Global growth concerns have deepened over the last month, such that more central banks have turned dovish including the Federal Reserve. This not only has implications for the U.S. economy but also for the GCC which will no longer face the possible headwind of further rate hikes this year. To the extent that this also contributes to softening the dollar it will also be helpful.

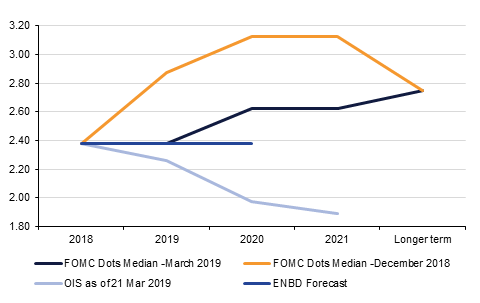

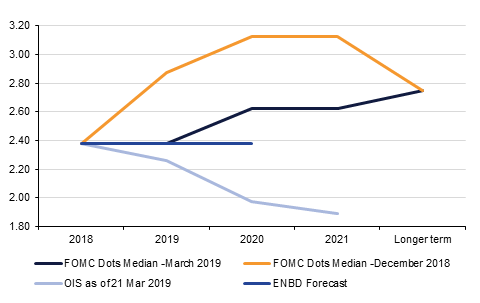

- Global macro: The main development of the last month was the March FOMC meeting where the Federal Reserve turned dovish, downgrading its rate hike forecasts from two to zero in 2019. We have also adjusted our own forecasts to reflect no further U.S. interest rate hikes this year.

- GCC: Slower growth in tourist numbers in 2018 likely reflects the dirham’s appreciation against key EM currencies. An increased supply of hotel rooms is weighing on revenues.

- MENA macro: We have made a modest upgrade to our real GDP growth forecast for Jordan in 2019 on the back of a successful investor conference held in the UK in February.

- Currencies: The dollar retreats in the aftermarth of the Federal Reserve shifting from a tightening bias to a neutral stance.

- Equities: As we approach the end of first quarter of 2019, global equities are on the verge of having their best quarter since mid-2010. This is in stark contrast to investor expectation at the start of 2019. At the moment, it appears that most headwinds at the beginning of the year have actually become tailwinds.

- Commodities: Political risk affects around 40% of OPEC’s production capacity as sanctions, militant activity or untested political change hits several members. The uncertain outlook for production will help to keep a bid under oil prices even if output is in no serious risk of being disrupted.

A more benign interest rate outlook from the Fed

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

Click here to Download Full article

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research