- Markets continued their ascent overnight as there were few material macro catalysts to change market sentiment. Equities across Europe and North America were up strongly, benchmark bond yields continue to rise and commodity prices are surging. Markets seem to be sending a strongly positive signal towards US President-elect Joe Biden’s picks for his cabinet, favouring a return to institutional, rather than personality based policymaking.

- Business sentiment in Germany slipped in November to 90.7 on the country’s IFO Business Climate index, down from 92.5 a month ago. The fall is generally in line with the numbers we’ve seen from Germany’s flash PMI estimates earlier in the week. Germany leadership may seek to extend lockdown measures in the run up to the holiday season, likely to dampen investor mood further.

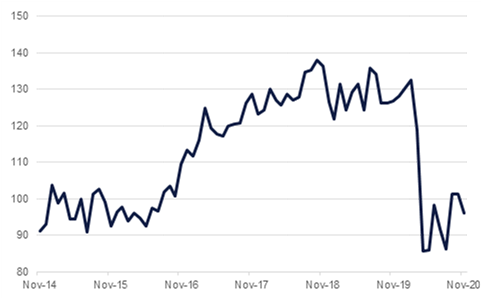

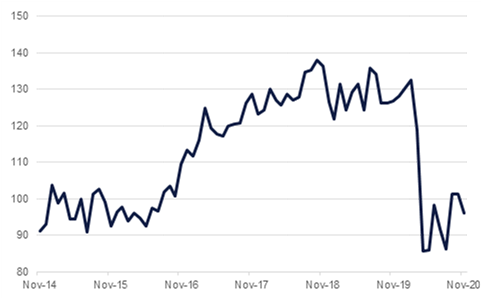

- In the US, consumer confidence, as measured by the Conference Board, slipped for November to 96.1 from over 100 a month ago. Both the future expectations and current conditions measure fell. Consumers seemingly expect the difficult economic conditions to persist, at least for the near term, even as vaccine test results have been successful.

- Moroccan central bank governor Abdelatif Jouahri has told the country’s parliament that the IMF stands ready to renegotiate the country’s precautionary liquidity line and that the decision rests with them. Morocco had held a previous USD 3bn PLL as a support and policy anchor for eight years since 2012 before being forced to call on it as it dealt with the fallout of the coronavirus pandemic this year.

- Lebanon’s progress towards an essential IMF deal, which could in turn release billions of dollars of Paris Club pledges and help the country find a way out of its current economic and financial crisis, remains slow. The country’s audit firm quit last week over a lack of access to BdL data, leading to President Michel Aoun to yesterday call for a ‘forensic audit’ of the central bank. Lawmakers are set to discuss the president’s calls on Friday.

US consumer confidence slips in November

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Fixed Income

- Yields were higher across the UST curve as the market is caught up in a risk-on, “return-to-normal” rally. Yields at the front end of the curve were little changed with the 2yr closing at 0.16% while the 10yr UST yield added almost 3bps to close out at 0.8799%. The 2s10s curve steepened to more than 70bps as markets seemingly get ahead of what may still be a tough few months for the US economy.

- Emerging market bonds are caught in the upswing although gains were reasonably modest. Yields over benchmark USTs continue to compress to just over 300bps.

- Turkey priced a USD 2.25bn 10yr bond overnight at 5.95%, tighter than initial guidance.

- Fitch affirmed Saudi Electricity’s rating at ‘A-‘with a stable outlook.

FX

- Movement amongst major currencies was relatively subdued on Tuesday, but ramped up in the late evening and this morning as US president-elect Joe Biden's transition gathers pace. The DXY index traded in a tight range and then fell by the most in almost three weeks to reach 92.090. The EUR rallied off the back of the USD's weakness and sits just above the 1.9 handle, the first time it has done so since early September.

- Commodity linked-currencies performed strongly; the AUD advanced to a high of 0.7373 this morning and has held firm at 0.7360 amid market optimism and comments from the RBA's Deputy Governor Guy Debelle who casted doubts on the impact of negative rates. The NZD reached its highest level since mid-2018 at 0.7005 and remains in a strong position at 0.6990.

Equities

- Global equity indices rose strongly yesterday, bolstered by the steps towards the US presidential transition and his cabinet picks, not least Janet Yellen as Treasury Secretary. Benchmark US indices hit new highs as the Dow Jones, which has lagged the S&P 500 and the NASDAQ this year, gained 1.5% to breach 30,000 for the first time. Meanwhile the NASDAQ added 1.3% and the S&P 500 1.6%.

- In Europe, the FTSE 100 was the primary gainer, adding 1.6%, while the CAC (1.2%) and the DAX (1.3%) also closed higher. In the region, the DFM added 1.9% and the Tadawul 0.3%.

- The momentum has continued in early trading in Asia this morning, as the Hang Seng is currently up 1.5% and the Nikkei 1.6%.

Commodities

- Oil prices were up strongly overnight with both Brent and WTI futures closing up either side of 4%. Brent is only around USD 1.50/b away from hitting USD 50/b at present while WTI is back up above USD 45/b. Both benchmarks are benefitting from the broad gain in risk assets, even if a Joe Biden presidency may be less friendly to oil producers.

- Data from the API reported a build in US crude inventories of 3.8m bbl last week along with a gain in gasoline stocks.

To watch today

- South Africa October CPI y/y – 3% estimate/3% previous

- US initial jobless claims – 730k estimate/742k previous

- US durable goods orders – 0.9% estimate/1.9% previous

- US Q3 GDP second estimate – 33.1% estimate

- US PCE deflator y/y – 1.2% estimate/1.4% previous

Click here to Download Full article

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research