Inflation in the UK sank in April as the drop in energy prices helped push headline CPI down to 0.8% from 1.5% a month earlier. Core inflation also slipped, declining to 1.4% in April from 1.6% a month earlier. Following on from statements from the Bank of England’s chief economist in the last week that negative rates weren’t off the table, the soft inflation data will likely push the market to price in more BoE easing in the short-term. The UK is the latest major economy to report disinflationary—or outright deflationary—effects from the coronavirus as demand collapses as consumers stay home and investment has come to a halt. Relative to other major economies the UK’s latest inflation read shows less of a decelerating trend—compared with the US where CPI fell to 0.3% m/m in April. However, the coronavirus pandemic has catalyzed a build-up of unused capital—whether human or industrial goods—that will weigh on the inflation outlook globally for some time.

Saudi Arabia also reported inflation data with CPI falling month on month to just 1.3% on an annual basis. Greater than 1% inflation is a vast improvement on the persistent deflation that impacted Saudi Arabia for 2019 but like other major economies the absence of consumer demand will put downward pressure on prices. In particular, Saudi public sector workers won’t receive a cost of living allowance from June which may further depress consumption.

Hotel occupancy in Dubai fell to just 23.6% in April as the UAE was closed to visitors. Average occupancy from January to April stood at 57% compared with 82.9% in the same period last year, according to data from STR Global. The supply of hotel rooms in Dubai fell by more than 14% y/y in April, as operators closed some hotels to reduce operating costs. Abu Dhabi’s hotel occupancy stood at 48.6% last month, most likely due the use of hotels as quarantine facilities by the authorities. According to STR Global, average hotel occupancy globally was around 20% in April.

The IMF has approved a USD 396mn Rapid Financing Instrument (RFI) low interest loan to Jordan, to help the country weather the coronavirus storm and its related drop in government revenues. This is in addition to the new USD 1.3bn, 48-month Extended Fund Facility (EFF) signed off in March, which will focus on ongoing structural reforms. RFIs are designed to help IMF member countries with urgent balance of payments requirements, and have been in heavy demand in recent weeks as the pandemic crisis has taken its toll, with requests for RFI assistance from all over the developing world from Jamaica to Nigeria to Kyrgyzstan. Within the region, Egypt was granted an RFI last week, and will likely also enter into a new EFF soon.

Another regional market in early discussions with the IMF is Lebanon, but this will likely be a politically fraught process as the government looks to walk its tight rope between initiating vital reforms and protecting vested interests. One of the key sources of contention in Lebanon has been the loss-making parastatal power firm EDL, which has been a massive drag on the fiscal balance for years but has so far resisted any comprehensive overhaul. Now Lebanese energy minister Raymon Ghajar has told Reuters that they plan to sign memoranda of understanding with major international energy firms to develop new power plants, potentially funded by export credit agencies.

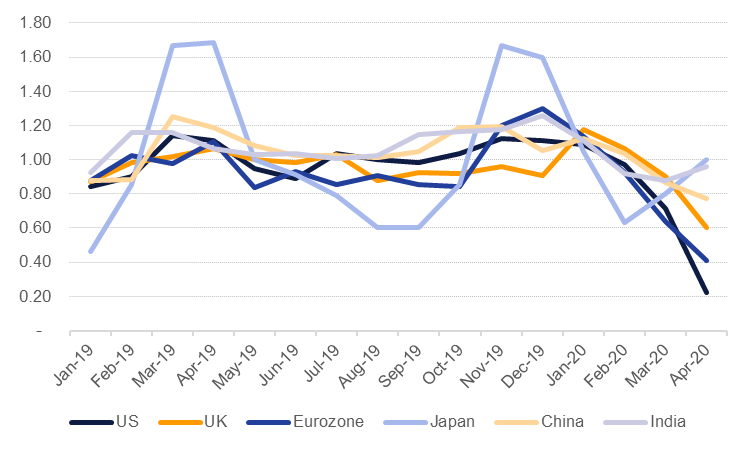

Source: Bloomberg, Emirates NBD Research. Note: India April is consensus estimate

Source: Bloomberg, Emirates NBD Research. Note: India April is consensus estimate

Treasuries traded in a tight range amid a rebound in risk assets and as investors absorbed minutes from the last Fed meeting. Yields on the 2y UST and 10y UST remained flat at 0.16% and 0.68% respectively.

Beyond the Federal Reserve’s concern over economic impact of the viral outbreak, the minutes showed interesting discussions about future guidance. Members discussed clarifying guidance via date or outcome based thresholds. There was also discussion on QE guidance both in general terms as well as a specific yield curve control of capping yields for short and intermediate term. A lot more clarity could emerge following the central bank’s next meeting in June.

Regional bonds continue to benefit from renewed appetite for some emerging market assets as search for yield resumes. The YTW on Bloomberg Barclays GCC Credit and High Yield index dropped 9 bps to 3.51% and credit spreads tightened 7 bps to 287 bps.

Fitch affirmed Commercial Bank of Dubai’s rating at A- with stable outlook.

The dollar continued to struggle on Wednesday with its DXY index falling to 99.160, marking a decrease of over 1.20% since the start of the week. However, it has made a slight recovery this morning to trade at 99.340. A retest of the 100-day moving average (98.906) cannot be ruled out and will likely come into focus in the coming days. The JPY was largely unchanged, recording modest gains to reach 107.65.

The euro advanced for a fourth day against the dollar, increasing beyond the 100-day moving average (1.0970) and briefly looked to break through the 1.1000 mark but met resistance at this level. The currency is currently trading at 1.0960. Sterling is trading at 1.2200 after Bank of England Governor Andrew Bailey stated that negative rates were "under active review". The AUD continued its bullish form yesterday but has reversed a lot of its gains this morning to hover around 0.6560, whilst the NZD experienced similar movement but not quite as dramatic to trade at 0.6125.

Turkey and Qatar have tripled the scope of their FX swap arrangement from USD 5bn to USD 15n, potentially shoring up Turkey's reserves by USD 10bn and contributing to the lira's strengthening ahead of today's central bank policy decision. After being left out of the US's extended swap arrangements last month, Turkey has been desperate to find alternative partners, with Japan and the UK touted as potential candidates earlier this week. While the Qatar extension is the only new swap measure confirmed so far, the lira has strengthened in recent days on the back of this and state-driven liquidity restrictions which have been aimed at countering what the government sees as speculative attacks on the currency. The lira has retrenched markedly from the record low of TRY 7.20/USD recorded on May 7, and is now back at TRY 6.79/USD, levels last seen at the start of April. Given this, the likelihood is that the TCMB will implement its ninth consecutive cut to its one-week repo rate later today.

Developed market equities closed higher as they continued to trade based on daily assessment of coronavirus and resulting measures impact on broader economy. At the moment, tensions between the US and China and indications of a prolonged downturn in economic activity appears to have limited impact on markets. The S&P 500 index and the Euro Stoxx 600 index added +1.7% and +1.0% respectively.

Regional markets closed mixed as investors paused to assess the recent rally. The Qatar Exchange added +0.6% while the DFM index and the Tadawul closed marginally higher. Egyptian equities closed sharply lower as the country tightened restrictions to combat coronavirus. The EGX 30 index fell -1.5%. Elsewhere, Aldar Properties reported a 46% y/y decline in Q1 2020 net profit to AED 300mn.

Both WTI and Brent rose more than 3% overnight to settle at USD 33.49/b and USD 35.75/b respectively. WTI has gained five days in a row—its longest stretch since February—is also moving higher in early trade this morning.

Crude inventorie in the US fell by almost 5m bbl last week, their second week in a row of draws. Inventories at Cushing were down 5.6m bbl, allaying fears that storage would be hitting tank tops soon and helping to keep front month spreads relatively narrow. Digging deeper into the stock numbers, however, showed builds in gasoline and distillates with total petroleum inventories up 5m bbl. Production slipped another 100k b/d to 11.5m b/d while product supplied—a demand proxy—fell by 228k b/d.