Markets tempered some of last week’s exuberance on the potential for a US-China trade deal and a pending resolution to Brexit. On trade, Chinese official publications cautioned that pen needed to be put to paper on the initial agreement reached on the weekend before any further steps toward a broader deal are made. Pressure remains high on China’s economy to reach a deal. Producer price inflation, a good proxy for corporate health in China, fell by 1.2% y/y in August, its steepest decline since July 2016. Meanwhile, car sales continue to plummet, falling by more than 5% y/y in September, the 15th month in a row of declining sales. Meanwhile in the UK, the Queen’s Speech laid out the ambitions of Boris Johnson’s government with a priority to leaving the EU on October 31st. No substantial new views on Brexit were provided although a new points-based immigration scheme for EU nationals would take effect from 2021. Markets have begun cut back some of their enthusiasm that a deal can be reached as EU leaders hold a meeting ahead of a leadership summit later this week with any agreement to be voted on in an unusual weekend session of the UK parliament.

Industrial production in the Eurozone showed a tentative turnaround in August, increasing by 0.4% after two months of decline. Output rose across most of the regional economy and was faster than markets had been expecting. Capital goods output also increased in August, up 1.2% m/m. The tepid growth hardly changes the narrative of a broad slowdown in the Eurozone economy: PMI figures for September had shown a sharp slowdown, suggesting a substantial contraction taking hold in Europe’s industrial sector.

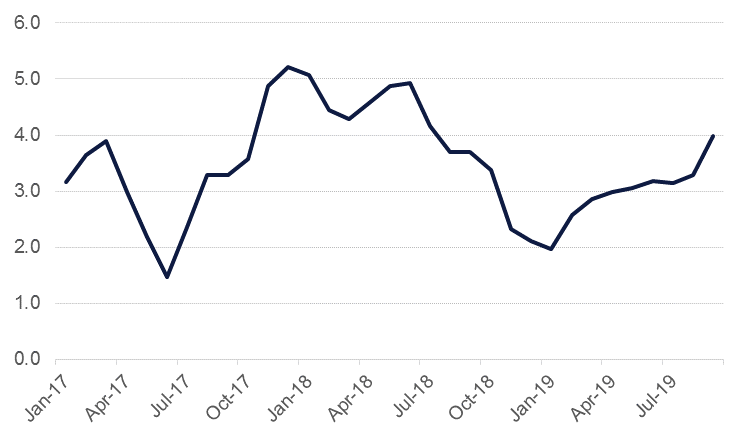

India’s CPI for September 2019 came in at 3.99% y/y. The print was higher than August’s revised reading of 3.28% and consensus expectations of 3.80%. The primary driver of higher inflation was food and beverage prices which rose 4.7% y/y following onion and tomato crop damages. The reading, though elevated, is in line with RBI’s medium term target of 4% and unlikely to be a factor at the central bank’s next meeting where they are expected to cut interest rates further. More so given continued weakness in high frequency data and weak global economic backdrop. Wholesale price index, which was released before the CPI, came in at 0.33% y/y versus 1.08% reading in August 2019.

Source: Eikon, Emirates NBD Research

Source: Eikon, Emirates NBD Research

Fixed Income

It was a rather lackluster day of trading in fixed income space yesterday owing to public holiday in the US. Regional bonds remained largely unchanged with the YTW on the Bloomberg Barclays GCC Credit and High Yield index closing at 3.29%.

FX markets curbed their enthusiasm with Euro and Sterling both declining against the dollar as EU officials noted their was still significant work to be done to reach a deal on Brexit. GBP fell 0.3% against the USD to settle at 1.2606 while EUR fell to 1.1028. The DXY index gained 0.16%.

Developed market equities closed lower as fresh doubts emerged over the ‘Phase 1’ trade deal between the US and China. The S&P 500 index and the Euro Stoxx 50 index dropped -0.1% and -0.4% respectively.

Regional equities continued to trade mixed. The DFM index gained +0.5% on the back of continued interest in mid-cap stocks. Deyaar Development rose +14.7% on no major corporate development. Air Arabia rose +1.5% following reports that the company is looking to place new orders for aircrafts. Elsewhere, the Qatar Exchange index rose +1.2% on the back of strength in banking sector stocks ahead of corporate earnings.

Oil prices drifted lower to start the week, erasing much of the gains recorded at the end of last week. Concern over how sustainable the trade truce between the US and China will be, and whether a significant deal can be achieved, are weighing on commodities. Brent futures settled down 1.9% at USD 59.35/b while WTI closed at USD 53.59/b, down more than 2%. Both contracts are edging lower in early trading today.

Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman, speaking at a Saudi-Russia economic conference, said he expected production to level off at around 9.86m b/d in October and November while repair work will allow Aramco to reach capacity of 12m b/d by the end of November. Meanwhile, his Russian counterpart Alexander Novak told the event there was no imminent change expected in the OPEC+ production cut agreement.