Markets ended last week in better shape than they spent much of it, but the possibility of more turmoil has not gone away with both fundamental and technical forces likely to continue exerting pressure. In particular, the passage of a US budget bill through Congress at the end of last week is only likely to reinforce the bullish bias to bond yields, given the impact it will have in boosting the fiscal deficit. This may in turn extend the concern about equities even though corporate earnings appear relatively healthy. The dollar may be stronger for now as investors have pared short positions, but this cannot be counted on to last especially if the Fed begins to look behind the curve when it comes to inflation. As such the January CPI data in the coming week will be the main event risk, with the possibility of a firmer core rate keeping sentiment uncertain.

The passage of the USD300bn two-year budget deal through Congress at the end of last week not only averted another government shutdown, but it has added significantly to upside growth and inflation risks in the coming year. The stimulus is worth approximately 0.5% of GDP, on top of the tax cuts already passed at the end of last year, making it likely that growth could exceed 2.5% in 2018. The Fed has been cautious about the volatility seen in the markets, downplaying it and signaling that monetary policy tightening will only proceed gradually. Of course the markets are aware of the Fed’s record when it comes to back-stopping stocks, but in this instance with global growth more secure we doubt if the current market instability will delay a rise in interest rates in March.

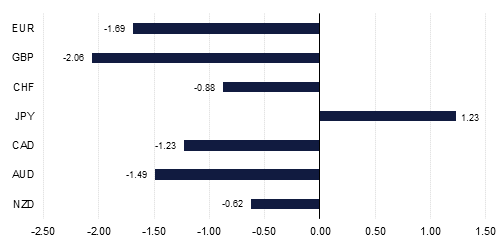

Source: Emirates NBD Research

Source: Emirates NBD Research

New Fed Chair Powell will have an opportunity to address these issues near the end of the month when he will testify to Congress. However, events may already be running ahead of him if inflation data in the coming week confirms that price pressures are finally resurfacing. Such an outcome is likely to keep bond yields headed higher, which may mean that equities will have to endure more volatility than a ‘healthy correction’ might seem to imply. The same probably applies to the dollar, with its recent gains likely to be short-lived if the markets begin to sense that bond market induced equity weakness could extend.