Saudi Arabia’s central bank surprised the market by raising its benchmark repo and reverse repo rates by 25bp on Thursday evening, nearly a week before the Fed is expected to hike by 25bp (0.25%). Saudi interbank rates have fallen below their USD equivalent in recent weeks as USD LIBOR has increased, while there is substantial liquidity in the Saudi banking system. While the 3m SAIBOR remains lower than 3m USD LIBOR after the rate hike, the difference has narrowed. It remains to be seen whether SAMA will hike by another 25bp this week after the Fed’s expected move, although we think this unlikely.

Jerome Powell's first FOMC meeting as Fed Chair will clearly be the main focus in the coming week with unanimous expectations of a 25bps rate hike on Wednesday, raising the Fed funds band to 1.50-1.75%. The most important part of the Fed’s decision will probably be the FOMC's ‘dot plot’ projections along with the forecasts for growth, unemployment, and inflation. Powell and some other Committee members have indicated that they already boosted their own economic outlooks due to the recent fiscal stimulus measures, but these have not been recognized in official forecasts, and it is not clear if it means the dot will be increased from three to four hikes this year. Data is relatively light this week and most of the crucial reports for the month are out of the way. However, other central banks will also meet in the coming week, notably in the UK and also some in Asia.

Japanese trade data in February has showed exports climbing by 1.8% y/y while imports grew by 16.5%, leaving a trade surplus of JPY3.4bn in the month up from a deficit of JPY943bn in January. Interestingly Japanese exports to the US saw the biggest increase growing by 4.3% perhaps adding to concerns about possible US tariffs.

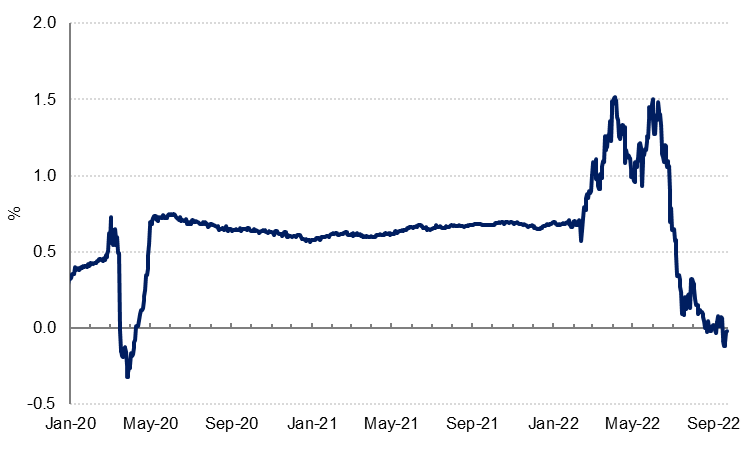

Source: Bloomberg, Emirates NBD Research

Source: Bloomberg, Emirates NBD Research

US treasuries ended the week mixed with the curve flattening following a rather subdued inflation print in the US and as investors’ await the outcome of the Federal Reserve meeting. While a 25 bps rate hike is widely anticipated, the focus will be on median projections for 2018 and 2019. Yields on the 2y UST, 5y UST and 10y UST ended the week at 2.29% (+4 bps 5d), 2.64% (-1 bp 5d) and 2.84% (-5 bps 5d).

In a much anticipated move, Moody’s cut Oman’s rating by one notch from Baa2 to Baa3 and kept the outlook at negative. Moody’s sees Oman’s fiscal and external metrics continuing to weaken, with current account deficit remaining “wide” at around 9% of GDP in the next few years. It also sees the country’s real GDP growth remaining relatively subdued in the medium term and close to a full percentage point behind the population growth excluding expatriates. Despite wide spread expectations of the rating cut, Z-spread on Oman government bonds widened by 6bps to 11bps with OMAN 28s closing at yield of 5.80% (+3bps) and Z-spread of 292bps (+6bps). We would expect ratings on Omani GREs to be cut soon in line with the sovereign rating change.

The dollar gained for a fourth consecutive week, the Dollar Index rising 0.16% to reach 90.233. While these gains are relatively modest, there are observations which support the likelihood of further near term gains. Analysis of the daily candle chart shows that the index has broken above the 50 day moving average (90.045). This is a key level which the index has remained below since 18th December 2017 and which has provided resistance multiple times over the course of the last month. In addition, the 14 day RSI (Relative Strength Indicator) currently shows bullish momentum at 53.60 showing that further buying pressures seem to be likely in the days ahead. While the price stays above the 50 day moving average, we expect the path of least resistance to be further climbs towards 91.30, not far from the 23.6% one year Fibonacci retracement of 91.34.

Over the course of last week, EURUSD fell 0.14% to reach 1.2290. This decline is significant, as it represents a daily close below the 50 day moving average (1.2303) as well as a test of the supporting baseline that had been in effect since 15 December 2017. A break of this level looks likely in the week ahead and we see further losses towards our Q1 2018 forecast of 1.22 being the most likely course of action.

Regional markets, with the exception of the EGX 30 index, closed lower. Volumes remained on the lower side as excitement over last week’s new flow faded. The EGX 30 index added +1.8%.

DP World gained +3.2% after the company acquired Peru’s Cosmos Agencia Maritma for USD 315.7mn. Depa, which started trading in AED, had a lacklustre session. The stock gained +0.5% but only 6,500 share traded.

Oil prices held roughly steady over the course of the week, edging up slightly thanks to an upward spike on Friday. Brent futures closed the week up 1.1% at USD 66.21/b while WTI gained 0.5% to finish USD 62.34/b. Market structures continued to shrink and WTI fell back into contango at the front of the curve from the middle of last week. The US drilling rig count moved higher again, adding four rigs last week and erasing the previous week’s decline.

As oil prices have maintained a relatively stable range for most of March investors have grown more skittish about long positions and dumped more than 24.6k net long positions in WTI last week and barely changed their views on Brent. With limited upside and a market risking a more wholesale plunge back into contango more longs could be liquidated in comings weeks.