Saudi Arabia kicked off its 2026 borrowing with a USD 11.5bn issuance in four tranches. The deal was comparable to how the sovereign started 2025 with a USD 12bn three-tranche issue in January 2025.

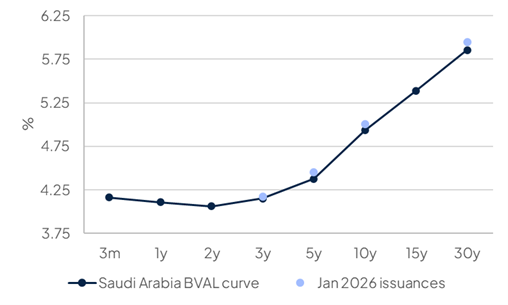

Pricing for tranches was as follows:

Source: Bloomberg, Emirates NBD Research.

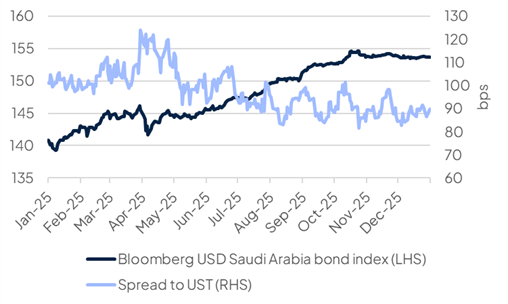

Source: Bloomberg, Emirates NBD Research.

Total books for the new Saudi issuances were more than USD 28.2bn, showing that there is still strong overall demand for Saudi government bonds. The bid coverage ratio for the January 2026 issues at 2.45x was comparable with the coverage in January 2025 at 2.54x.

The new issuances were priced above the pre-existing Saudi curve, providing some room for investors if spreads converge on the existing curve.

Saudi Arabia is rated at ‘Aa3’ by Moody’s and ‘A+’ by Fitch with stable outlooks from both.

Saudi Arabia confirmed its 2026 borrowing plans earlier this week, expecting between USD 14-18bn to come via international bond markets. If confirmed, the January issuance would represent about 70% of the total international bond issuances expected in 2026. In 2025, the sovereign followed up its January issuance with two additional bonds (including a EUR 1.5bn green bond) and two USD sukuk.

For 2026 the government plans to make more use of private credit offerings, with about 50% of its total borrowing needs to come via private channels.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research