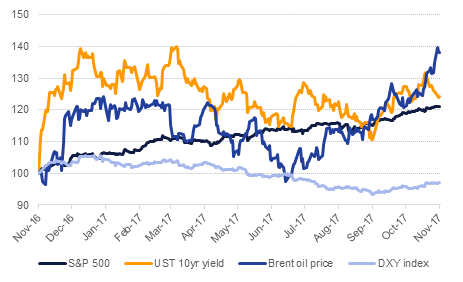

Donald Trump was elected president of the US on this day one year ago, pledging to bring a new kind of politics and management to the White House. Since his election, markets have performed well. The S&P 500 index of US equities has gained more than 21% in the past year and measurements of market volatility have plubmed to among their lowest levels in 10 years. Yields on 10yr US treasuries have gained around 45bps on the back of thee rate hikes while Brent oil has jumped more than 38%. Overall growth in the US economy also looks on a strong and sustainable footing, expanding by at least 3% y/y in both Q2 and Q3 and the US economy has added nearly 1.7m jobs in the first 10 months of Trump’s presidency.

However, trying to pin these successes directly to policies coming out of the administration is a bigger challenge. The president has yet to score a major legislative victory—whether on healthcare or immigration—and a successful change in tax policy has not been achieved yet either. Meanwhile, Turmp’s main achievements—such as pulling out of the TPP or Paris climate accord—have come on the back of executive orders despite having a strongly politically aligned Congress. A much mooted infrastructure spending plan has gone quiet and would likely face serious opposition from some Republicans.

Abroad, relationships with key trading partners have come under threat as the president has threatened to dismantle NAFTA and renegotiate trade deals with critical allies like South Korea and Japan. On the domestic front, the president remains under pressure from the ongoing Mueller investigation into Russian involvement in the 2016 campaign while Republicans have also just lost key gubernatorial elections in New Jersey and Virginia to the Democrats. Moreover, the president’s approval rating has steadily moved lower from a maximum of less than 50% and is currently worse than any president aside from Gerald Ford by this point in their presidencies. While his first year as president has been eventful and unexpected, Trump’s next year could prove even more volatile.

Source: EIKON, Emirates NBD Research

Source: EIKON, Emirates NBD Research

It was an uneventful day of trading for US Treasuries with yields across tenors remaining well within 1bps of previous day closing levels. Having said that, the long-end of the curve did outperform to take the 5s30s spread to a fresh multi-year low of 78 bps.

Regional bonds continued to remain under pressure for a second consecutive trading session as political risk within the region increased. The YTW on the Bloomberg Barclays GCC Credit and High Yield index rose 4 bps to 3.66% and credit spreads widened by another 5 bps to 164 bps.

The 5y CDS on Saudi Arabia increased for a second consecutive session to close at 100 bps. The last time CDS was trading at this level was in July 2017.

Emirates NBD raised USD 750mn in a 5y bond which was priced at MS + 125 bps, 15 bps tighter than initial pricing guidance of MS + 140 bps.

JPY trades slightly firmer in the Asia session amid concerns that US corporate tax will be delayed. As we go to print, USDJPY trades 0.18% lower at 113.80, erasing the gains realised the previous day. Analysis of the two hour candle chart shows that the current uptrend remains intact and we expect support to be found at the 200 (2h) moving average (113.58). A level which acted as support on the 30th and 31st of October.

Developed market equities closed lower amid concerns over further delay in the US tax reform. It is also likely that investors decided to take some money off the table as we head into the year-end. The S&P 500 index closed flat while the Euro Stoxx 600 index declined -0.5%.

Regional markets continued to trade lower amid widening of the corruption probe in Saudi Arabia. All major indices closed in negative territory with the DFM index losing -1.8% and the Tadawul dropping -0.7%. The KWSE index dropped -2.8% in what appears to be a move by investors to lock in their profits. The KWSE index is the only one to still remain in positive territory for the year.

Oil prices dipped, likely on the back of profit taking yesterday. Brent prices fell 0.9% and WTI gave up 0.3%. OPEC’s secretary general, Mohammad Barkindo, said the group was trying to achieve consensus on extending production cuts ahed of the November 30th meeting. OPEC’s own assessment for the next two years points to a decline in demand for OPEC barrels as alternative producers fill in the gap created by the production cut agreement.

Market structures held steady yesterday, in ranges where they have been for most of November. Even as Brent futures have pushed up to as high as USD 64/b the backwardation at the front of the curve has actually weakened somewhat while the contango in WTI has flatlined at around USD 0.22/b.