Markets cheered the positive outcome of Covid-19 vaccine trials along with hope that the EU will finally reach agreement on its EUR 750bn economic recovery package. While widespread deployment of a vaccine is still some ways off, the possibility that preventative measures against Covid-19 will work should help to reinforce market confidence that the current economic slump will, at some point, come to an end. Equity markets in particular were buoyed on the news while risk assets generally—such as the Aussie dollar and emerging market bonds—closed the day higher.

EU policymakers appear to have closed the gap between the ‘frugal’ nations and those in dire need of support and approved the EUR 750bn support package early on Tuesday. The EU will provide EUR 390bn in the form of grants, likely to be taken up by economies that have been hard hit by the virus, with the remainder to be in the form of low cost loans. Providing grants moves the EU further along the path toward greater fiscal integration although it won’t be without challenges. Beyond the financially strained countries in the south of the EU, Poland and several other member states in central and eastern Europe are also resisting calls for funds to be suspended if economic reform goes backward in individual countries.

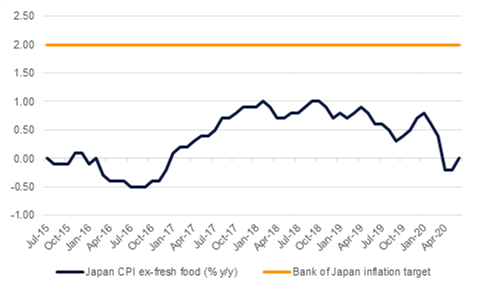

Inflation in Japan moved higher in June, rising to 0% y/y and the first non-negative print since March. The upswing in energy prices in Q2 was likely behind the move. The Bank of Japan expects that prices will decline by 0.5% on average in 2020 with the BoJ’s 2% looking increasingly like an unachievable goal. Short-term increases in prices will largely be determined by factors exogenous to Japan’s fundamentals.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasury markets appeared largely indifferent to the risk-on move in equity markets overnight with yields on the 2yr UST edging up slightly while on the 10yr yields fell more than 1bp, pushing the 2s10s curve flatter by almost 2bps. In Europe Italian bonds say the biggest move with yields on 10yr bonds falling almost 7bps and tightening their spread over bunds to 156bps as markets cheered the EU support package.

Emerging markets bonds extended gains as most countries would be major beneficiaries of a vaccine being deployed. Spreads over Treasuries still remain at around 390bps as benchmarks remain unmoved on the prospect for a potential end to the health crisis.

The dollar experienced some choppy movement on Monday. The DXY index started the session in positive fashion but failed to hold onto any momentum and has extended its losses to 95.690. USDJPY earned modest gains, increasing by just over 0.15% to trade at 107.20. The next key indicator to look out for will be the 50-day moving average of 107.48.

The euro has maintained its upwards trajectory following the dollar's weakness. The currency is currently trading at 1.1460 which is higher than the early March spike and its highest point since January 2019. The EU has managed to reach agreement on its EUR 750bn support which may provide further legs for the Euro’s rally. Sterling was the big winner for the day with the currency increasing over 0.85% to reach the 1.2675 handle. The next level to beat will be the 200-day moving average of 1.2704. Both the AUD and NZD recorded gains to trade at 0.7025 and 0.6575 respectively.

In Europe, shares were boosted by reports that the EU summit was approaching a compromise deal on its proposed EUR 750bn stimulus package. In Germany, the DAX closed up 1.0%, while Italy’s FTSE MIB gained also gained 1.0% and in France the CAC gained 0.5%. The UK by contrast saw a -0.5% drop in the FTSE 100, even despite the Oxford coronavirus vaccine triggering a safe response – although developing partner AstraZeneca did see a 1.5% gain. In the US meanwhile, the S&P 500 closed up 0.8% yesterday, and is now up on the year for the first time since February 24, currently sitting up 0.7% ytd.

Regional equities were fairly mixed, with the DFM climbing 0.2%, while the Tadawul lost -0.6%.

Oil prices advanced overnight with Brent futures adding 0.3% to close at USD 43.28/b while WTI was up 0.5% at USD 40.81/b. There have been few oil-specific fundamentals to push markets in either direction at the moment but prices will likely be caught in the broader risk up swing.

Chevron announced that it will buy independent producer Noble for USD 5bn. Aside from natural gas projects in the Eastern Mediterranean, Noble is a major producer in the Permian basin in Texas and the move represents the first major consolidation in the oil and gas industry since the Covid-19 slump began.