Situated in the Arabian Peninsula, the State of Kuwait, is a small and relatively open economy with proven crude oil reserves. As at 2017, it had population of circa 4 million and estimated GDP of $120 billion. Petroleum accounts for circa 57% of GDP and over 90% of government revenues.

Kuwait is rated AA/stable, Aa2/stable and AA/stable by S&P, Moody’s and Fitch respectively.

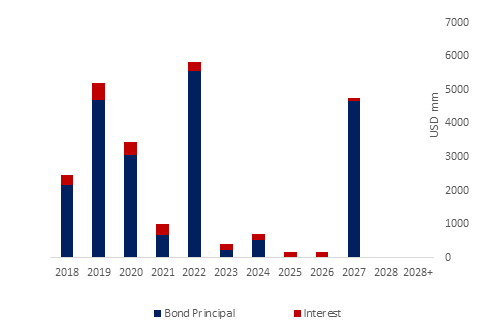

Kuwait’s government debt stands at US $24.12 billion comprising of USD and local currency bonds. One key difference between Kuwait and other GCC sovereigns is that Kuwait has majority of its debt in the domestic local currency market instead of in hard currencies in international markets.

Kuwait plans to tap international markets again this year after seeking parliament approval to raise debt ceiling to KWD 25 billion from KWD 10 billion and to increase bonds/ sukuk tenure from 10yr to 30yr.

One of the strongest factor supporting Kuwait’s credit rating is the large size of FX assets at Kuwait Investment Authority, KIA, of over $580 billion as at Dec 2017. Kuwait ranks the highest among all the sovereigns rated by S&P Global Ratings in terms of net general government assets. Though low oil prices caused the central government’s budget to run in deficit, substantial investment income on KIA assets meant that overall government budgets have remained mostly in the green even during the times of low oil prices.

Click here to Download Full article