is expected to increase the size of its EUR 750bn pandemic emergency purchase programme at its next monetary policy meeting (next Thursday) while the European Commission is expected to provide more detail on the proposed EU recovery fund today.

China also announced a USD 500bn fiscal stimulus package at the annual Two Sessions conference at the end of last week. The measures include increasing the budget deficit to a record -3.6% of GDP from -2.8% in 2019 and issuing special bonds to fund “new infrastructure” investment. Significantly, there was no GDP target announced for this year, given the uncertainty around the impact of the coronavirus. The government also announced a new national security law for Hong Kong which has lead to further protests there. The US has also threatened to sanction China if the law is passed, with the White House indicating that an announcement could be made as early as this week. This adds to the uncertainty around the implementation of the “Phase 1” trade deal agreed by the two countries at the start of the year.

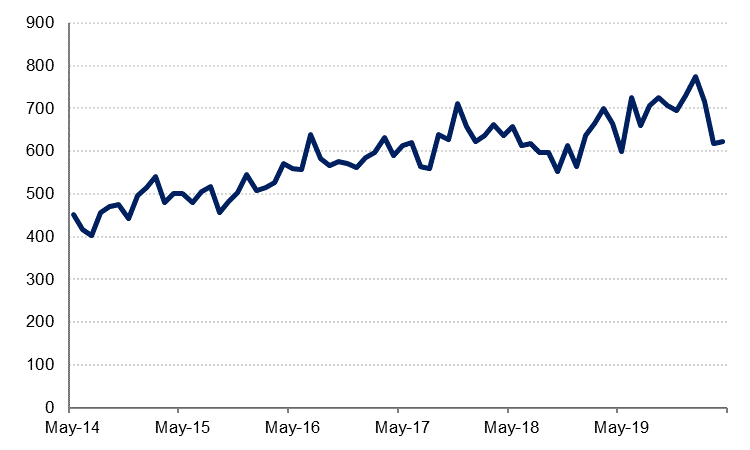

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

Treasuries closed lower as risk assets continued their positive run. The curve bear steepened with yields on the 2y UST and 10y UST ending the day at 0.17% (+1 bp) and 0.69% (+4 bps) respectively.

Regional bonds continued their momentum as oil prices retained their near-term strength and local economies started to ease restrictions further. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 2 bps to 3.47% and credit spreads tightened 5 bps to 282 bps.

FX

Despite starting the week in a positive fashion, the dollar experienced a steady decline on Tuesday. The DXY index saw the currency plunge from Monday's test of the 99.975 resistance to lows of 99.140 as risk appetite developed. It did fall below the 100-day moving average (99.030), but has partially regained some of its losses this morning. Still it will remain a key indicator to look out for and a test of the 200-day moving average (98.512) can not be ruled out. The JPY experienced a bullish reversal after trading with limited movement on Monday, to reach 107.50.

The weakening dollar has proved beneficial for the euro, which saw an increase of over 0.50% to reach 1.0960. The market is in an upbeat mood amid hopes that a return to normal life may be on the horizon. Sterling was similarly positive, increasing over 1% to reach 1.2320 after reports that the EU may be ready to make concessions to the UK on fisheries. The AUD and NZD both reached highs not seen since March, with both currencies increasing over 1.40% to reach 0.6645 and 0.6190 respectively.

Equities

Notwithstanding concern over escalating tensions between the US and China, developed market equities closed higher. The S&P 500 index and the Euro Stoxx 600 index added +1.2% and +1.1% respectively amid continued optimism over lockdown easing and progress on vaccine testing.

Commodities

Oil prices continued their march higher overnight with Brent settling at USD 36.17/b—up 1.8%—and WTI closing above USD 34.35/b, a gain of 3.3%. Prices have lost a little ground in early trade today as headlines swirl around whether Russia may seek to limit its production cuts as early as July given the improvement in prices and rebalancing occurring in headline balances.