Markets staged a risk-on rally yesterday following the announcement by the Fed that it is promising unlimited QE in order to backstop the financial system. Optimism about Congress passing a USD 2trn stimulus package soon was also responsible, while encouragement was also drawn from hopes that Italy might be turning the corner. China will see an important milestone today as it begins relaxing restrictions on travel to and from Hubei province (the origin of the coronavirus pandemic) according to the Hubei Health Commission. The liberalization will initially apply to all areas of the province except for Wuhan, the provincial capital, where the travel ban will remain in place until April 8.

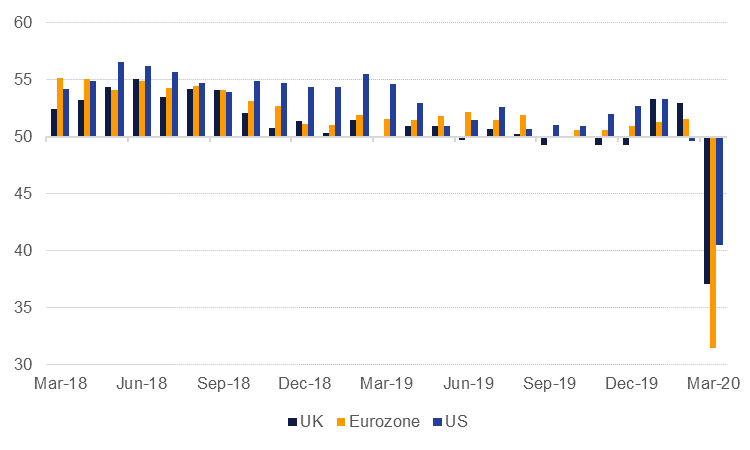

Meanwhile, however, the economic damage from the coronavirus shutdowns is only now becoming visible in Europe with PMI activity data for March recording sharp contractions. The UK's preliminary March composite PMI hit a series record low (since January 1998) of 37.1 in the headline reading, collapsing from 53.0 in February. Eurozone preliminary March PMIs also signaled a deep recession is likely already underway. The composite index fell to 31.4, down from 51.6 in the previous month, with the services index showing the sharpest drop to 28.4 from 52.6 in February. In the US the impact was only partially visible. The March services PMI dropped to 39.1 from 49.4, but the manufacturing index held up better at 49.2 down only slightly from 50.7. The Richmond Fed index actually rose to +2 in March from -2 in February, but the late impact of coronavirus in the US probably explains this and there will likely be a delayed more negative effect seen in April.

Tunisia has entered into talks with the IMF to begin a new programme as the coronavirus pandemic exacerbates longstanding economic troubles in the country. According to finance minister Nizar Yaiche, talking to Bloomberg, the new programme could run for five years, and the Fund has pledged a USD 400mn loan to help offset the economic effects of the virus. Tunisia is one of the first countries to report that it is set to receive coronavirus-specific assistance from the IMF, which last week made available USD 50bn to help poorer countries withstand its pressures - boosted by a GBP 150mn promised contribution from the UK. According to a blog entry yesterday by IMF MENA and Central Asia regional director, Jihad Azour, a dozen countries in the region have so far asked the Fund for pandemic-related help so far, with Kyrgyzstan likely to be the first recipient.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

It was another volatile session of trading for treasuries as the curve whipsawed. Overall, USTs ended lower as risk sentiment gathered pace over the course of the trading session on optimism over stimulus. Yields on the 2y UST and 10y UST ended the day at 0.37% (+6 bps) and 0.84% (+6 bps) respectively.

Regional bonds benefitted from a revival in risk-on mood but the move was rather subdued. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 2 bps to 5.00% and credit spreads tightened 10 bps to 422 bps.

In terms of rating action, Fitch revised the rating outlook of Dubai Aerospace Enterprise to negative. The rating agency also downgraded Omantel to BB. The rating outlook is negative.

The dollar weakened sharply yesterday. The "unlimited" quantitative easing package announced by the Fed has weighed on the currency, and as a result almost all of the major currencies pairs have seen some gains as risk appetite returned. EURUSD saw an uptrend for most of the day and GBPUSD made strong gains despite the plunge in UK Services PMI reaching its lowest point since the series began in 1998. After closing on Monday at 1.1542 GBP has rallied to 1.1802 currently.

Developed market equities saw a massive relief rally as investors’ were comforted by reports that the stimulus bill in the US Congress will likely get passed sooner rather than later. The steps taken by various central banks also appear to working in easing stress in liquidity. The S&P 500 index and the Euro Stoxx 600 index added +9.4% and +8.4% respectively.

Regional markets were no different. The ADX index and the Tadawul added +6.1% and +3.4% respectively. Gains were broad based amid signs of bottom fishing. Egyptian equities gave up some of their recent gains with the EGX 30 index losing -2.8%.

Oil markets firmed yesterday with Brent futures holding at around USD 27/b and WTI closing on USD 24/b. Additional stimulus from the Fed along with hope that the US Congress will pass economic support measures are helping to shore up sentiment in the oil market. However, as India becomes the last country to enforce a nation-wide shutdown the scale of demand destruction will start to become clearer.

In an unusual message, the G7 called on “oil-producing countries” to try and promote economic stability, presumably meaning to cut production and match current demand conditions. We doubt that OPEC producers or Russia will pay much heed to the G7 request at this time and the current stabilization in oil prices may just be a false dawn.

Click here to Download Full article