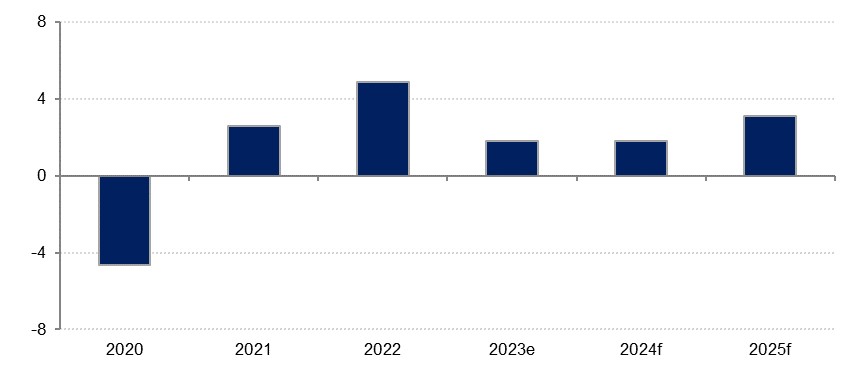

We forecast real GDP growth of 0.7% in Kuwait in 2024, which would mark an improvement on the estimated 0.4% contraction last year (one of two GCC states which is likely to have seen its economy shrink in 2023, along with Saudi Arabia) but remains far off the 6.1% recorded in 2022. While diversification efforts have seen the proportion of the hydrocarbon economy in the rest of the GCC decline in recent decades, in Kuwait it still accounts for over half of GDP. As such, the constrained outlook for oil production in the bloc this year will weigh heavier in Kuwait than in some of the other economies where diversification efforts have been more gainful. In 2025, we forecast that Kuwait’s growth will accelerate to 2.2%.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Oil production curbs will weigh on growth and budget

Amid ongoing OPEC+ production curbs, Kuwait’s oil output declined 3.7% last year according to Bloomberg estimates, averaging 2.7mn b/d. On the back of this we estimate a 3.0% contraction in oil GDP last year, compared with a 12.1% expansion in 2022 as production was ramped up coming out of the pandemic. The first quarter last year saw 2.5% y/y growth in the oil sector, but this turned negative at -3.9% in Q2, and we expect that it will have continued to decline through the second half of the year.

The year ahead is not especially brighter for growth in the oil sector, with OPEC+ recommitting in recent months to its strategy of curbing production to try and put a floor under prices, and Kuwait amongst the several members which has said it will extend its voluntary cuts through into Q1. There is a further 135,000 b/d set to be taken out which would see production average 2.41mn b/d through the first quarter with a potential pick up thereafter. With this in mind, we forecast a 1.0% contraction in oil GDP this year, although the completion of the final phase of the Al Zour refinery at the close of 2023 offers some upside risk to this outlook.

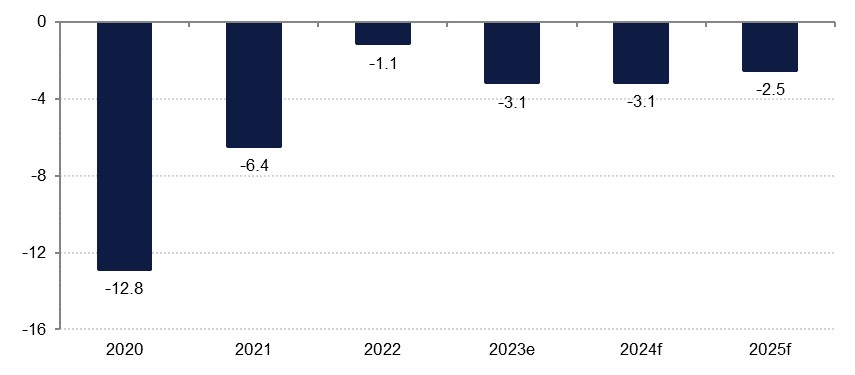

The further decline in oil output has implications for the budget as well, and we forecast a deficit equivalent to -1.0% of GDP in 2024/25 (ending March 2025), following a projected -1.4% in the current 2023/24. Kuwait ran its first budget surplus in eight years in 2022/23 as higher production and prices combined to generate a surplus of 11.5% of GDP, but a decline in oil revenue and prices while expenditure has been maintained has seen this reversed. We forecast that Brent crude will average USD USD 82.5/b in 2024, little changed from the USD 82.2/b averaged last year but still substantially lower than 2022’s USD 99.0/b. Further, the investment ambitions of Kuwait Petroleum Corporation over its five-year plan aimed at boosting production capacity mean that the state oil firm is unlikely to distribute its annual dividends to the state budget over the duration of the plan.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

Nevertheless, the bumper windfall seen in 2022/23 means that pressure on Kuwait government finances have eased somewhat, which will potentially push back any efforts at diversifying the revenue base. The protracted journey of the debt law (which would enable Kuwait to tap international markets when the budget is in deficit) through parliament which began in 2017 has yet to conclude, with finance minister Fahad al-Jarallah saying in September that it was not a priority. He also pushed back against reports that the introduction of VAT was being considered, with Kuwait one of two GCC states (along with Qatar) yet to implement the sales tax.

Non-oil sector will fuel growth

Lower oil revenues and a failure to diversify government income or enable borrowing will also potentially weigh on the non-oil sector, with government spending and investment likely to come in under projections, slowing growth both in the near-term but also over a longer horizon as diversification efforts take longer to bear fruit. Bureaucratic hurdles have also slowed progress: according to press reports citing a Kuwaiti government issuance, only around 10% of the funds allocated in the budget to public projects were spent in the first half of the present fiscal year, and only five out of 130 approved projects were completed in the period.

Political deadlock between parliament and the government has been a key factor in the lack of progress on reform and economic diversification in recent years. However, the new Emir’s appointment of Dr Mohammed Sabah al Salem as prime minister may usher in a period of greater cooperation and progress on economic policy and reform.

Private sector investment also appears to have lagged amid a higher interest rate environment, with credit growth to industry down -4.8% y/y in November. On the consumption side, spending has likely continued to be constrained by price growth which has been at elevated levels compared with the long-run average. CPI inflation averaged 3.6% in 2023, down from 4.0% in 2022 but still around double the five-year pre-pandemic average of 1.7%. Higher interest rates will also have constrained activity here, and the real estate sector has been slower. Consumer loans were up just 0.4% y/y in November and while GDP data shows a robust expansion in restaurants and hotels in H1 last year, averaging 12.7% over Q1 and Q2, this reflected base effects from pandemic restrictions still in place at the start of 2022. Wholesale and retail trade performed far weaker, contracting 1.2% y/y in Q2 2023. Our estimate for non-oil growth in 2023 is 2.0%, compared with 0.8% in 2022.

This year we anticipate stable non-oil GDP growth at 2.0%. Some of the challenges of the past several years remain in play, with interest rates likely to remain around present levels through the first half of the year and come off gradually thereafter, even if any further hikes are unlikely. Inflation will slow to an average 2.5% according to our forecasts but there remain upside risks given ongoing geopolitical uncertainty and its potential to disrupt markets.