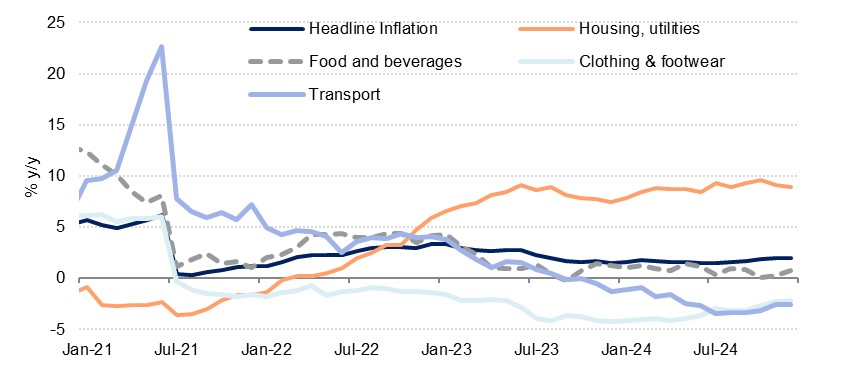

Headline CPI inflation in Saudi Arabia slowed marginally in December, coming in at 1.9% y/y, down from 2.0% the previous month. This was the first time inflation had slowed since June. For 2024 as a whole, annual price growth averaged 1.7%, down from an average 2.3% in 2023 and marking the slowest average pace since 2019 as the post-pandemic surge in price growth seen around the world has dissipated. We forecast a modest acceleration to an average 2.0% in 2025, predicated on an expectation of strong demand, especially in the housing component of the CPI basket. However, a strong dollar, ongoing discounting by businesses, and lower global oil prices should all continue to balance against these housing pressures.

Source: Haver Analytics, Emirates NBD Research

Source: Haver Analytics, Emirates NBD Research

As was the case throughout the year, housing, water, electricity remained the key driver of price growth in December as prices rose 8.9% y/y, although this was down from 9.1% in November and was the slowest pace since August, contributing to the slowdown in headline inflation. Rapid population growth (especially in Riyadh), demographic changes, and a quickening urbanisation trend have driven demand for new housing and rents rose by 10.6% y/y in December. The likelihood is that price pressures from housing will continue to determine the headline inflation rate in 2025 as while there are significant government targets around boosting supply, this will likely take some time to make a meaningful impact.

Elsewhere there was an acceleration in food & beverages inflation which rose 0.8% y/y, up from 0.3% the previous month. Education was up 1.1% y/y, unchanged from the previous two months, while restaurants & hotels saw inflation of 0.9% y/y, down from 1.5% previously. The other components of the basket all showed some modest deflation, as was the trend throughout the year. Clothing & footwear prices were down 2.2% y/y in December, while transport costs were down 2.5%.

Source: Riyad Bank, Emirates NBD Research

Source: Riyad Bank, Emirates NBD Research

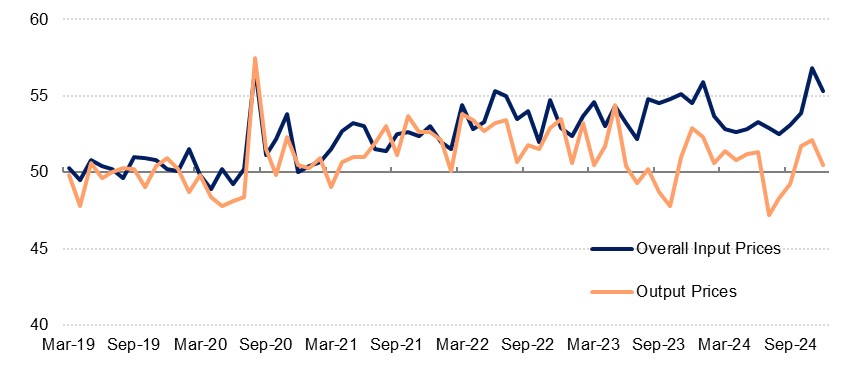

An upside risk to our inflation forecast for 2025 would stem from businesses passing on their higher input prices to consumers more meaningfully than they did through 2024. According to the Riyad Bank PMI survey, firms outright discounted their sales prices in three months last year, while their price hikes in the others were fairly mild even as their input prices rose at a sharper rate. However, with some of the pressures around firms’ costs likely to be softer in 2025 as interest rates fall and Suez Canal shipping disruptions diminish, they should still able to position themselves competitively.