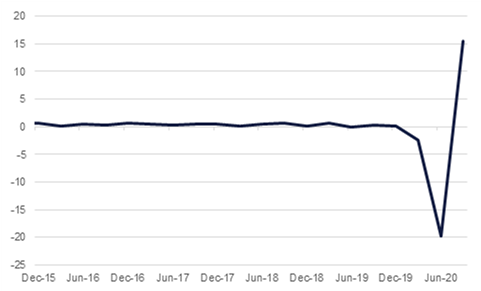

Japanese GDP growth hit an annualised rate of 21.4% y/y in Q3 in data released early this morning, the fastest growth since 1968. The rebound followed a -28.8% contraction in Q2, and exceeded expectations of an 18.9% expansion. On a m/m basis, growth was 5.0%. The recovery was driven by a rise in exports and consumption, bolstered by massive government stimulus. However, with the stimulus fading and a resurgence in Covid-19 cases in some areas, potentially as a result of the government’s drive to boost domestic tourism, a slowdown in the final quarter of the year seems all but certain.

UK GDP rebounded in Q3, expanding by 15.5% q/q, compared to the -19.8% contraction recorded in the second quarter. This was modestly weaker than consensus estimates of 15.8% growth. In y/y terms, the economy was -9.6% smaller than it was in Q3 2019. While the headline figure was encouraging, the fact that September growth slowed to just 1.1% m/m, compared to 2.2% in August and 6.3% in July, shows that the recovery was weakening sharply even before the latest lockdown was imposed. Given current restrictions, it seems likely that the UK economy will contract once again in the fourth quarter. Meanwhile in the Eurozone, the Q3 growth figure was revised down to 12.6% q/q, from the previous estimate of 12.7%. This remains by far the strongest growth recorded, but as with the UK, the fourth quarter will likely see another contraction given pandemic-related pressures.

In the US, initial jobless claims declined last week, coming in at 709,000, down from 757,000 the previous week. This was the biggest fall in five weeks and was lower than expectations of 731,000. However, while new claims are at the lowest level since March, the numbers are still far higher than seen prior to the pandemic, and the rapid rise in Covid-19 cases in the US in recent weeks could jeopardise this downward trend through the remainder of the year. The weak labour market is keeping US inflation muted, as annualised price growth dipped to 1.2% in October, down from 1.4% in September, and missing consensus projections of 1.3%. On a m/m basis, price growth was flat at 0.0%. Meanwhile, the University of Michigan’s consumer sentiment index dipped unexpectedly, falling from 81.8 to a three-month low of 77, and missing expectations of 82. The survey results were at least in part politically driven, with Republicans in particular seeing a worse outlook for the economy following the November 3 elections and Democrat Joe Biden’s victory in the presidential ballot.

The Central Bank of Egypt cut its overnight deposit rate by 50bps on Thursday, citing ‘muted inflationary pressures.’ This takes the benchmark interest rate to 8.25%, levels last seen in 2014.

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US treasuries fell last week as market optimism surged on the back of positive vaccine results reported from Pfizer along with expectations that other pharmaceutical companies were nearing in on vaccines for Covid-19. Yields gained across the curve with the 2yr UST closing the week at 0.179%, up almost 3bps over the week, and the 10yr yield gaining almost 8bps to settle just shy of 0.9%. In the wake of the US election the chance of additional support spending from the US government look slim, particularly as the Trump administration has passed the responsibility of negotiating on to Senate Republicans who appear far more obstinate in their approach to spending.

Bond markets in Europe also were weaker in line with the move to risk assets with 10yr gilts and bunds falling in line with their US counterparts. Emerging market bonds (USD-denominated) managed to gain in line with a more optimistic attitude toward risk even as doubts creep in about the sustainability of the recent pop in oil prices.

S&P affirmed its sovereign rating on Israel at ‘AA-’ and has the rating on a stable outlook.

At the start of last week the USD surged off the back of optimism surrounding a Covid-19 vaccine, but this optimism would slowly fade as the days went on. The DXY index, a measure of the dollar against a basket of major currencies, advanced from lows of 92.130 to highs of 93.208, before closing at 92.721. USDJPY experienced similar movement, reaching a multi-week high of 105.68, marking a break above the 50-day moving average of 105.20, before settling at 104.63.

The EUR rallied to its highest point since September at 1.1920 but broad-based USD strength as well as a marginal downgrade to Q3 Eurozone GDP growth weighed on the currency, finishing at 1.1834. Similarly the GBP reached its highest level since September as well at 1.3310 but fluctuated heavily amid ongoing Brexit and Covid-19 developments. Sterling closed at 1.3189, marking a slight increase on the prior week's closing price. The AUD and NZD also recorded volatile movement, with the former ending the week with minimal gains at 0.7271, whilst the latter retreated from its highest point since 2019 at 0.6915 to close at 0.6848.

The positive news from Pfizer and BioNTech last week saw equity markets around the world move significantly higher over the period despite ongoing lockdowns, with the FTSE 100 recording its best week since April. The UK benchmark closed up 6.9% w/w, even as a stronger pound saw the index lost 0.4% on Friday. The CAC has seen even stronger gains at 8.5% w/w, while the DAC gained 4.8%.

The outcome was a little more nuanced in the US, where the tech-heavy NASDAQ lost -0.6% over the week, while the Dow Jones and the S&P 500 rose 4.1% and 2.2% respectively. The NASDAQ remains the outperformer over the year however, up 31.8% ytd to the S&P’s 11.0% and the Dow’s 3.3%.

Regional equities have also soared over the week, as the DFM gained 4.0% and the Tadawul 4.3%. In Asia, most equity indices also rose, except for the Shanghai Composite which lost 0.1% w/w, weighed down by pressure on tech stocks related to Chinese government antitrust measures.

Oil prices rallied last week on the back of the positive vaccine test results from Pfizer as well as growing expectation that OPEC+ will endorse an extension of its current level of production cuts from the start of 2021. Brent futures rallied 8.4% to settle at USD 42.78/b, despite declining the final two days of the week, while WTI closed at USD 40.13/b, a weekly gain of more than 8% albeit with a few days of losses at the end of the week.

OPEC+ holds its joint ministerial monitoring committee this week with anticipation that the focus will be on how to respond to the hit to demand caused by resumption of lockdowns in major European economies along with the rapid rise in Libyan production.