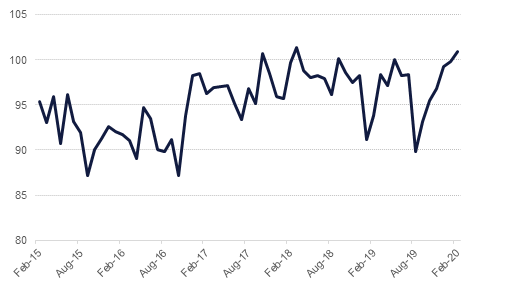

Economic data collected before the outbreak of the Covid-19 virus showed that major economies were already beginning 2020 on a soft footing. Industrial production and core retail sales in the US slipped in January. Industrial output fell 0.3% m/m, negatively impacted by warm weather and production shut-ins at Boeing. Headline retail sales rose by 0.3% m/m but underlying core retail sales—stripping out cars and building materials—were unchanged. However, the flat retail sales may be just a blip given the persistent health of the US labour market and consumer confidence which continues to remain high. The University of Michigan’s consumer confidence measure moved to 100.9 for February, a two-year high.

Meanwhile the Eurozone economy recorded negligible GDP growth in the final quarter of 2019, expanding by just 0.1%. Germany’s economy recorded no growth in Q4. The weak data puts the Eurozone economy in a weak negotiating position as it needs to counter higher tariffs imposed by the US on its aircraft industry. The US administration raised tariffs on imports of EU aircraft to 15% from 10% previously, threatening to bring the EU and US closer to a trade war. The weak economic data for the Eurozone will hamstring the ECB into keeping rates on hold with a bias towards cutting for the foreseeable future, weighing on the outlook for the Euro. Having fallen below 1.09 against the USD, the Euro is trading at its lowest level since early 2017.

A cabinet shuffle in the UK led to the resignation of Chancellor of the Exchequer Sajid Javid who will be replaced by Rishi Sunak. Javid’s resignation was reportedly over a reluctance to increase borrowing and hesitancy to increase spending. Heavy fiscal spending was meant to be a hallmark of the Boris Johnson government and markets appear to be giving Sunak a vote of confidence that he will raise spending in the next UK budget. Sterling and gilt yields moved higher in response to the news.

Japan was the latest economy to report weak data for the last quarter of 2019 with the economy shrinking by 6.3% at an annualized rate in Q4 last year. A higher sales tax rate slashed consumption growth and also led to businesses cutting investment by 14% as they wait for the tax hit to subside.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Treasuries closed lower as risk assets continued to rally. However, losses were muted as investors looked to play the impact of coronavirus on global economy through USTs. Mixed economic data also weighed on USTs. Yields on the 2y UST and 10y UST ended the week at 1.42% (+2 bps w-o-w) and 1.58% (flat w-o-w) respectively.

Regional bonds continued their rally as investors resumed their hunt for yield and pressures on emerging market assets eased. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 5 bps w-o-w to 2.93% and credit spreads tightened 5 bps w-o-w to 140 bps.

In terms of rating action, S&P downgraded the Emirate of Sharjah to BBB from BBB+ with stable outlook. The rating agency said that it anticipates the net government debt to exceed its previous expectations and reach 33% of GDP by end-2020 and expects interest expense to revenue of 11.1% in 2020.

EURUSD fell 1.05% last week to close at 1.0831, the lowest weekly close since April 2017. While the price remains below the 23.6% one-year Fibonacci retracement (1.0974), it remains vulnerable to further declines. This is reinforced by the weekly close below the 23.6% five-year Fibonacci retracement (1.0864). The 14-day RSI (Relative Strength Index) shows at 22.99 that EURUSD is oversold and therefore there may be some reprieve as sellers lock in profits.

Gains of 1.20% took GBPUSD to 1.3047 and reversing half of the losses of the previous week. This move was accompanied by several key technical developments. Firstly, analysis of the weekly candle chart shows that the price broke back above the 100-week moving average (1.2967) and even was able to close just above the 200-week moving average (1.3045). In addition to this, analysis of the daily candle chart shows that further gains were only halted by failed attempts to break the 50-day moving average (1.3071) on Thursday and Friday. It is also noteworthy that the price found support at the 100-day moving average (1.2929) during the week. While the daily close remains above this level, we expect further upside from GBPUSD and would look for a break of the 50-day moving average to trigger a rise towards the 76.4% one-year Fibonacci retracement (1.3147).

Regional equities started the week on a mixed note inline with cues from global markets over the weekend. The Qatar Exchange (-1.0%) and the KWSE PM index (-0.7%) were notable losers.

In terms of stocks, Arabtec lost -1.6% after the company reported an annual loss of AED 774mn for 2019. The company also confirmed that the CFO has resigned. The company attributed the loss to tight liquidty in the real estate and construction sector and slowing real estate sector resulting in limited new contracts among other reasons.

Oil prices managed to stage something of a recovery last week despite downgrades to demand expectations from major forecasting agencies. Brent futures gained 5.2%, snapping five consecutive weeks of decline, to close at USD 57.32/b. WTI ended the week at USD 52.05/b, up 3.4%. Commodities in general were bid higher as differing projections on the number of Covid-19 cases hit the markets. For oil, the rally largely appears to be on the back of expectation that OPEC+ will indeed take some action to stem the decline in prices.

The longer the market waits for a clear signal from OPEC+ on how it plans to deal with Covid-19’s impact on demand, the greater the risk oil could slip again. While there are signs the pace of the outbreak is slowing and some Chinese refineries have reportedly been bargain hunting given the drop in prices, a forceful message from OPEC+ would help to stabilize a floor under oil prices. Meanwhile, Saudi Arabia and Kuwait plan to restart production at the neutral zone where fields with as much as 500k b/d of capacity are set to come back into production.