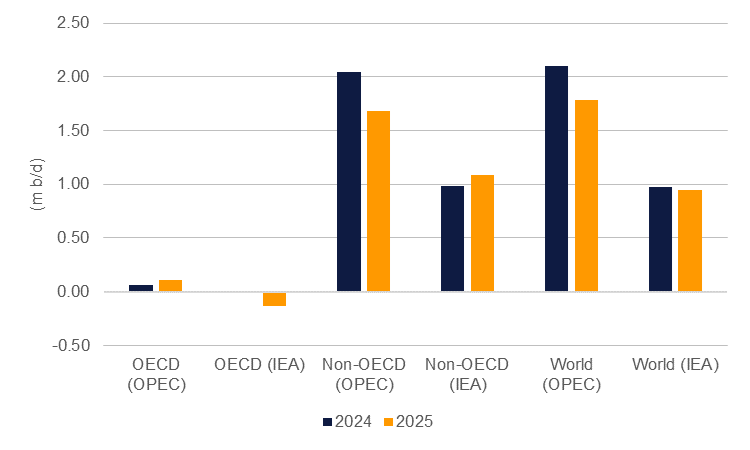

The IEA and OPEC have both published this week their latest monthly oil market reports and remain far apart in their expectations for demand growth this year. The IEA left its demand growth estimate for 2024 unchanged at 0.97m b/d though adjusted the trajectory slightly, raising their Q2 estimate on the back of higher US oil demand and cutting their Q4 estimate. For OPEC, the alliance of exporters shaved its demand growth estimate for 2024 slightly lower, by about 130k b/d for the annual number with all quarters showing a slight downward revision. Nevertheless, OPEC still expects a strong level of 2.1m b/d of global oil demand growth in 2024.

Source: OPEC, IEA.

Source: OPEC, IEA.

Both forecasting agencies expect a slowdown in consumption next year though again the gap between them is wide. The IEA projects demand growth of 0.95m b/d with all the growth coming from developing economies as OECD consumption is set for a relatively steep drop of 140k b/d. For OPEC, demand growth is set to cool to 1.8m b/d, slightly lower than their previous estimate, with emerging economies again accounting for most of the demand.

OPEC+ countries are due to add barrels back to oil markets starting from Q4 as production cuts are unwound. At the August session of the OPEC+ joint ministerial monitoring committee, OPEC+ noted that the phase-out of production cuts “could be paused or reversed, depending on prevailing market conditions.” Demand is forecast to accelerate in Q4 based either on forecasts from the IEA or OPEC, giving OPEC+ countries room to increase production. But that improvement stands at contrast with broader macro themes—cooling inflation, slowing jobs growth, interest rate cuts—which suggest economic growth is adjusting to a lower pace and hence oil demand should trend lower as well. The adjustment this month in market pricing for interest rates from the US, for instance, with 100bps of cuts priced in before the end of this year compared with less than 75bps at the end of July, has caught oil and other commodities up as well.

Oil markets will be highly sensitive to broader macro data points—inflation and rates—in the coming months while also still keeping a close eye to geopolitical risks in the Middle East. Those forces to us will push against each other and suggest prices will hold around their current range in the low USD 80/b with occasional swings on either side.