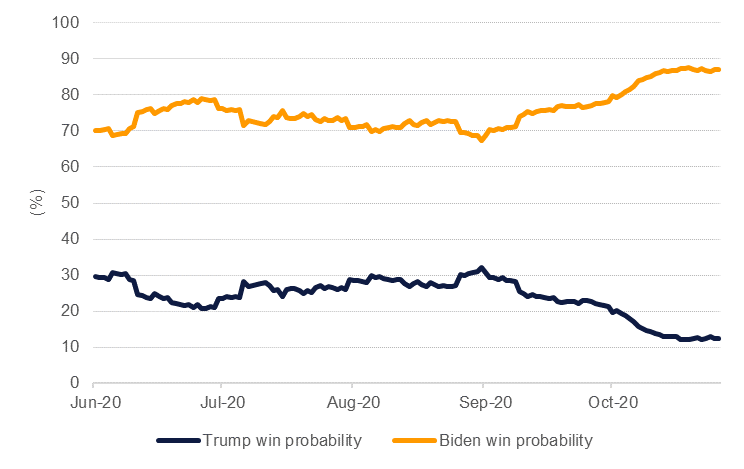

In the final full week of the US presidential campaign polling still points to Democrat Joe Biden having a high probability of winning the presidency on November 3rd. According to major polling aggregator 538, Biden has an 87% chance of winning the electoral college. Although his lead over President Donald Trump is still wide at over 8 percentage points in national polling, it has narrowed in recent days. A similar narrowing of the polls occurred in 2016 and allowed Trump to win the election. Polls are even tighter on a state level, suggesting the race may be perhaps more competitive than we may otherwise believe at this stage. Nevertheless at this late stage of the race and with the Trump campaign running with no new messaging, particularly on how the president would handle the persistent Covid-19 pandemic in a second term, the time is running short for a significant narrowing in favour of President Trump.

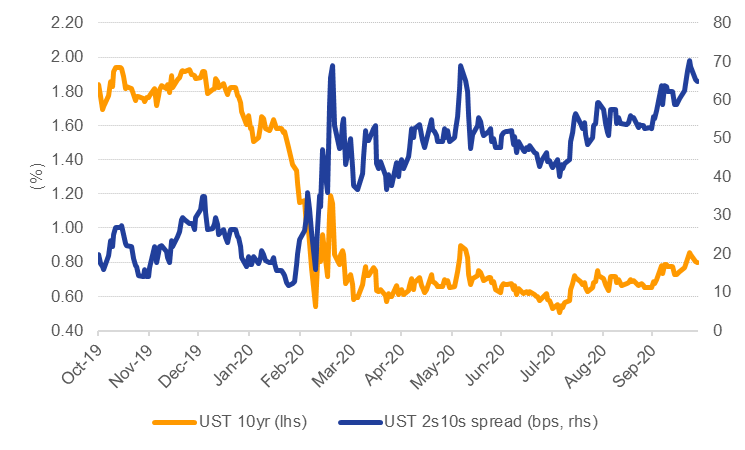

Democrats are also expected to win control of both the Senate and the House of Representatives, setting in place a ‘Blue Wave’ that would allow the party to shape the legislative agenda. Markets are evidently pricing in enormous Democratic stimulus measures to get the US economy back in shape after the Covid-19 pandemic. Yields on 10yr US Treasuries are close to 0.8%, their highest level since June in anticipation of stimulatory measures that allow the economy to grow and boost inflation.

Source: 538.

Source: 538.

But Democrat control of the Senate would likely be narrow, perhaps 1-2 seats. The highest probability scenario that 538 estimates is Democrats controlling just 51 seats. Such a narrow hold on the Senate would likely empower the marginal Democratic senators, particularly those who lean toward the centre or are running in Republican-leaning states.

That means there would still need to be some bipartisan support for any spending measures to avoid filibusters in the Senate. Democrats would need the support of at least 60 senators to secure cloture and avoid endless filibustering that would delay and potentially scupper a stimulus package from being agreed. Considering how challenging it has been to get a new stimulus measures approved at present with House Leader Nancy Pelosi still locked in negotiations with Treasury Secretary Steve Mnuchin, we are a little more circumspect than the market appears to be on how easy it would be to achieve a significant fiscal stimulus after the election, even if there is strong blue colouring to DC.

Markets are clearly pricing in additional fiscal stimulus, assuming a Democrat lean in government from January 2021. More than just the outright rise in US 10yr yields, the treasury curve has steepened considerably: the 2s10s spread has risen to 65bps and is sustainably near its highest level for 2020 as a whole, while 5yr5yr inflation swaps have pushed to almost 2.2%. If the Democrats win control of the senate by only a small margin and an eventual stimulus package disappoints, then we expect further upside on yields to be limited. Even more troubling for markets would be a close or disputed election. In such a scenario we would expect to see a major flight to safety (in the form of Treasuries) pushing yields lower and flattening the curve.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Regardless of the outcome, we maintain that the Federal Reserve will keep an accommodative stance to policy and prevent yields from rising too rapidly (for instance by ramping up its asset purchases) at a time when the economy is still recovering from the Covid-19 pandemic. Our expectation is for rates to remain unchanged throughout 2021 even if markets over-estimate the speed and scale of a Democrat stimulus package. We expect UST yields to rise gradually (albeit at a shallower trajectory than where the market has put them at the moment) and for the USD to weaken moderately against most peers.