Market focus will squarely be on Chair Janet Yellen’s press conference after the FOMC meeting today which is widely expected to deliver a 25bps rate hike. On the data front, the Producer Price Index in the US yesterday increased 3.1% in November which augurs well for higher consumer inflation in the coming months. On the political front, Democrat Doug Jones, defeated the Republican candidate, Roy Moore, in Alabama’s senate race. Alabama voted overwhelmingly for President Donald Trump last year and Jones’s victory cuts the GOP’s already narrow Senate advantage to 51-49, which will make it harder for the party to enact its agenda.

UK inflation accelerated modestly to 3.1% in November, from 3.0% in October and September, marking the highest rate since March 2012. The acceleration in inflation was driven by higher air fares and more expensive computer games. As the print was more than one percentage point off the target rate of 2%, the Bank of England governor, Mark Carney, is now obliged to write to the Chancellor of the Exchequer laying out how he intends to bring inflation back into line, but having raised rates by 25 basis points in November, we do not expect another hike in the near term.

The ZEW Economic Sentiment Indicators for Germany and the Eurozone both slowed in December. Political uncertainties remain paramount, with Germany still without a government nearly three months after September 24 elections, and Brexit concerns likely weighing on sentiment in the wider bloc. That said, December’s dip in German ZEW investor sentiment from +18.7 to +17.4, leaves the index still at nearly its highest level since 2011 and suggests that investors do not see political uncertainty as a major threat to the economic outlook.

India’s CPI for November 2017 came in at 4.88% compared to 3.58% in October. The sharp rise was mainly on account of 4.4% surge in food inflation. Core inflation also ticked up by 30 bps to 4.77%. With inflation data coming in higher than the Reserve Bank of India’s revised range of 4.3% to 4.7%, it is apparent that the room for any further easing in monetary policy in the current fiscal FY 2018 has closed completely.

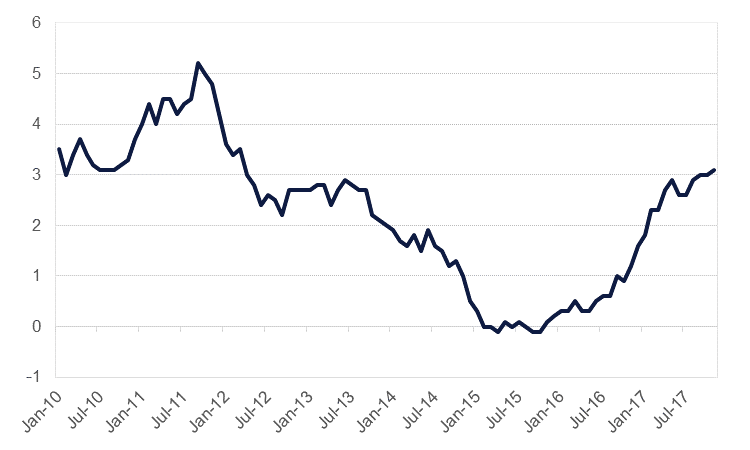

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Higher than expected PPI data and progress on tax reform bill supported the marginal increase in US Treasuries yield with 2yr and 10yr closing circa a bp higher each at 1.83% and 2.40% respectively. 10yr Gilt yields rose 2bps to 1.22% as headline CPI at 3.1% came in higher than expectations.

Credit spreads were little changed and CDS levels on US IG and Euro Main closed range bound at 51bps and 48bps respectively.

Locally, GCC bonds had muted day of trading with minimal price action. Average yield on Barclays GCC index closed a bp higher at 3.56% while credit spreads were unchanged at 131bps.

Dollar strengthened overnight, however has weakened this morning after the outcome of the senate election in the state of Alabama in the US where Democrat candidate defeated his Republican counterpart.

JPY rose against the dollar to 113.27 and the AUD gained 0.1% to 75.68 against the USD. Euro was largely steady at 1.1758 while sterling was boosted up after higher than expected inflation data in the UK was released. GBPUSD is trailing at 1.3323.

The sustained rise in oil prices seem to be finally having some positive impact on regional equity markets. Most indices in the region closed higher with the Tadawul adding +0.3%. Much of the gain on the Tadawul came from rally in petrochemical stocks. Saudi Kayan and PetroRabigh added +3.7% and +3.0% respectively.

After the market closed, Emaar Properties announced that it will pay c. AED 0.55 per share as special dividend to its shareholders in two tranches. This translates into a total payout of AED 4.0bn, lower than AED 4.8bn which the company raised by selling 20% stake in the development business. This is also much lower than what investors were pricing in the stock price. The stock was suspended yesterday and will resume trading today. Additionally, Adnoc also starts trading today.

Oil futures fell overnight, giving up more than they gained on Monday. Brent futures lost more than 2% to close at USD 63.34/b while WTI was off more than USD 1/b to end at USD 57.14/b. Profit taking was a likely culprit for the drop in oil prices but the EIA also revised higher their expectations for US oil production in 2018, expecting growth of 780k b/d to take output to over 10m b/d, a new record high. Data out from the API showed a decrease in crude stocks and builds in products. If confirmed later by the official EIA figures it will again raise doubts about the viability of demand in the US.

The whipsawing in prices this week has pushed volatility in both Brent and WTI higher, snapping the persistent downward trend that was in place since Q2 2017. With the major price catalyst—the OPEC deal extension—out of the way, we would expect to see prices moving in an exaggerated fashion on what would otherwise be standard news flow.

Click here to download the publication